G7 governments have a narrow window in which to future-proof their steel industries. While the real economy is moving away from carbon-intensive production, policy progress is lagging behind. Industrialised countries and major steel producers need to make concerted efforts in 2024 to turn this around. Steelmakers, communities and climate targets all depend on it.

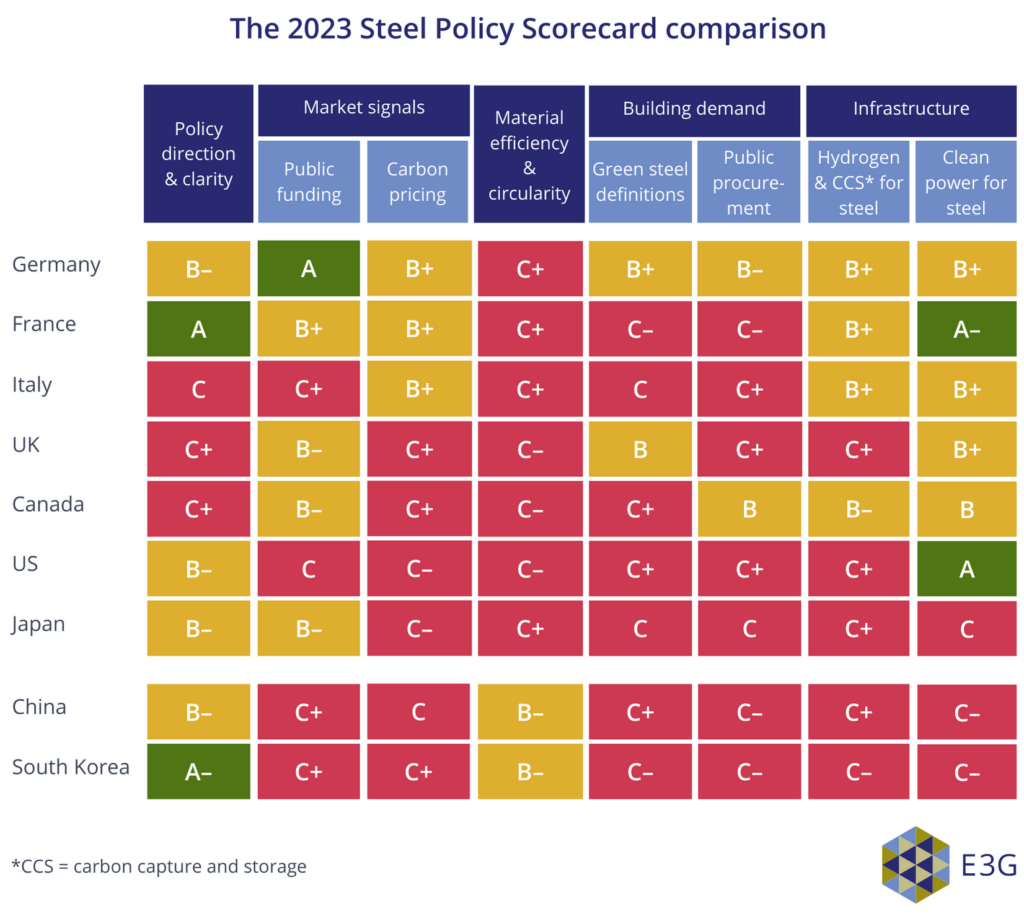

This second edition of E3G’s Steel Policy Scorecard shows pockets of progress in 2023, but still much to be done to decarbonise an industry that accounts for 8% of global CO2 emissions. Much higher ambition is needed to shift the sector onto a pathway compatible with keeping global temperature rise within 1.5°C.

G7 needs to do more to shift the steel pathway at home and globally

Coherent policy moves to support the steel transition can ensure long-term competitiveness and secure jobs throughout the industrial value chain. Steelmakers in each of these countries face pivotal investment decisions in the next decade.

G7 countries also have a critical role in shifting overseas investments. Globally, there is currently seven times as much high-emission steel capacity in the pipeline as near-zero emission steel.

Major steel players can take a lead in 2024

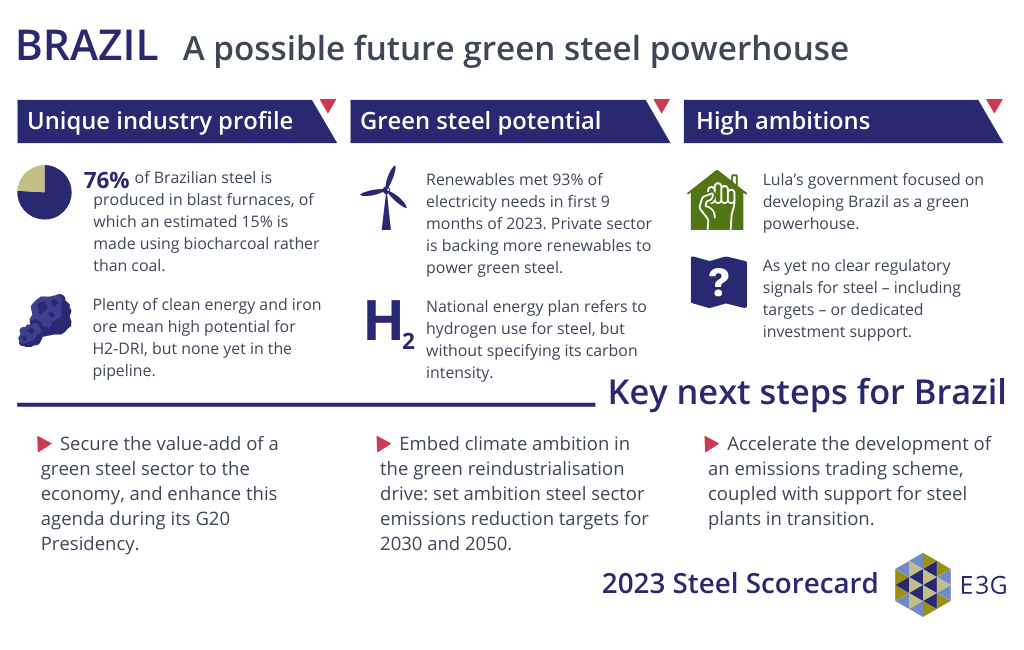

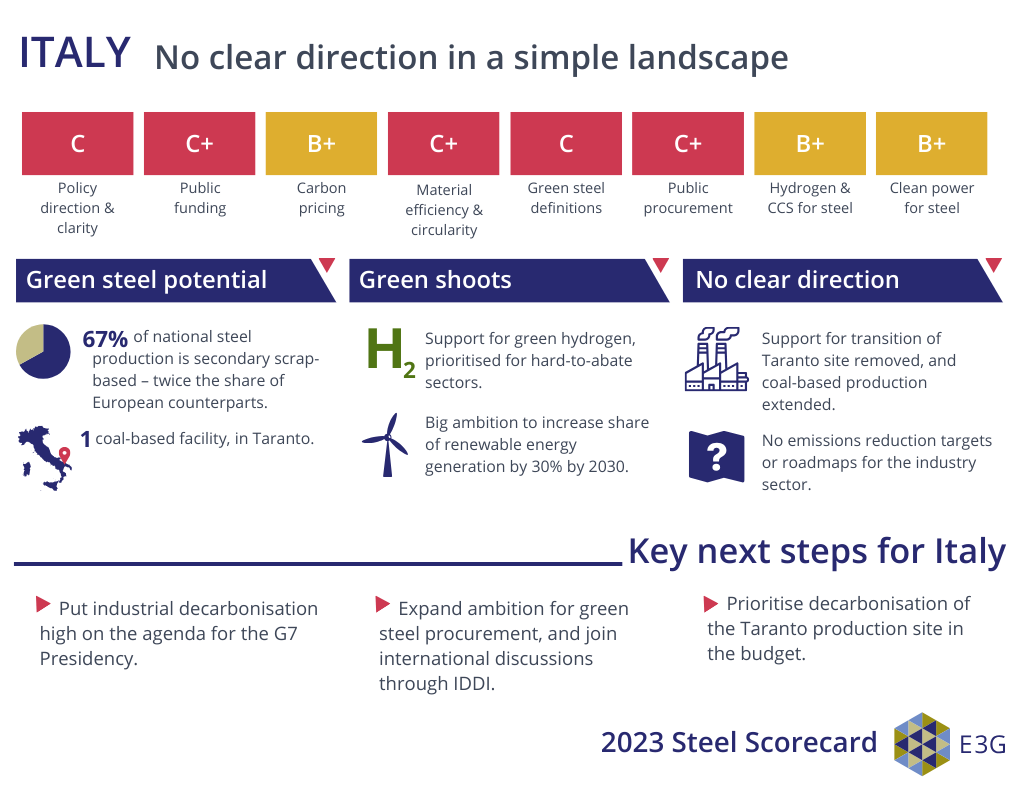

The G7 and the G20 Presidencies in 2024 sit with Italy and Brazil, respectively. Both countries can demonstrate leadership in aspects of the steel transition, and use their platforms convene other countries round this agenda. Italy is a front-runner on steel recycling, and has only one remaining carbon-intensive steel site. Brazil, with abundant renewable energy and iron ore resources, has the makings of a green steel powerhouse.

Recommendations for collective efforts to accelerate policy ambition on steel decarbonisation in 2024

- Set emissions reduction targets and agree sectoral roadmaps.

- Turn ambition on building the market for green steel into implementation.

- Scale up investment into clean energy infrastructure and improve lead times for deployment.

- Pursue country partnerships to kick-start green iron trade.

The E3G 2023 Steel Scorecard Report tracks and compares how the G7 countries, and key producers outside the G7, are meeting the challenge of phasing out coal use for steel. It explains the policy levers available, and shows how countries can seize the opportunity to future-proof their steel industries.

Read the 2023 Steel Scorecard Report here.

Read the headlines for each country analysed and click through to individual country profiles through the drop-down menu below.

Brazil generated nearly 93% of its electricity from clean sources in 2023. Its remaining renewable energy potential can fuel its green reindustrialisation aspirations. The country needs to embed steel decarbonisation in its push to be a green powerhouse. As 2024 G20 President, it can drive an agenda for international agreements and purchasing clubs on green steel.

Canada could be the first all-green iron and steel producer in the world – if it moves quickly. Factors in its favour include low steel production, strong renewable energy potential, and a stable regulatory environment. But so far, it lags behind other G7 countries in its public support for near-zero emissions technologies. Its existing cement and concrete decarbonisation roadmap can be a model for its approach to steel.

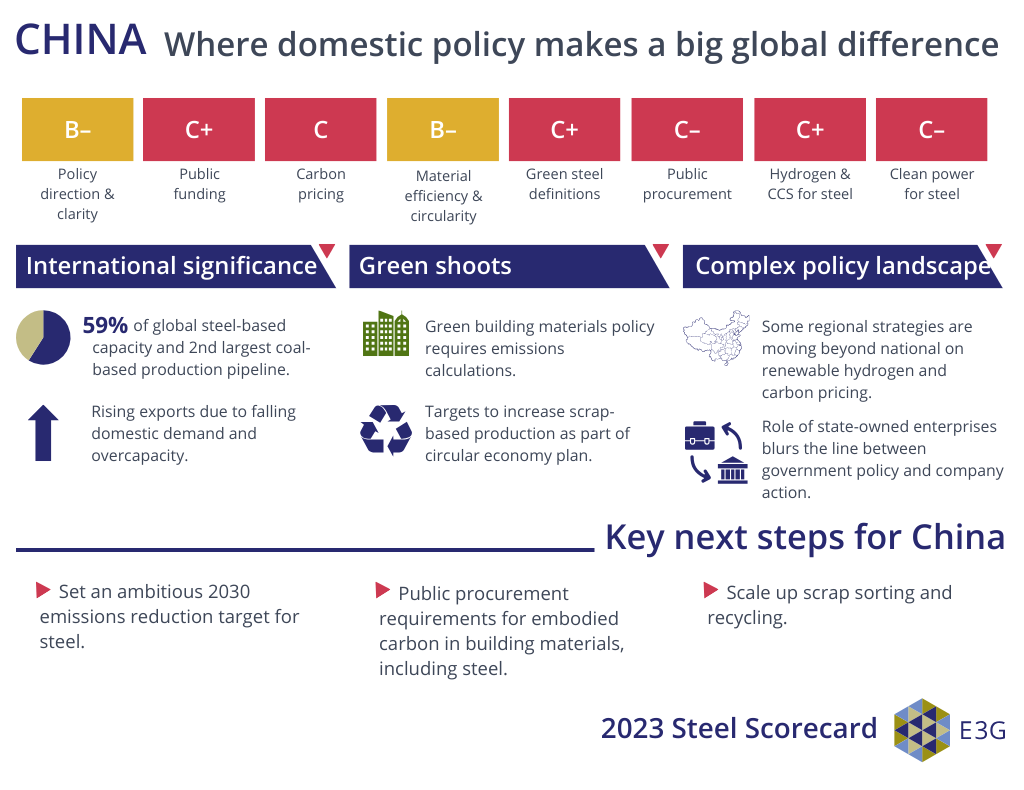

59% of the world’s coal-based steel production is based in China. The impacts of China’s overcapacity and rising exports on international steel prices will also have a major impact on the global steel transition. The infrastructure for emissions reporting and scrap-based steel production are areas of progress that China can build on.

Two coal-based steelmaking sites are responsible for 25% of France’s industrial greenhouse gas emissions. The incoming site-based transition roadmaps will apply to both sites, with the government pledging to financially support their transition. The process needs to be more transparent though, and incorporate roll-out of clean electricity and hydrogen infrastructure.

The 2023 Steel Policy Scorecard leader is also the EU’s largest steel producer. Despite progress on many policy levers and a significant green primary steel project pipeline, recent decisions to reline blast furnaces mean coal-based production lives on. Decarbonising steel while maintaining its existing production capacity will require large energy imports, so Germany’s steel transition depends as much on international partnerships as on domestic policy.

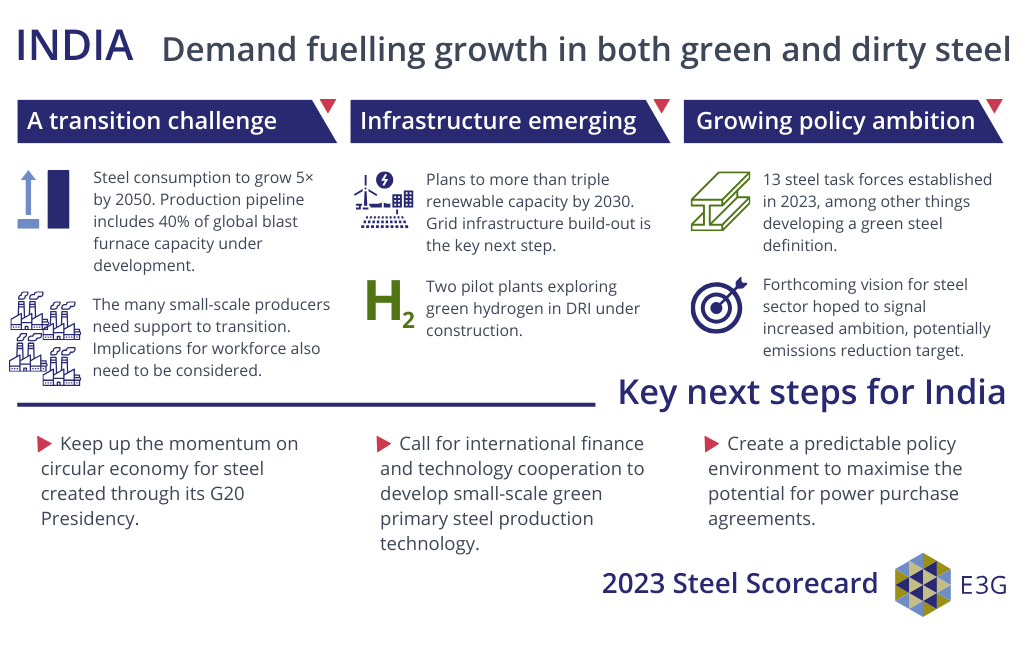

The world’s second largest steel producer faces a big transition challenge, with limited financial capacity, a diverse production landscape, and growing demand. India showed leadership as G20 President on steel circular economy, and is making positive policy moves internally including on green hydrogen. The country will need international support to transition its many small-scale production facilities.

With only one coal-based facility left and 67% of its production based on scrap, Italy could become a green steel leader. Yet despite hydrogen and clean energy ambition, it has no overall cohesive policy on steel decarbonisation. Italy can show global leadership by putting industrial decarbonisation high on the G7 agenda during its 2024 Presidency.

The world’s third largest steel producer scored lowest on the Steel Scorecard. Japan has no green primary production pipeline, and overall a lack of direction and ambition for power and industry decarbonisation. The country needs to prioritise technologies with higher emission reduction potential, and plan to include industry in its carbon pricing mechanism.

There is ample potential for South Korea to get its steel transition on track, notably by leveraging its emission trading system and tightening up public procurement requirements. Despite having a steel decarbonisation strategy, the country’s policy signals are currently ambiguous at best. Ambition to decarbonise the power sector – vital for decarbonising steel – is particularly lacking.

A recent agreement to transition a major blast furnace site to electric arc furnace steelmaking is a big move for UK steel decarbonisation. However, government policy is piecemeal overall, and lacks the context of a broader industrial policy. The plan for secondary-only production in future needs to tie in with more renewable power and grid improvements.

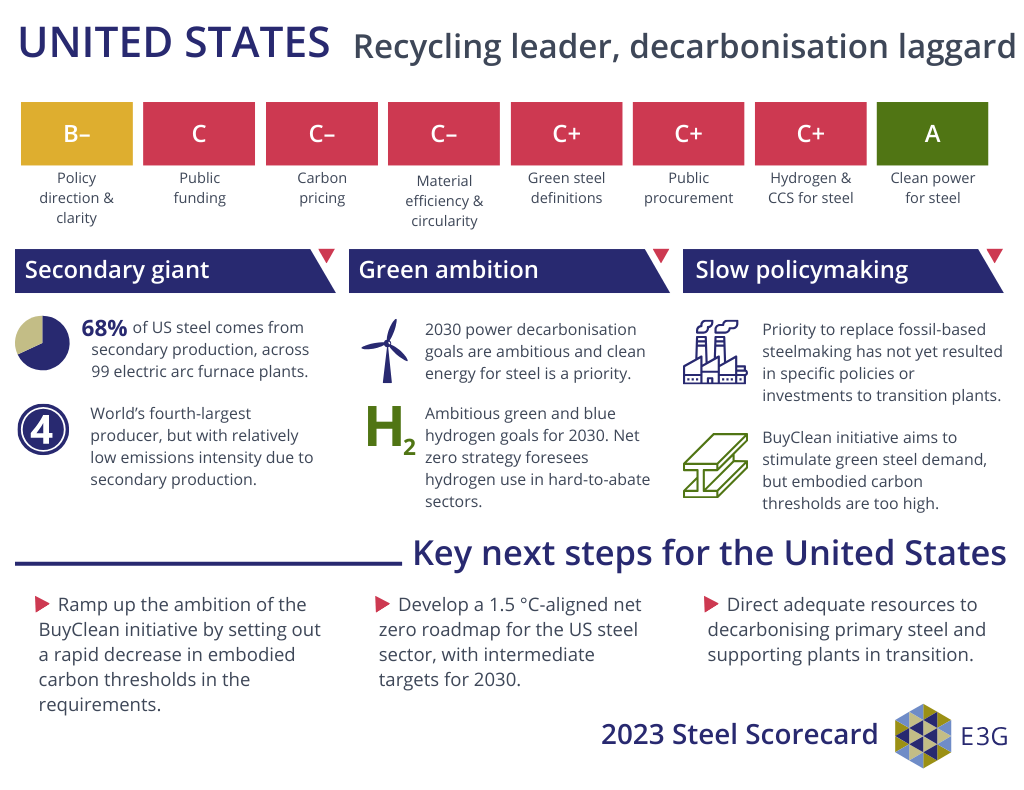

68% of US steel production is scrap-based, but specific support to ramp up green steel remains lacking despite some welcome moves on hydrogen and CCS in the Inflation Reduction Act. Following through on the ambition of the BuyClean procurement initiative would stimulate demand. Overall, the US needs a dedicated roadmap to decarbonise steel, backed up with funding to support facilities to transition.