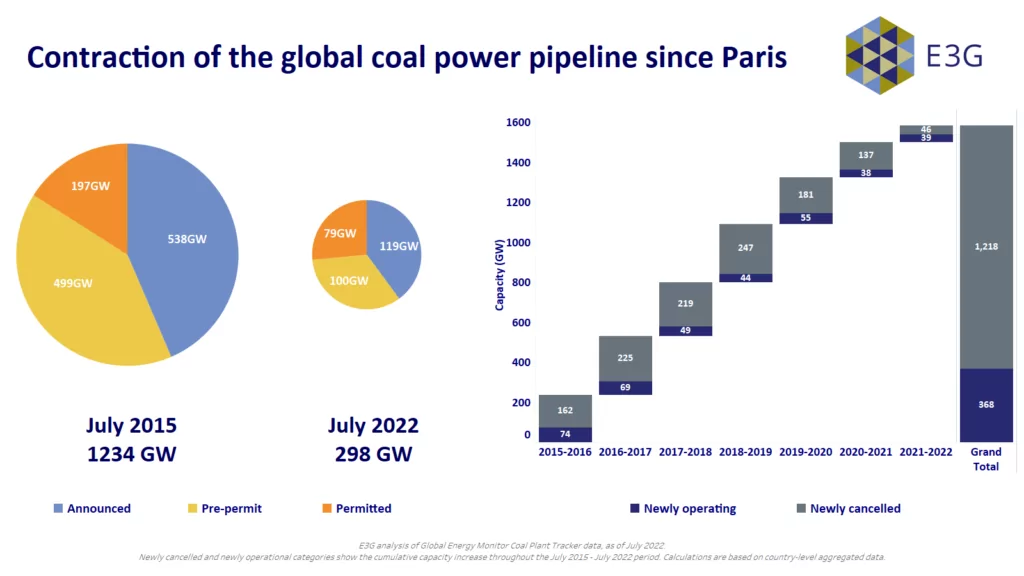

The IEA Special Report on Coal in Net Zero Transitions: Strategies for rapid, secure and people-centred change reaffirms that “Reducing coal power sector emissions in line with the 1.5-degree goal means no new development of unabated coal-fired power plants”. In September 2021, E3G analysis found that the scale of the global project pipeline of proposed coal power plants had collapsed by 76% since the Paris Agreement in 2015. This briefing paper reviews the latest key trends and datapoints, which confirm that the majority of the world is fast converging on the IEA’s first key milestone of no new coal power plants moving into construction.

This briefing provides the latest analysis on the current state of the global landscape of planned new coal power projects.

Summary: Key dynamics in 2021–2022

The global retreat from new coal power plants has continued over the past year since COP26. The vast majority of countries and regions are seeing a decline in the scale of new coal plants being considered for development (figure 1), while the remaining pipeline of projects is increasingly concentrated in China, now home to 66% of proposed capacity.

Key headline progress is detailed in the full briefing and below:

Positive progress towards No New Coal:

- Of 34 countries still home to proposed new coal power plants, 25 countries have seen a decline in the scale of the pre-construction coal project pipeline since June 2021. This includes 9 countries that have seen their entire pipeline of proposed projects shelved or cancelled, totalling 7 GW of capacity.

- The scale of new coal power plants under consideration has declined in all regions except China and Central Asia.

- For the first time ever, there are no new coal projects under consideration anywhere in the EU27, making it the first world region to reach this milestone moment.

- North America is close behind: the last coal project in Mexico has been cancelled, leaving one pilot project in the USA which is unlikely to proceed.

- The OECD as a whole is very close to having no new coal projects under consideration. Positive progress in Australia, Colombia, and Japan leaves only Turkey with more than one proposed new coal project.

- Indonesia has seen more than half of its planned coal capacity cancelled, resulting in it dropping out of the 5 countries after China with the largest pre-construction pipelines.

- Following China’s commitment to ending support for coal power plants, 21 GW of capacity has been cancelled across 26 plants in 15 countries. Analysis by CREA identifies a further 53 GW that should be cancelled or converted to renewable energy.

- 16 countries have only one new coal project still on the table, including Australia, Japan, and the USA. Seven of these countries are home to projects that were previously seeking financing from China. These projects tend to be smaller totalling ~3 GW in aggregate, making them amenable to rapid replacement with alternative renewables projects.

- Ahead of COP27, 97 countries had either explicitly committed to No New Coal or had considered coal in the past decade but no longer have any active projects in their pipeline.

Continuing challenges:

- Despite most of the rest of the world moving towards a coal-free future, China’s total pre-construction capacity has increased by a net 13 GW to a total of 197 GW, following the announcement of proposed new coal power plants.

- China is now home to 66% of global capacity at pre-construction stages. China’s overall share continues to grow year-on-year as the rest of the world retreats from new coal.

- Beyond China, only 6 countries1 have seen an increase in planned new coal capacity over the past year, totalling just 3 GW of capacity. 4 of these countries have just a single project.

- Overall, 73 new coal power projects have been proposed worldwide since June 2021. China is home to 48 projects totalling 58 GW, with 25 projects in other countries, totalling 18 GW.

- Mongolia saw an addition of 1.5 GW of proposed capacity, which has moved it up into the 5 countries with the largest coal capacity under consideration after China. This contributed to making Central Asia the only region that has seen an increase in proposed coal capacity since July 2021.

- Over the 12 months from July 2021, 45 projects entered into construction across 5 countries. China is home to 36 projects newly under construction, totalling 29 GW. The remaining projects that moved into construction were located in Bangladesh (2 projects), Indonesia (4), Iran (1) and Vietnam (2), giving a total capacity of 9 GW.

Read the full briefing here.