In its first 100 days, the European Commission has put into motion a series of flagship plans intended to boost the EU’s economy in difficult times. So far, they add up to a mixed overall strategy. While some pieces provide strong and logical links between decarbonisation and competitiveness, their ambitions lack fresh sources of funding or a credible mechanism for joint EU action. Meanwhile, the first “simplification” effort delivers deregulation and uncertainty. This shaky start leaves multiple politically charged decisions for the remaining 1,500 days.

Amid growing geopolitical upheaval, the European Commission offers two steps forward, one step back

The executive’s first burst of policymaking has primarily focused on European competitiveness. This happens as the international post-World War II global order faces historic stress, with Europe trying to find a seat at the table amid the re-emergence of “great power” politics driven by economic competition and protectionism. The series of initiatives proposed by the Commission attempts to thread a needle in the context of Europe’s own challenging domestic politics – aiming to balance industry demands with a forward-looking agenda. The outcome so far is a mixed bag that recommits to decarbonisation as Europe’s economic backbone while simultaneously rowing back on key policies steering in that direction.

Top take-aways

The EU grasps the challenges ahead but shies away from difficult questions

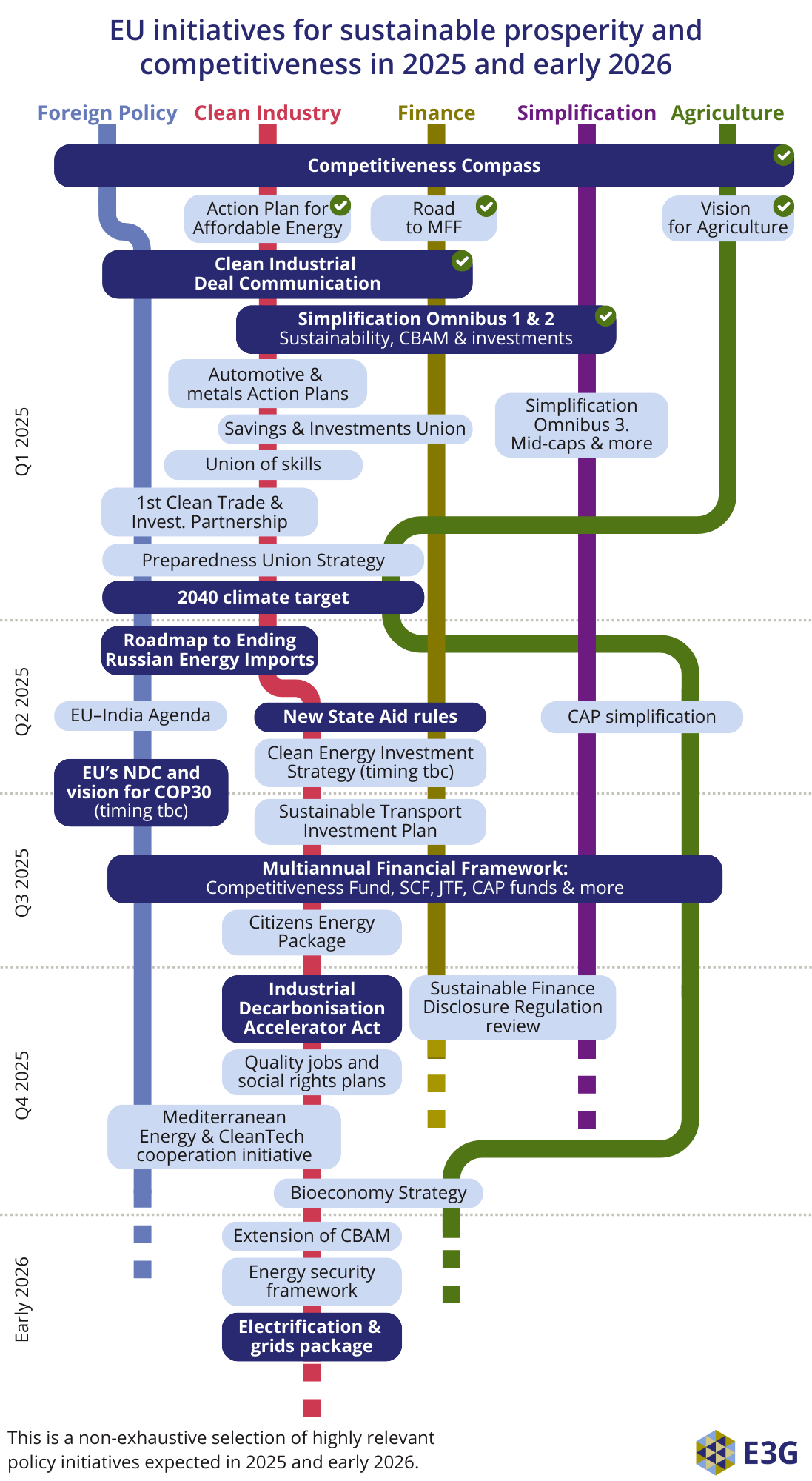

President Ursula von der Leyen’s first batch of policies – notably the Competitiveness Compass, Clean Industrial Deal, simplification Omnibuses, Action Plan for Affordable Energy and “Road to the MFF” – give shape to Europe’s effort to support its economy, stake out a stronger position on the global field, and ensure that households reap benefits along the way. Yet the difficult questions that sit at the heart of the puzzle, such as how to effectively coordinate the bloc or increase EU-level funding, remain unanswered.

The competitiveness agenda opts for evolution over revolution

Despite the urgency and transformative ideas put on the table by the Draghi and Letta reports, the Commission’s plans stay clear of the systemic change that could be unlocked through bolder, EU integration-oriented policy backed up by a larger EU purse. Instead, the current approach opts for an incremental step towards greater economic intervention.

Contradictions and indecisiveness weaken the credibility of EU plans

The Commission positions decarbonisation as an economic driver, yet deregulating the sustainable finance framework undermines this objective. Similarly, measures aim to shield citizens from fossil fuel price volatility and better equip the just transition, but their delayed timeline, soft-law nature, and narrow focus on skills overlook the urgency of social unrest and the factors that feed it.

EU politics remains a delicate balancing act, with some opportunities ahead

The mix of plans presented so far reflects President von der Leyen’s attempt to speak to the priorities of the fragmented political landscape making up her majority. With the Commission appearing somewhat constrained by this delicate balancing act, it will take member state leadership to facilitate scale, speed and action. As these plans get fleshed out in the months ahead, the devil will be in the detail and the ball in the Council’s court, with an increasingly tense geopolitical setting stepping up the sense of urgency.

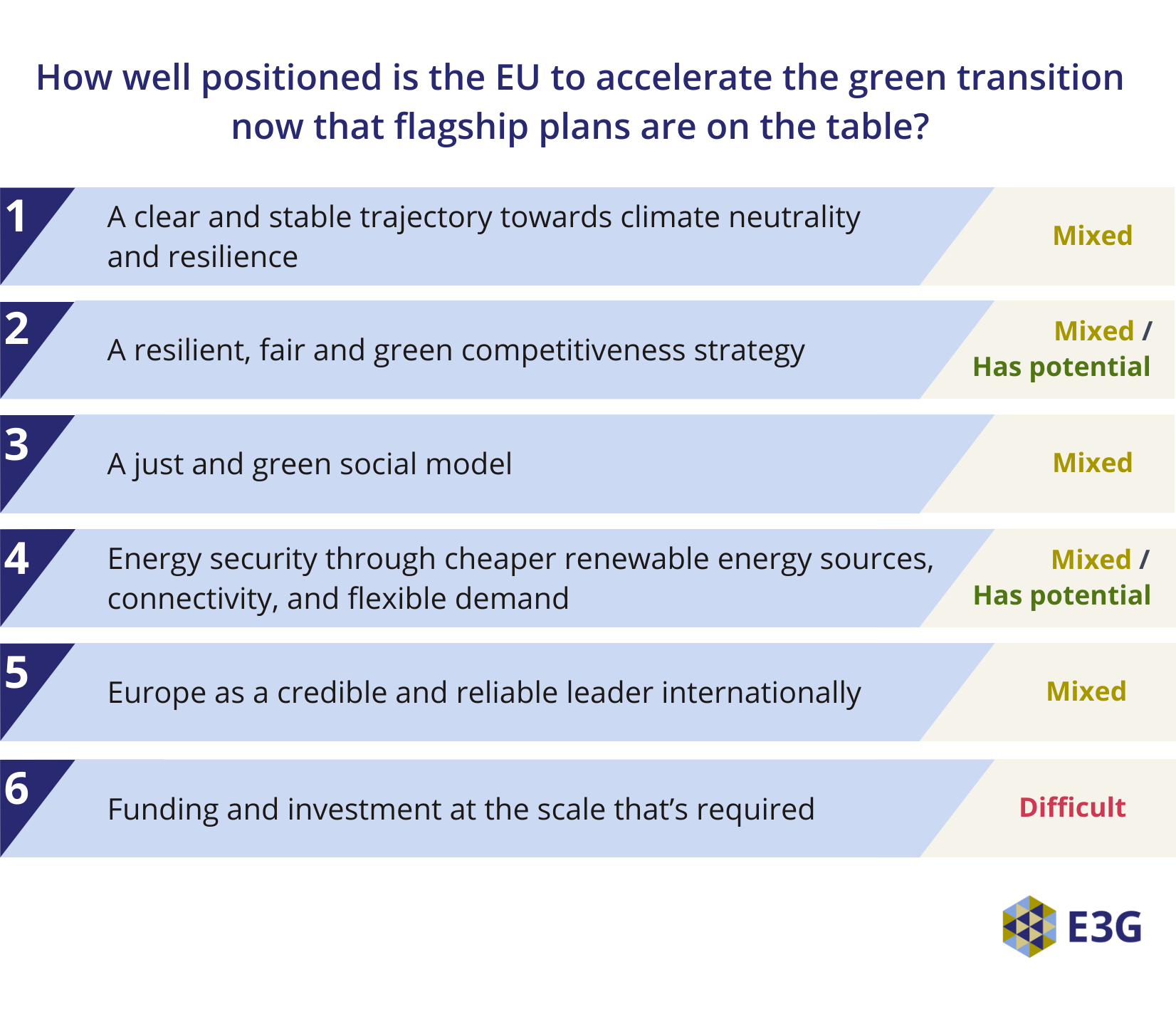

How well positioned is the EU to accelerate the green transition now that flagship plans are on the table?

Below, we grade the European Commission’s first batch of proposals (see visual above) against the key elements needed for securing a fast, fair and funded transition in Europe and internationally.

Download the full briefing for expanded analysis of how the Commission’s plans stack up against our benchmarks.

Assessment: The Commission has positioned accelerated decarbonisation as an economic driver, but the weakening of key sustainable finance rules and the 2025 CO2 target for carmakers – in addition to hints of further deregulation – means instability and contradictory signals.

Ahead: A proposal for a –90% greenhouse gas emissions by 2040 target in March would provide clarity on the trajectory to climate neutrality and facilitate the adoption of the EU’s 2035 Nationally Determined Contribution ahead of COP30. The upcoming Preparedness Union Strategy could offer guidance on how the EU plans to adapt and become more resilient to heightened climate impacts.

Grade: Mixed

Assessment: The Commission paints competitiveness and decarbonisation as two sides of the same coin and the CID moves towards industrial policy territory – but the plans lack the transformative potential of fresh funding or EU-level industrial coordination. The EU Auto Plan weakens CO₂ targets and gives vague support for battery production, on balance weakening competitiveness, despite positive steps on greening corporate fleets.

Ahead: Eyes will be on the new State Aid Rules (Q2), Industrial Decarbonisation Accelerator Act (Q4) and March Council, where leaders will discuss competitiveness and the economy. The forthcoming Competitiveness Coordination Tool will need to make sure not to leave cleantech and energy-intensive industries out of its scope.

Grade: Mixed / Has potential

Assessment: The new plans have the potential to lower energy bills for households and better support workers through restructuring processes. However, social measures focus narrowly on skills, rely on soft law, will come late in time, and face uncertain funding.

Ahead: Upcoming CID initiatives will need to prioritise industrial sectors and locations and related just transition implications, while the Multiannual Financial Framework should deliver on the promise of a “significantly increased Just Transition Fund”. Member states can use their Social Climate Plans – due in June – to deliver on the Commission’s guidance on electricity prices and support for workers and consumers.

Grade: Mixed

Assessment: Plans to boost grids and electrification can lower reliance on volatile fossil fuels and increase energy security, but depend on member states’ still limited institutional capacities to deliver. Increasing transparency and enabling demand-side flexibility to stabilise gas markets have the potential to lower energy prices, but current plans don’t provide a clear pathway to transition away from fossil gas.

Ahead: The upcoming Energy Security Framework revision, Citizens Energy Package and proposed strategies on electrification and heating and cooling will be opportunities for managing the EU’s fossil gas demand reduction. Meanwhile, the upcoming plan to phase out Russian fossil fuel imports should provide clarity on reducing overall fossil fuel demand and avoid creating new dependencies.

Grade: Mixed / Has potential

Assessment: The EU recognises its global responsibility and the potential of integrating decarbonisation with trade policies and partnerships, but proposals lack detail, focus mainly on Europe’s own industrial interests rather than co-benefits, and shy away from international climate leadership.

Ahead: A series of Clean Trade and Investment Partnerships – the first one expected in March, a Trans-Mediterranean Energy and Clean Tech Cooperation initiative with the potential to spur investments in renewables in the region, and defining the EU’s 2035 Nationally Determined Contribution ahead of COP30 to strengthen the EU’s global leadership in a time of geopolitical crisis.

Grade: Mixed

Assessment: The Commission’s plans acknowledge Europe’s significant investment needs and make an effort to address them by mobilising private investment in cleantech via InvestEU and the EIB, while also cracking the door to new own resources. Yet, no significant fresh money is put on the table and the Omnibus rolls back rules intended to steer private finance.

Ahead: Eyes will be on the Savings and Investment Union (Q1) and discussions among EU leaders signalling the appetite for joint EU action ahead of the Commission’s release of the new budget proposal in July. Also ahead: new State Aid Rules (Q2), changes to the CSRD and CSDDD go to the inter-institutional negotiation process.

Grade: Difficult

What’s next?

EU leaders will meet in March on security and the economy

High-level discussions are currently driven by the tumultuous geopolitical and security landscape ushered in by the US administration. EU leaders are meeting informally twice in March to discuss Ukraine and defence, and formally on March 20–21 to tackle Europe’s competitiveness strategy to give further steer to the Commission. Key questions likely to arise are around trade, funding for defence, and Europe’s overall economic strategy. An appearance by UN Secretary General António Guterres may prompt leaders to consider Europe’s flagging climate leadership and role in a faltering multilateral system.

Europe’s 2040 target is slated to be proposed in the coming weeks

The Commission has said it will table the legally required amendment to the European Climate Law – containing its 2040 climate target – before the end of March. This will set into motion discussions towards a political agreement, while also providing a trajectory from which to determine Europe’s NDC, which is running behind schedule.

Germany forming a new government, and presidential elections in Poland and Romania

German election winner Friedrich Merz (CDU/CSU) has kicked off talks with the Social Democrats, aiming for a coalition by Easter. Results of coalition negotiations will determine Germany’s position on the path Europe takes for its security, finance, and industrial policy. Poland, which holds the Presidency of the Council of the EU until July, will have presidential elections in May. The run-up to this domestic race has reportedly contributed to the Commission’s delay in tabling Europe’s 2040 climate target. Romania will have its new presidential election in May, following an annulled election in December that drew critical remarks from US Vice President Vance, which widened a growing transatlantic rift.

The EU’s financing debate has kicked off

Discussions around the EU’s next long-term budget (2028–2034) are intensifying in the run-up to the Commission’s proposal due in July. The size of the budget, own resources, and cohesion policy reform are likely to draw the most attention – and have the potential to boost, or harm, the EU’s decarbonisation plans. Also coming up is the EU’s plan to energise capital markets via a Savings & Investments Union, a new State Aid package, Clean Energy Investment Strategy, and Sustainable Transport Investment Plan.