| Paris alignment | Reasoning |

|---|---|

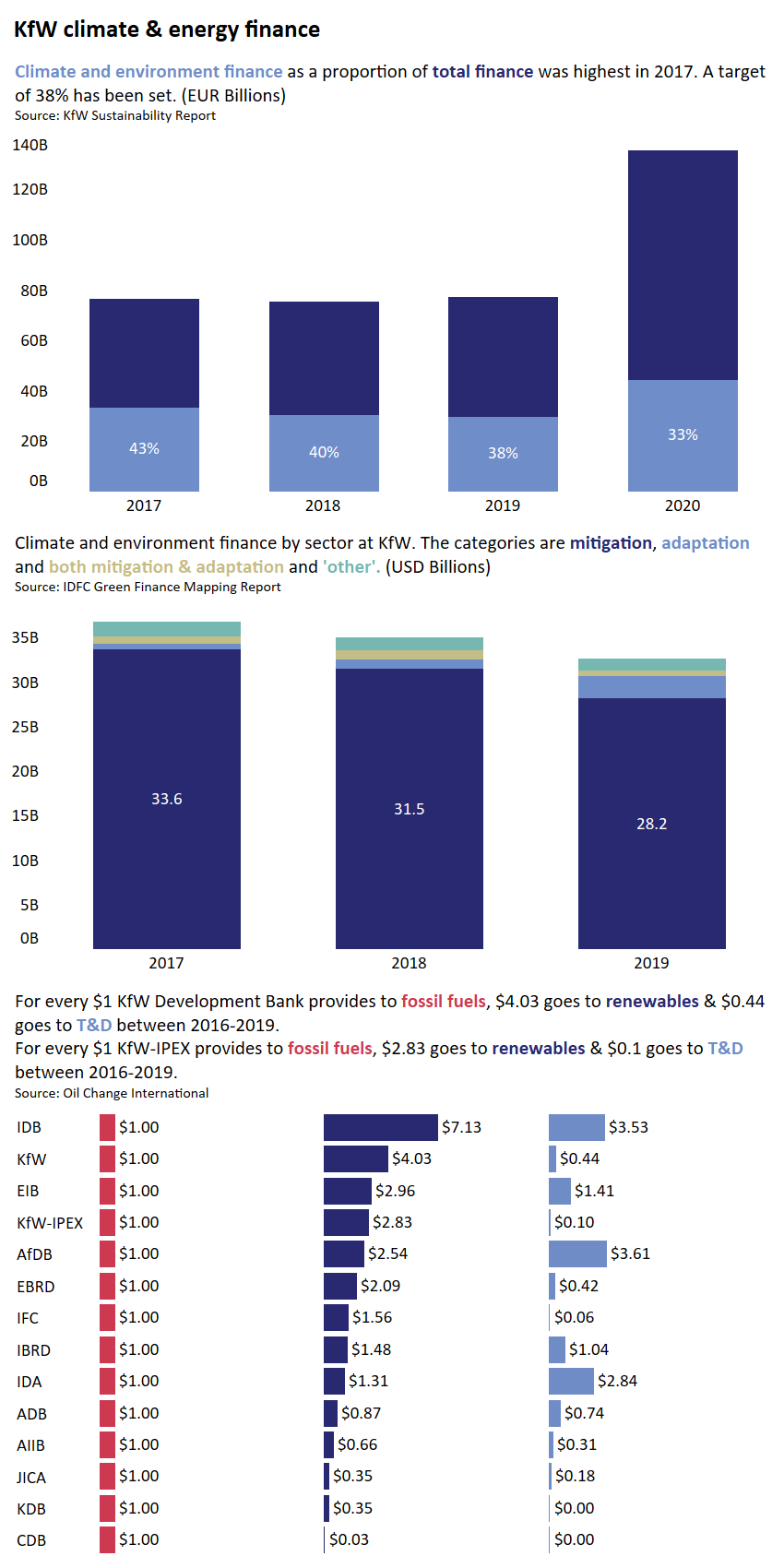

| Some progress | For every $1 KfW Development Bank provided to fossil fuels, $4 went to renewables. For KfW IPEX, for every $1 in fossil fuels, $2.93 went into renewables. No data is available for domestic lending and DEG. KfW has publicly stated that it may invest up to 1/3 of its energy investment into fossil gas until 2030. |

Explanation

KfW has set a target of 38% of annual finance to be commuted for the megatrend climate and environment. This target has not been achieved in 2020, which can be explained with KfW’s role in providing short-term economic relief in Germany to cushion the impact of the COVID-19 pandemic.

KfW’s finance in climate and environment is overwhelmingly for mitigation activities, with adaptation and cross-sectional activities only making up a fraction of overall climate and environment investment.

Oil Change International has calculated that for every dollar invested in fossil fuels, KfW Development Bank invests $4 in renewable energy. This is one of the highest shares amongst the development banks. For KfW IPEX, every dollar invested in fossil fuels stand against $2.93 dollars invested in renewable energy. However, it should be noted that the data set is not complete and does also not cover the domestic branch of KfW and DEG.

Note that, according to its sector guidelines, KfW Group estimates that 1/3 of its energy investment can still flow in fossil gas projects, while maintaining Paris alignment. This stands in stark contrasts to the International Energy Agency’s net-zero report to keep 1.5°C in reach.

According to KfW’s SDG Mapping, the Group committed $26.4 billion under SDG 7, for clean and affordable energy. Assuming KfW considers fossil gas projects to be part of this, this would imply that KfW Group would be able to invest at least €8 billion annually in natural gas infrastructure.