Climate impacts are accelerating around the world with devastating consequences. Countries must work together to strengthen global resilience and urgently tackle the growing financing gap developing countries face to adapt to increasing climate threats. Pathways Towards Resilience proposes three realistic shared goals to deliver positive outcomes on adaptation finance for vulnerable countries. It sets out a roadmap for what needs to happen in 2025 to achieve these goals and enable countries to better prepare and adapt for the future.

Climate impacts are accelerating, with increasingly high human, social and economic costs. The macroeconomic costs of inaction are clear – 15–34% of GDP by 2100. Climate change also poses an increasingly important security threat as it exacerbates existing vulnerabilities and threats, driving up instability, conflict, and displacement.

The return on investing in adaptation and resilience is equally clear: beyond the positive human impact, every dollar invested returns $2–10 in economic benefits. Yet the countries hit the hardest by climate impacts are often those with the most limited capacity to adapt. The growing scale and severity of the climate disasters they face are perhaps only equalled by the growing gap in financing to tackle them. The estimated funding gap for preparing and adapting to increasing climate threats is $187–$359 billion.

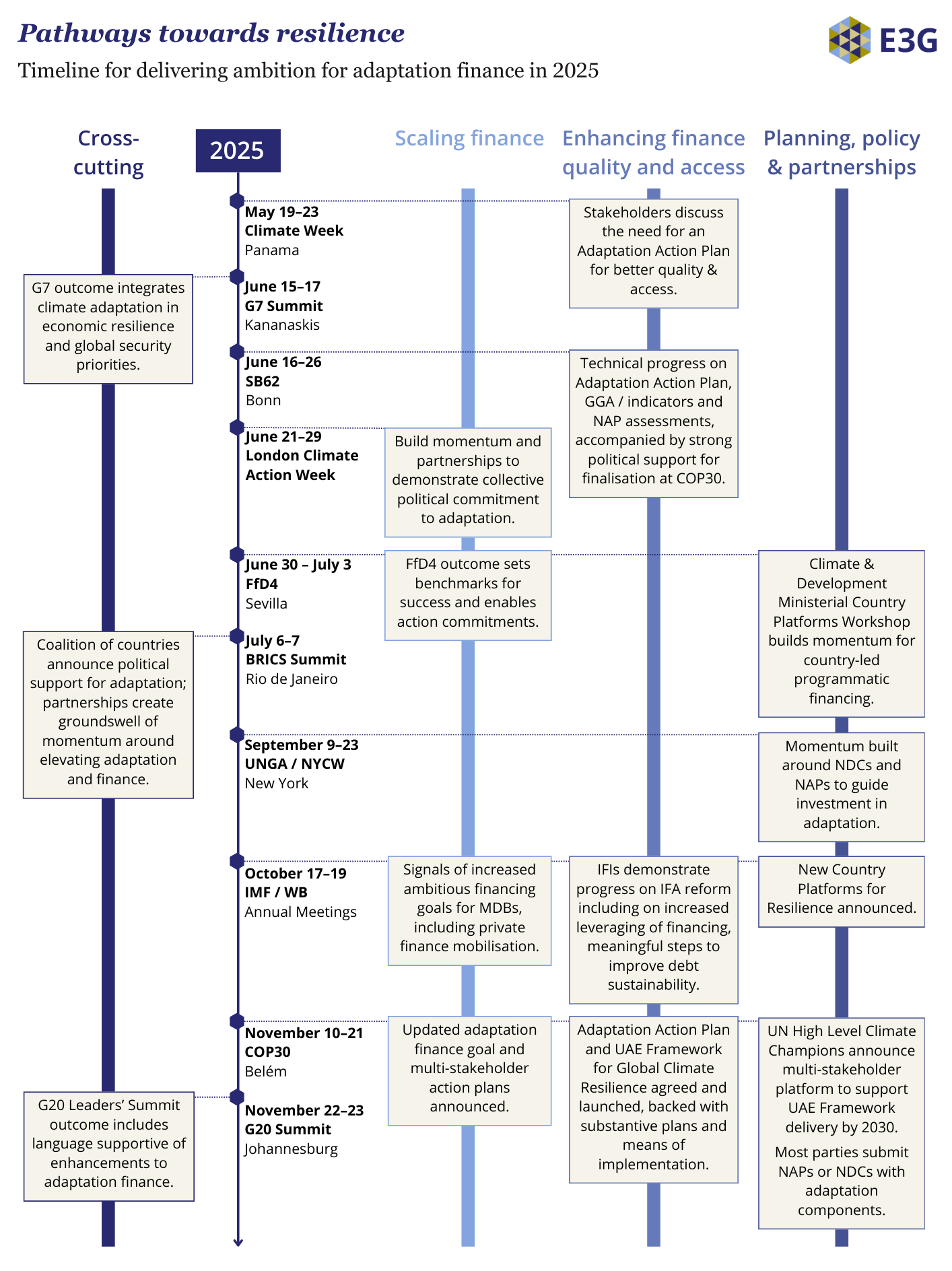

A roadmap to advance resilience in 2025

In the current turbulent geopolitical landscape, urgently scaling efforts for global resilience requires an all-hands-on-deck approach, including political commitment, technical solutions, dexterity, and partnerships. Decision makers must be willing to work together through diplomacy to chart a pathway to resilience, and champion the actions that will deliver at the scale needed.

In Pathways Towards Resilience we set out an actionable and achievable diplomatic agenda on adaptation finance for 2025, consolidating the diverse threads around three shared goals:

- Scaling finance: A wide range of financing sources – including critically more public finance but also genuinely unlocking the potential of private finance – will be needed to meet needs. There is significant potential to better leverage our largest global financing institutions, the multilateral development banks (MDBs), to help achieve this with ambitious new adaptation targets. Increased commitment to adaptation finance – including through an updated and needs-oriented adaptation finance goal – must be taken forward to COP30.

- Enhancing finance quality and access: Improving the quality and accessibility of finance is also crucial for resources to reach vulnerable communities and allow them to address their adaptation needs. This means effectively reducing the cost of capital, tackling continuing debt sustainability challenges, and a timebound credible plan to address barriers to access and operationalise the UAE Framework for Global Climate Resilience.

- Policy, planning, and partnerships: Effective resilience action must be formulated and integrated into broader national priorities, policymaking, and implementation processes. Practically, this means national development plans, National Adaptation Plans, and Nationally Determined Contributions, ideally accompanied by adaptation investment plans. Supportive multi-stakeholder platforms and initiatives can be key to real delivery, including Global Stocktake outcomes and Global Goal on Adaptation targets.

Opportunities to leverage political moments in 2025

Delivering the above actions requires leveraging the many key political moments that exist at global, national and regional levels in 2025 and beyond. Some of the big global moments and fora where momentum can be built this year include:

- The UNFCCC processes throughout the year, culminating in COP30 in Belém, will set the big-picture politics and provide critical technical foundations for delivery.

- The G20 and G7 moments can demonstrate the world’s largest economies’ commitment to this agenda and are critical for the process to reform the international financial architecture, which will be fundamental to increasing the quality and quantity of finance.

- The MDBs themselves – particularly their board and governance processes – will be critical to leveraging up investment, particularly in a constrained fiscal context.

- Financing for Development and the Climate and Development Ministerial will be additional critical focus points.

Additionally, action-oriented coalitions – including through the Climate Weeks – can and should form the political backbone that will build sustained commitment, reform, and mobilisation. High-ambition countries are critical to this, but the MDBs, the private sector, non-governmental actors, and others all have a role to play.

The path to success is not straightforward or easy, but the cost of failure is too high to allow for anything else.

Want to learn more? Download Pathways Towards Resilience for E3G’s complete set of recommendations for building global resilience through enhanced adaptation finance.

In E3G’s briefing Bridging the Finance Gap for Adaptation, which complements Pathways Towards Resilience, we map the state of play in key types of finance for adaptation and identify areas for potential progress in closing the adaptation finance gap in this crucial COP30 year.