| Paris alignment | Reasoning |

|---|---|

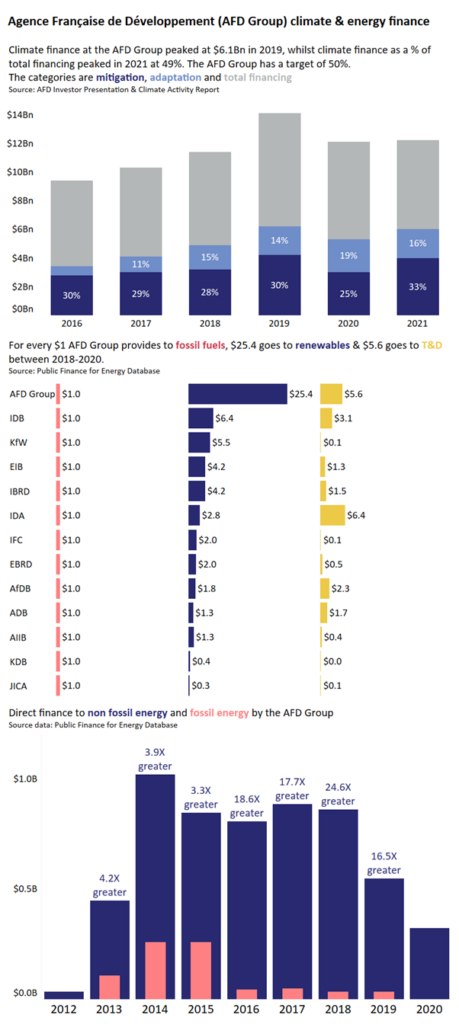

| Transformational | For every USD 1 AFD Group provided to fossil fuels, USD 55.1 went to renewables in the period 2019 -2021. There was no fossil financing between 2020-2022, making AFD the first public development bank in the Matrix to reach this criterion. |

Explanation

Between 2019 and 2021, for every USD 1 AFD Group provided to fossil fuels, USD 55.1 went to clean energy and USD 27.7 went to Transmission & Distribution. This is the highest ratio E3G has seen for the Public Development Banks it has assessed. It is worth highlighting there has been no fossil fuel financing between 2020-2022[1], making AFD the first public development bank assessed in E3G’s Public Bank Climate Tracker Matrix to reach zero fossil fuel lending across a three-year period, which is transformational.

The AFD achieved 62% financing of projects with climate co-benefits in 2022, according to its annual climate report, up from 58% in 2021. AFD has therefore surpassed its established target of 50% of financing with climate co-benefits. Furthermore, Proparco reached a 45% share of climate finance in 2022, up from 34% in 2021. The AFD group has therefore totalled USD 7.26 billion (EUR 6.9 billion) in climate finance in 2022, 15% increase from 2021.

Adaptation finance represented approximately 32% of total climate co-benefits lending or USD 2.31 (EUR 2.2 billion), a 10% increase in absolute amounts from 2021. Of these funds, 30% were dedicated to water management, 25% to urban and infrastructure resilience, 16% to LULUCF, 13% to Governance and risk management, 8% to social infrastructure and capacity-building and 7% to intermediary lending finance.

Of the total USD 4.94 (EUR 4.7 billion) of climate finance dedicated to mitigation in 2022, transport and mobility accounted for 32%, renewable energies 26%, Financial intermediaries lending 17%, LULUCF 9%, Energy efficiency 5% and others (including waste management, education and technical assistance) 11%.

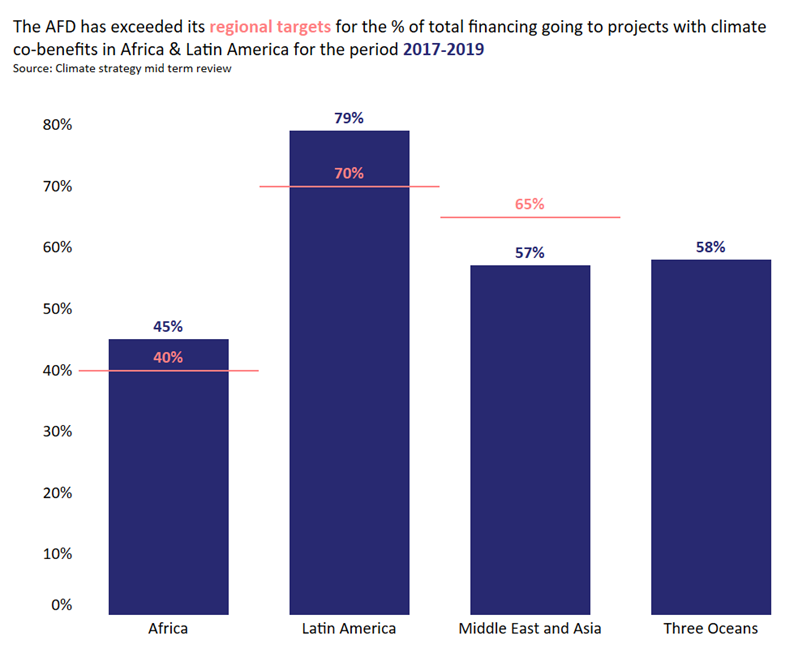

With regards to climate finance commitments according to geographical areas of operations, the AFD’s Climate Strategy provides differentiated targets based on geographical areas which were further updated in its mid-term review. Climate commitments should represent at least 70% of funding for Latin America, 65% for the Middle East and Asia and 40% for Africa. The AFD (excluding Proparco) has exceeded these targets in Africa and Latin America between 2017-2019.

[1] For 2020-2021, this affirmation is based on Oil Change International Data. For 2022, the data was provided directly by AFD.