For a more optimised experience, view this table on a larger screen size

E3G Public Bank Climate Tracker Matrix – Bilateral & National

Public and Development Banks have a critical role to play in ensuring a sustainable COVID-19 recovery. They are responsible for delivering $2.3 trillion in global finance annually. PDBs oversee 10% of total finance around the world.

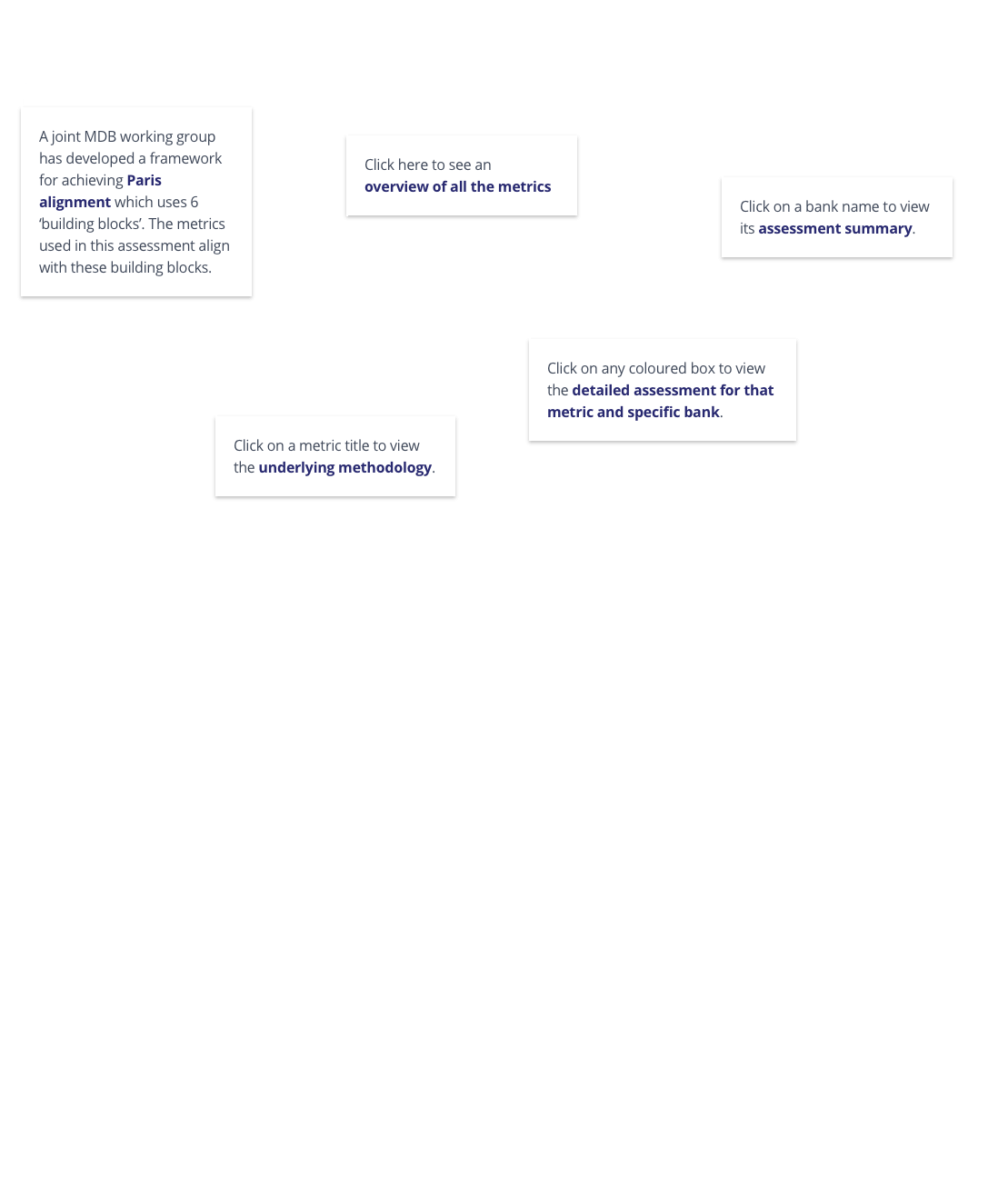

Use our interactive tool below to find out how the most well-known public banks, including National and Bilateral Development Banks such as the China Development Bank, are mainstreaming climate change into their work.

This tool covers the following banks:

Key

Our detailed methodology for assessing Paris Agreement alignment at public banks shows that no Bilateral or National Development Bank is yet on track to a climate safe world. Each bank should look to adopt best practices from its peers. Fossil fuel exclusions are a clear priority, as are greenhouse gas accounting, transparency and the integration of climate in transport, energy, water and urban strategies.

The counter-cyclical role of public banks – the ability to provide lending in the event of economic shocks – means they have the power to shape the course of the recovery from the current economic crisis.

Our Matrix is designed to provide shareholders, the banks themselves and civil society with a shared understanding of how to accelerate the transformation of each bank into a climate champion. It aims to translate the technical and obscure into a simple, easy-to-understand traffic light system.

The Matrix will be regularly updated to reflect changes at each bank and expanded to include more public banks, development finance institutions and export credit agencies.

The metrics or criteria have been categorised using the six ‘building blocks’ of Paris alignment as set out by the Multilateral Development Banks in late 2018: mitigation, adaptation, climate finance, policy support, reporting and internal activities. National development banks and European development finance institutions have similar approaches.

If you have any comments on this Matrix tool, please get in touch with the team at matrix.team@e3g.org. The Bilateral Development Banks included in this study were given the opportunity to provide feedback on our assessment.