This article is part of our series on coal phase out and the G7 in 2021. You can find a full list of articles, along with the backstory of our analysis of G7 coal trends since 2015, here.

Since 2015, E3G has tracked data trends and policy developments across the G7, building a picture of G7 progress on coal phase-out. We set out here the key data trends from our 2021 G7 Coal Scorecard report, with interactive data visualisations that explore coal capacity and electricity generation landscapes.

Our analysis combines publicly available data of operating and proposed coal power plants. This includes Global Energy Monitor’s Global Coal Plant Tracker (aggregated from plant- to country-level); electricity generation data provided by Ember; and E3G analysis of political commitments and policy developments.

We assess progress towards coal phase out by calculating the rate of retirements of the operating power plant fleet, starting from a 2010 baseline. We similarly incorporate forecasts of planned coal retirements to 2030, by when OECD countries should be coal-free to give the world a reasonable chance of keeping warming below 1.5°C.

Coal exit continues across the G7, Japan lags behind

Since our first assessment of G7 progress in 2015, there has been an acceleration of progress across two trends. Firstly, new coal construction slowed and stopped everywhere except Japan. Secondly, existing coal power plants have closed, through retirement decisions and government phase out commitments.

As Figure A shows, the pipeline of new projects shrank year on year, while the number of power plants heading to retirement grew. The acceleration of coal plant retirements is now the dominant trend.

Figure A. Data source: Global Energy Monitor, Sierra Club, Japan Beyond Coal, and E3G. View the graph on Tableau here.

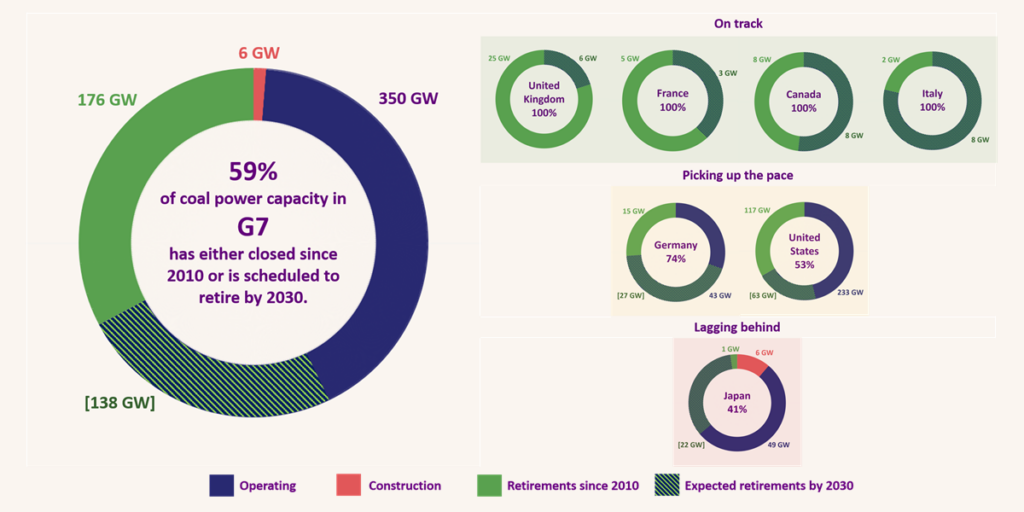

As of May 2021, the total operating capacity of G7 countries is almost 350GW, down 19GW since January 2020. Since 2010, G7 countries have retired around 174GW of coal power plants, with a further 138GW further scheduled to retire by 2030.

As highlighted in Figure B, 59% of G7 coal capacity has either retired since 2010, or is scheduled to retire by 2030, showing rapid progress over the past decade. Much of this progress has taken place in the UK, France, Italy and Canada, which are all on track to be coal free by 2030 at the latest.

Germany and the USA pick up the pace, Japan drags its feet

74% of Germany’s operating fleet has now closed or is scheduled to close by 2030. Its recently updated law should push this to 100%, as we explore in this analysis. Germany’s coal exit will certainly accelerate faster than its current Paris-unaligned 2038 coal phase-out date.

Retirements in the US have accelerated over the past decade, despite Trump’s pro-coal rhetoric, with 117GW closing since 2010. As of May 2021, 63GW of the currently operating 233GW that are confirmed to close by 2030, putting the USA 53% of the way to coal phase out. Closing remaining coal power generation by 2030 is the essential first step to achieving the Biden Administration’s 2035 carbon neutral electricity system goal, as confirmed by multiple studies.

In 2020 Japan announced its intention to retire most of the older, less efficient coal generation units by 2030, but this would still leave over 30GW of coal operating. Japan’s slow progress sees it needing to come up with a plan to accelerate the retirement of 60% of its coal capacity over the next decade.

The end of new coal is now in sight

Following the entry into operation of the controversial 1.1GW Datteln 4 unit in Germany in May 2020, Japan is now the only G7 country still pursuing new coal-fired power projects. It has 6GW of new plants currently under construction, but these are now the last. In April 2021 the final two projects in Japan’s project development pipeline were cancelled, meaning that no new coal plants are under development across the entire G7.

The past decade has seen the collapse of the new project pipeline across the G7.79GW of proposed projects were cancelled, while some of the youngest coal plants in Germany are already deciding to retire. Japan will shortly catch up with its G7 peers in finding that pursuing new coal was a costly error.

Renewables and gas displacing coal-fired power generation

2020 also saw the share of electricity generated from burning coal continue to fall. COVID-19 lockdowns hit coal hard as demand fell and the share of renewables grew. However, the shrinking coal share of electricity is a longer-running trend, reflective of the declining role of coal. In fact, the coal share has declined every year since 2013 across all the G7 countries except Japan. Of the G7, the UK has seen the most dramatic fall, from 40% of electricity in 2012, to less than 2% in 2021.

Figure C. Data Source: Ember, January 2021. View the graph on Tableau here.

This reduction in the prominence of coal in electricity generation is the result of two major trends. First, coal power stations are being utilised at historically low rates. For example, in the US the average capacity factor is only 32%. This has a direct impact on their economic viability, which in turns leads to stronger incentives for closure. Second, both renewable energy and gas capacity have grown rapidly over the past five years, creating competition for coal. Ember’s Global Energy Review 2021 shows that renewable energy generation grew by 1559 TWh between 2015 and 2019, with the US alone accounting for 204 TWh. Unfortunately, gas use in the power system has also grown rapidly over this period, with an increase of around 12% across the G7.

Jump to another article in this series:

- Charting the course away from coal: the G7’s leadership opportunity

- Strong currents: G7 coal transition data trends

- Surfing the waves: G7 progress towards coal phaseout

- Picking up the pace: Germany’s coal exit is getting closer to 2030

- Anchors aweigh: USA rejoins the coal transition mainstream

- Time and tide wait for no one: Japan’s coal progress