| Paris alignment | Reasoning |

|---|---|

| Some progress | FMO discloses aggregate, green-labelled finance in its annual report. However, there is no climate finance data available at project-level, nor for sub-projects financed through financial intermediaries. The Bank also conducts TCFD reporting, although some aspects of this would benefit from more granular disclosure. |

| Alignment and reasoning | |

| Climate Finance Data | FMO discloses its aggregate, green labelled finance under SDG13. However, FMO does not provide project level data. |

| Financial Intermediary Lending | FMO does not universally currently publish data on projects financed through financial intermediaries. This lack of granularity represents a risk in terms of guaranteeing that FMO aligned funds do not become unaligned after the disbursement process. However, as of November 2023, private equity fund sub-investments will be disclosed ex post publicly, on an annual basis. |

| TCFD Reporting | Although FMO conducts TCFD reporting, greater portfolio data and risk management disclosure is needed. |

Explanation

The DFI Transparency Index 2023 ranks FMO 10th (of 21) in the non-sovereign DFIs category with a score of 28.9 out of 100 (with a score of 100 being the most transparent). It is worth noting that FMO scored 100% for its environmental and social disclosure policies. Nonetheless, FMO should continue to improve its transparency by improving information access on investments made through financial intermediaries, as even ringfenced resources might otherwise inadvertently support harmful projects.

FMO has a disclosure policy in which it specifies which information it makes available to the public. Specifically, the bank adopts an ex-ante disclosure of proposed investments and, depending on the environmental and social risk category of a project, a proposed investment’s information is available on their website for 15-60 days. If a transaction is then signed, they publish updated ex-post information on their website.

Transparency of climate finance data

FMO reports on its progress relating to SDG 13 activities every year and discloses its aggregate, green-labelled finance in its annual report. Finances are labelled green based on the bank’s green label criteria.[1] However, this data is not available at the project-level in a machine-readable, downloadable format.

As FMO is not a public bank, it does not submit information to the OECD-DAC climate-related development finance database.

Transparency of financial intermediary lending

FMO has a Position statement on how it approaches impact and ESG for financial intermediaries in which it outlines its rationale and approach for investing through financial intermediaries. There is currently no information available publicly on projects financed through financial intermediaries. However, FMO has committed to the disclosure of private equity fund sub-investments. New sub-investments will be published, ex-post and once a year, to FMO’s website (on the Disclosure World Map). FMO will disclose name, sector, location of sub-project. The first round of data is expected to be uploaded to the website in November 2023.

According to a consultation response by a coalition of CSOs, FMO´s position statement on impact and ESG for financial intermediaries takes on “limited responsibility” for the outcomes of investments channelled through financial intermediaries. The recognition in FMO’s position statement that for the majority of FMO’s financial intermediary relationships “the eventual destination of the on-lending or sub-investment is not specified” and that clients are “responsible for and make decisions on how FMO’s funding is used” is seen as cause for concern. Insufficient minimum transparency obligations can risk FMO funds being used in Paris unaligned activities and compromise the positive contributions of more strictly safeguarded direct investments.

In response, FMO has argued that the transparency and disclosure of investments of financial intermediaries falls under the responsibility of these clients and not FMO themselves. Typically, financial intermediaries in FMO’s markets do not publish this information due to data protection laws. Moreover, FMO undertakes due diligence and supervision visits for high E&S risk projects on a regular basis to monitor compliance with the agreed Environmental and Social Action Plan (ESAP). The Bank is also in the process of establishing an annual monitoring framework on the use of proceeds in their green lines. In terms of Paris alignment, FMO expects the implementation of the upcoming tools and methodologies for assessing Paris alignment will guard against FMO funds being used in unaligned activities.

As FMO continues their efforts to operationalize their commitment towards portfolio and investment-level Paris alignment, E3G will monitor relevant developments closely and update as needed.

TCFD reporting

TCFD reporting at development banks is still at a nascent stage. As a greater level of disclosure is achieved, the usefulness of this reporting modality for comparison purposes across portfolios will increase.

FMO does conduct TCFD reporting since 2019 on an annual basis.

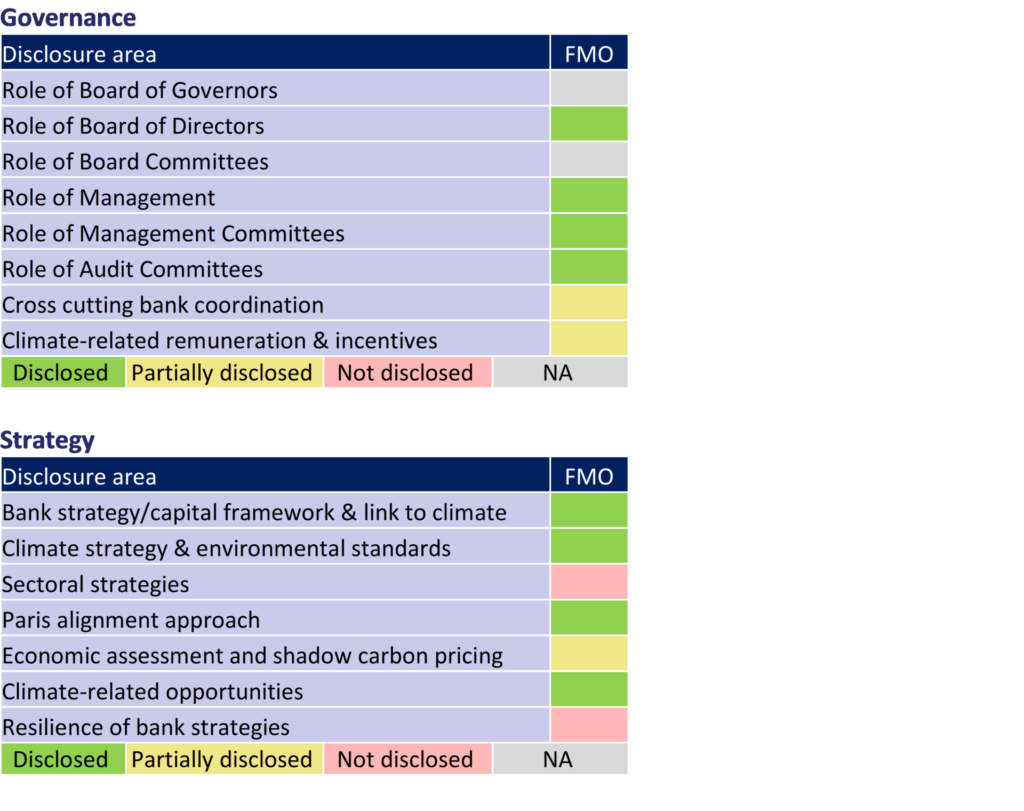

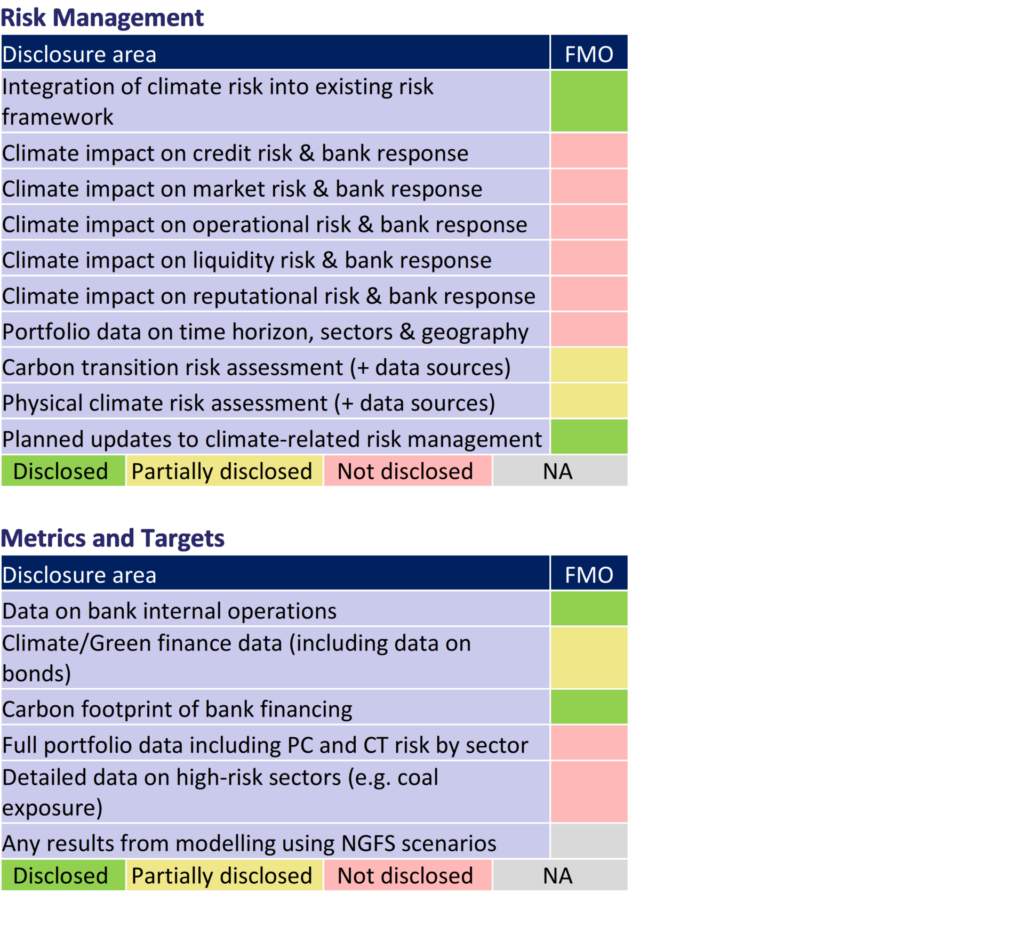

E3G has developed a list of areas under each of the four TCFD categories based upon the disclosure of the three MDBs who do TCFD reporting (EBRD, IFC and EIB) and what has been reported by AFD & JICA. This allows a comparison to be made between what is disclosed by each institution. This table is mainly designed to be informative of the different areas disclosed and provide ideas for improvement in future TCFD reports.

Recommendations:

- FMO should monitor the use of its financial resources by intermediary clients and make this data available. If that is not possible, FMO should apply a counterparty assessment approach to align intermediary clients’ investments to the Paris Agreement principles.

- FMO should publish project-level climate finance data, in a machine-readable format. This could be done in a similar format to that required for the OECD Climate finance Database.

- Specifically regarding FMO’s TCFD reporting, there remain particular areas which would benefit from more granular disclosure. Notably, the disclosure of climate/green finance data should include greater granularity in terms of trends, and sub-categories of green-labelled investments. Moreover, climate impacts on different aspects of risk and FMO’s risk management response are an area currently particularly lacking TCFD disclosure.

[1] For more information on Green Labelled investments, please refer to the “Promotion of Green Finance” metric.