As the EU prepares its next multiannual financial framework (MFF), it must decide how to use limited public resources to forge a path towards security, resilience and competitiveness, with decarbonisation at the core. Despite rising investment needs, the current EU budget still struggles to crowd in private capital at scale. The solution lies in approaching the issue from all angles: both using this MFF cycle to send much clearer investment signals towards target areas, and using the MFF as a tool to improve the deployment of transition finance.

The European Commission has announced that the development of the next MFF will see a fundamental rethink of EU public finances. The intention is to align EU public finances more with its policy priorities.

These developments provide an opportunity to consider how the MFF can be simpler and more effective at leveraging private investment – crucial to close an annual €800bn investment gap for the EU to restore competitiveness and security.

Five building blocks to leverage more private transition investment through the MFF

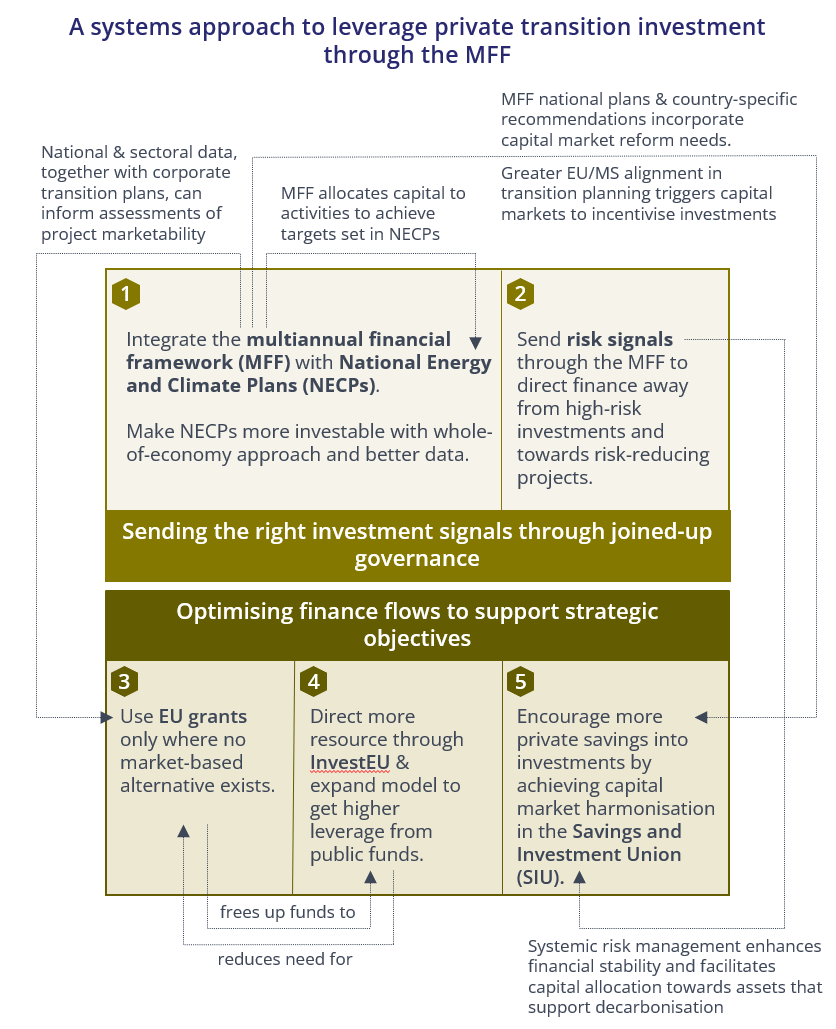

Our briefing presents a framework of five building blocks to make EU public finance more effective at crowding in private finance to support the EU’s priorities. To develop the framework we considered systemic approaches to send appropriate investment and risk signals, but also changes to improve the design and implementation of funding programmes. The five building blocks complement each other, and will have the most impact when addressed simultaneously.

- Leveraging EU governance tools. Integrating the MFF with National Energy and Climate Plans (NECPs), ensuring the MFF national plans direct capital towards the targets and objectives set in NECPs. NECPs themselves need to become more investable, with more information to help the private sector know where to invest. Climate, energy and just transition goals should be embedded across the MFF–NECP framework to give investors confidence.

- Resilient by design risk management. The MFF should send coherent signals to direct private finance away from high-risk investment – such as those likely to result in stranded assets. It should also encourage investment in risk-reducing and resilient projects.

- Optimising the use of EU grants. Grants should not be used for projects that are already marketable, and which therefore can already attract private investment. Rather, grants should be used to bring nascent technologies to market readiness.

- Scaling the InvestEU model. InvestEU has proven to be effective in scaling marketable clean projects. Expanding InvestEU’s resources should be a priority. Increasing the number and level of stakeholders implementing the model can achieve further impact; this should include efforts to allow better deployment in underserved areas. Finally, the InvestEU model can serve as a blueprint for new initiatives such as the EU Competitiveness Fund.

- Better capital allocation by developing the Savings and Investments Union (SIU). Leveraging the reform of the MFF to harmonise aspects of Europe’s capital market that can unlock more of the EU’s €37 trillion in private savings for transition investments.