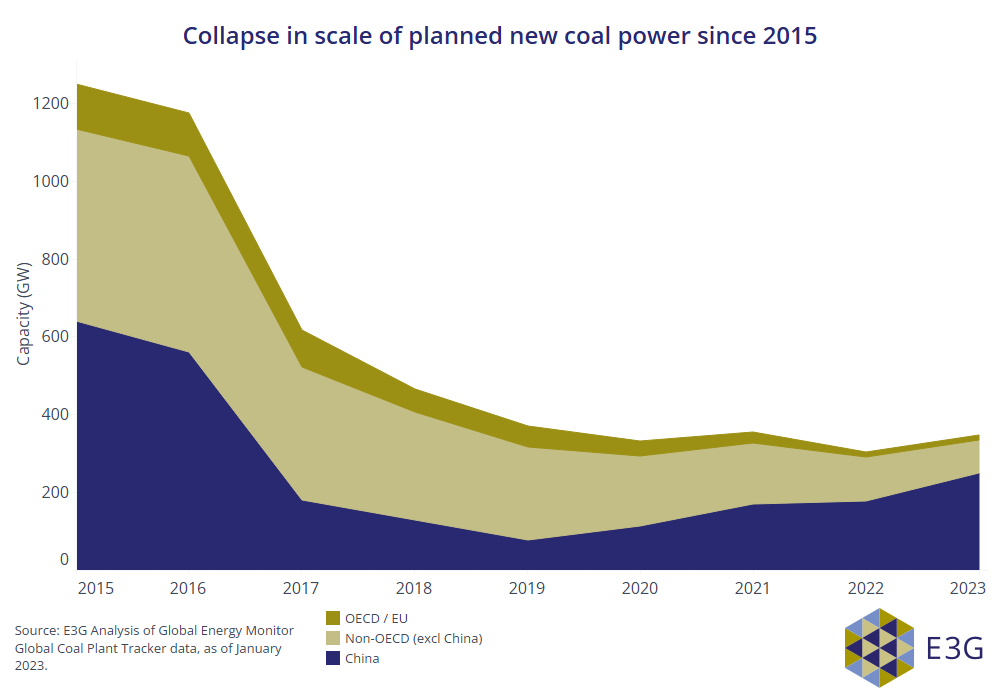

Ending the construction of new coal power is a critical milestone towards achieving the goals of the Paris Agreement. The IPCC and the IEA are clear that no new unabated coal power plants can be built if the world is to limit warming to 1.5 °C. Data from January 2023 shows that the new coal pipeline has reached historical lows. We are reaching the global milestone moment of No New Coal. However, China’s renewed coal boom threatens overall progress.

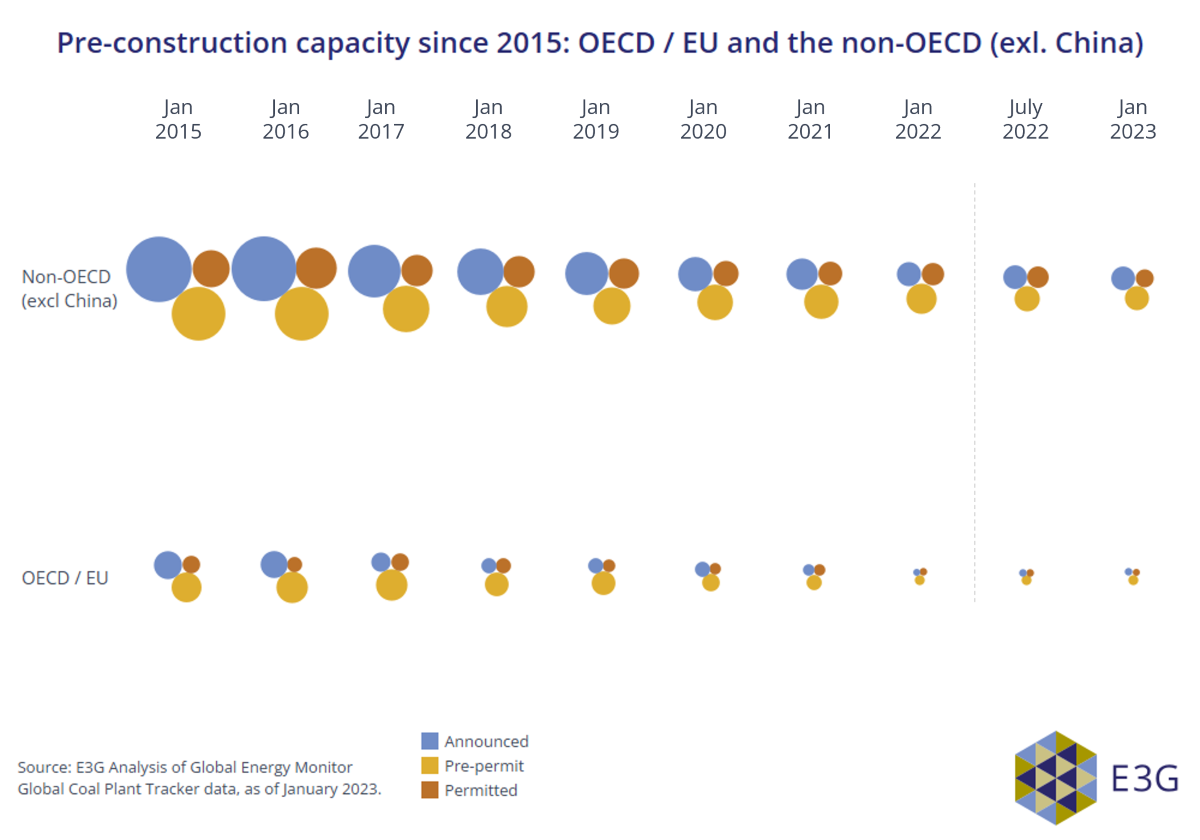

In the second half of 2022, the whole world outside China continued to move away from planning new coal power projects. The total scale of the coal power under consideration dropped below 100 GW for the first time since data collection began.

Meanwhile, all major world regions have seen the scale of new coal under consideration decline or plateau since mid-2022. Small increases in the size of India and Indonesia’s project pipelines were the only exceptions to this trend – aside from China.

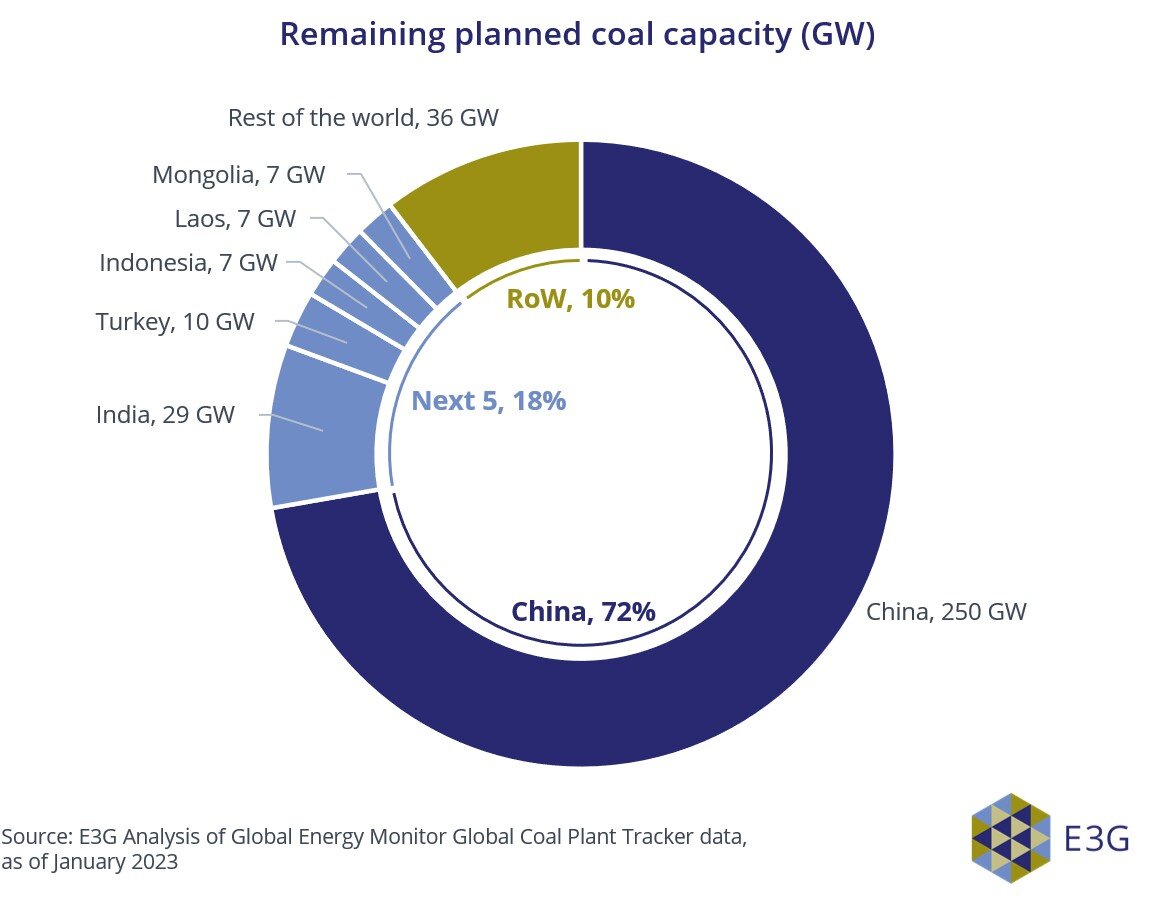

A renewed coal power boom in China threatens this clear progress in the rest of the world. The second half of 2022 saw the largest-ever increase in pre-construction capacity in China. As a result, China now accounts for 72% of global planned capacity, up from 66% in July 2022.

Our two briefing papers provide detailed analysis and commentary on this tale of two trends. The first captures the “diverging pathway” China is taking from the rest of the world, away from the pursuit of new coal power plants. The second dives deep into the country-level and regional dynamics “driving forward” the shift away from new coal power in the world outside China.

- China’s planned new coal capacity grew by 77 GW in the second half of 2022, the largest amount over a six-month period since 2015. China’s total pre-construction pipeline of 250 GW stands in stark contrast to the historic low of 97 GW in the rest of the world.

- China now accounts for 72% of global pre-construction capacity, up from 66% in July 2022. The next five largest countries account for 18%. The remaining 10% is thinly spread across 27 countries.

- China saw 41 GW of new construction starts in the second half of 2022, contributing to more than 50 GW for the full year. By contrast, OECD / EU countries have seen no new coal plant construction starts since 2019.

- All world regions outside China saw a decline or plateau in the scale of new coal under consideration in the second half of 2022.

- The scale of China’s renewed coal boom has reversed some of the gains made globally. As of July 2022, global new coal proposals had fallen by 75% since the Paris Agreement in 2015. This was reduced to 72% by the end of 2022.

- China’s relapse has seen it lose its leadership position. In 2019 it was ahead of the rest of the world in scaling down coal proposals; now China is being left behind.

Read the briefing – Driving forward: world outside China closes in on No New Coal

- Total pre-construction capacity outside China is less than 100 gigawatts (97 GW) for the first time since data collection began.

- Proposed new coal power capacity outside China is down by 84% since the Paris Agreement was signed in 2015. It has reduced by 90% in OECD / EU and 83% in non-OECD countries.

- All world regions outside China saw a decline or plateau in the scale of new coal under consideration in the second half of 2022. Only seven coal projects were proposed in the entire world outside China: six reactivated projects in India and one new project in Indonesia.

- As of January 2023, 98 countries had either explicitly committed to No New Coal or no longer have any active planned projects.

- This leaves only 32 countries outside China with proposed new coal power plants, down from 33 in July 2022. Our No New Coal Progress Tracker provides detailed analysis of these countries. 13 countries have only one new pre-construction coal project still under consideration.

- North America is the second world region to reach the milestone of No New Coal projects under consideration, after the European Union. The OECD is close to achieving No New Coal, as remaining proposed projects in Australia, Japan and Turkey are all unlikely to proceed.

- Brazil is now the only country with pre-construction capacity in all of the Americas.

- Viet Nam has seen more than four-fifths (7 GW) of its planned coal capacity shelved or cancelled since July 2022. It has dropped out of the top 5 countries for planned pre-construction projects outside China.

- Indonesia saw multiple projects cancelled or shelved, assisted by the $20 billion financing package for its Just Energy Transition Partnership (JETP). However, this progress was offset by a controversial proposal for a new “industrial coal” project.

Read the briefing – Diverging pathways: China’s new coal boom takes it on a detour

Visit our No New Coal introduction for more information on why the world must stop building new coal power stations – and what governments and other actors can do to progress this agenda.

Our No New Coal Progress Tracker is an interactive tool tracking progress towards the end of new coal power. It is updated at regular intervals across the year to reflect the latest data and political commitments. Explore the latest update now.