| Paris alignment | Reasoning |

|---|---|

| Some progress | The AFD receives details of each subproject financed by an intermediary. Accordingly, sub-projects are systematically checked internally by the task team leaders or by a verification consultant and –if required- by the climate and nature team. These sub-projects are evaluated against AFD’s taxonomy and the common principles for climate finance adaptation and mitigation. During COP27, AFD released its position paper: “Paris alignment of operations with financial institutions” where it outlines its current verification methodology for intermediary finance. The publication of this approach is welcome, and AFD is encouraged to continue the conversation by sharing the feedback it receives from other institutions, as well as lessons learnt collected so far under the initial “Pro-Climate” trial applied to some its client banks aiming to support their transformation and the reinforcement of their strategic and operational framework in order to better integrate climate change. On the other hand, it is worth highlighting as good practice AFD’s tool that allows the export in csv format of all climate projects financed. |

| Climate Finance Data | AFD provides adequate project level data to the OECD and in its sustainability report. |

| Financial Intermediary Lending | Map of Proparco lending provided but sub-projects are not disclosed due to bank secrecy. Proparco should make public as soon as possible the results of its analysis of the risk of Paris misalignment within its intermediated operations (which started at the end of 2021). |

| TCFD Reporting | The AFD conducts TCFD reporting. Not yet assessed for Paris alignment due to a lack of credible benchmark. |

Explanation

The Aid Transparency Index gives AFD a ‘Good’ rating for its levels of transparency. Proparco is not included within the index, so further analysis of Proparco is required.

Transparency of climate finance data

The AFD discloses its aggregate climate and green finance in different reports. It produces an annual Climate Activity Report where climate finance is disclosed, and it discloses green (and biodiversity finance) in the annual IDFC Green Finance Mapping report.

On its website the AFD also has a tool that allows you to choose all climate projects financed and export this in csv format. This is good practice and should be promoted amongst other DFIs, MDBs and public banks.

The AFD provides an adequate level of information in its submission to the OECD-DAC climate-related development finance database.

There are slight differences in reported climate finance percentages between the investor presentation and midterm review of its climate strategy, due to differences in regional scope.

Transparency of Financial Intermediary lending

Proparco, which conducts the majority of private sector lending within the AFD Group has a map of all the projects it has financed. In 2021, 40% of its lending went to financial institutions.

This map is welcomed; however, it does not provide a breakdown of what sub-projects are financed by a financial intermediary using Proparco funds.

Proparco has analysed the risk of Paris misalignment within its intermediated operations since the end of 2021. Proparco monitors ESG indicators for each of its clients, with a focus on supporting them over the long term to improve ESG performance.

Proparco has launched its Pro Climate technical assistance facility as a pilot to support the development of climate financing by partner banks as well as integrating climate challenges into their strategies and their operations.

A separate open data portal exists but does not appear to have been updated since June 2018.

AFD staff have informed E3G that financial institutions are required to share details on each sub-project with AFD. Accordingly, sub-projects are systematically checked internally by the task team leaders or by a verification consultant and –if required- by the climate and nature team. These sub-projects are evaluated against AFD’s taxonomy and the common principles for climate finance adaptation and mitigation. It would be beneficial if this process could be made public, to help establish best practice with other public banks. Additionally, there is a non-objection process where in some cases AFD officially has to authorize a sub-project to be financed by the credit line, after verifying its eligibility (technical and financial eligibility criteria as defined in the loan agreement and respect of the exclusion list of AFD Group). The activation mechanism of the latter should also be made available.

It is also worth highlighting that during COP27, AFD released its position paper: “Paris alignment of operations with financial institutions” where it outlines its current verification methodology for intermediary finance, both for earmarked and non-earmarked funds. Furthermore, AFD establishes its long-term vision by advocating for DFIs and other Public Banks to move from a project-based approach towards a system-wide one with regards to intermediary finance. E3G welcomes the transparent publication of this approach and encourages AFD to continue the conversation by sharing the feedback it will receive from other institutions, as well as the lessons learnt so far under the initial “Pro-Climate” pre-pilot applied to some its client banks aiming to support their transformation and the reinforcement of their strategic and operational framework in order to better integrate climate change.

Recommendation:

- The data from Proparco’s analysis of the risk of Paris misalignment within its intermediated operations (happening since the end of 2021) should be made available. The same applies to the ESG risk assessment performed by the AFD and to the activation mechanism of non-objection.

TCFD Reporting

TCFD reporting at development banks is still at a nascent stage. As a greater level of disclosure is achieved, the usefulness of this reporting modality for comparison purposes across portfolios will increase.

The AFD does conduct TCFD Reporting since 2021 and pledged to update it biannually.

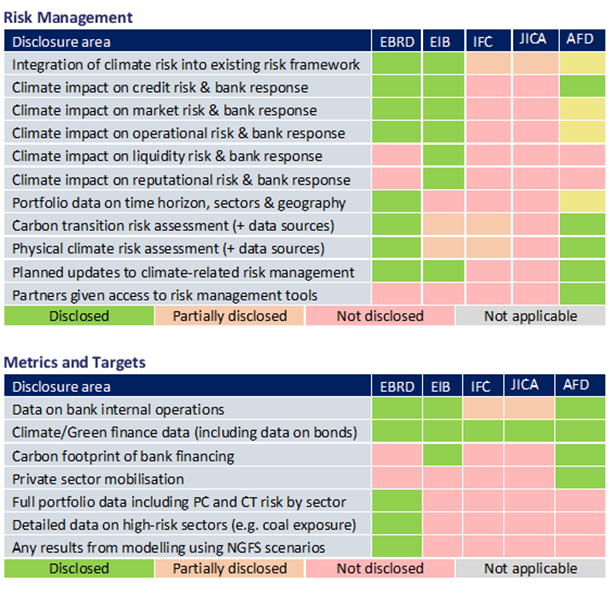

E3G has developed a list of areas under each of the four TCFD categories based upon the disclosure of the three MDBs who do TCFD reporting (EBRD, IFC and EIB) and what has been reported by AFD & JICA. This allows a comparison to be made between what is disclosed by each institution. This table is mainly designed to be informative of the different areas disclosed and provide ideas for improvement in future TCFD reports. For example, the portfolio data provided by EBRD is a good example of something the AFD could replicate in its own TCFD report.

Recommendation:

- The AFD published its first TCFD report in 2021 and pledged to update it biannually. In its next edition, AFD should look to replicate elements of the ‘Metrics & Targets’ TCFD reporting of the EBRD. This includes more information on any analysis done on the whole portfolio of AFD in relation to physical and transition risk. The results of analysis using Network for Greening the Financial System (NGFS) scenarios has also been included in the TCFD report.