Europe’s industrial future is on the line. Heavy industries such as steel, cement, aluminium and ammonia are not only responsible for a large share of emissions – they are the backbone of Europe’s economy. Yet, after years of high fossil-energy prices, growing competition and global oversupply, Europe’s fossil-based production has not become only environmentally unsustainable but also financially untenable.

A new report by E3G and the Industrial Transition Accelerator (ITA) shows that Europe’s pipeline of commercial scale deep decarbonisation projects in these sectors represents a €100bn investment opportunity. Yet, most of these projects are stalled before reaching final investment stage, held back not so much by technology or finance, but the absence of robust markets for clean industrial products. Without predictable demand, clean industrial projects cannot secure financing and move forward.

The Clean Industrial Deal has rightly recognised this challenge and committed to developing lead markets for clean materials. The forthcoming Industrial Accelerator Act (IAA) will be a key test of Europe’s ability to deliver on that agenda through ambitious demand-side policies.

Building “lead markets” for clean materials and chemicals

The report identifies four high-impact downstream sectors where demand-creation policies can catalyse investment and scale up clean production:

- Automotive (aluminium and primary steel),

- Buildings (cement and steel),

- Infrastructure (cement and steel) and

- Fertilisers and select agriculture-products (ammonia).

Smaller sectors such as renewables and defence can also play a strategic role in testing standards and building secure supply chains.

Key findings

- Fossil-based production is financially unsustainable. European steel, aluminium and ammonia are already more expensive than global averages and highly exposed to volatile energy markets.

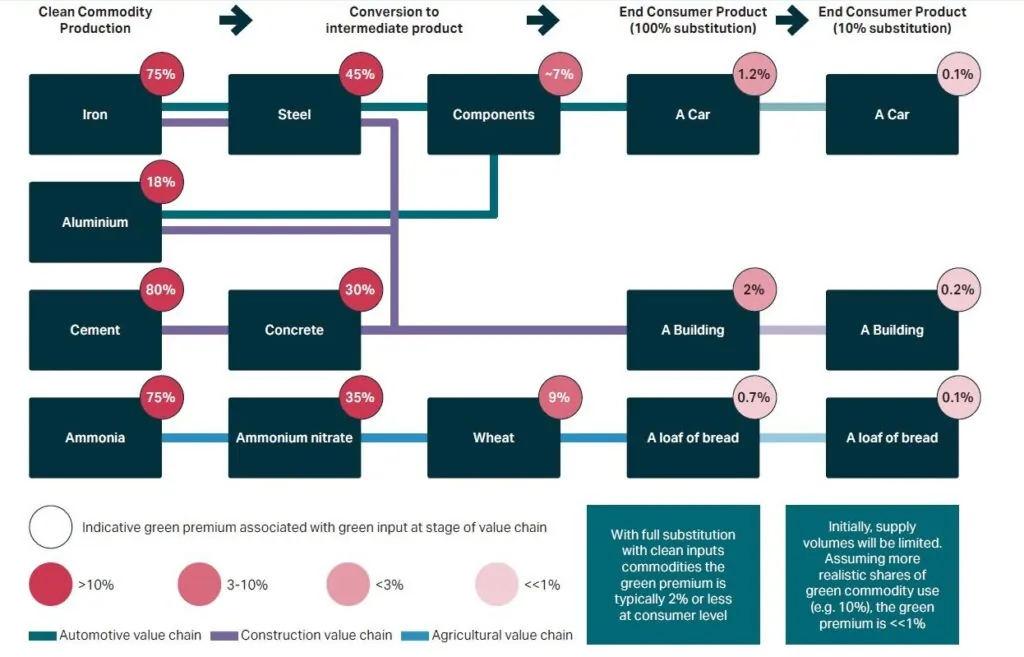

- Clean production is affordable. Switching to clean steel and aluminium would increase the cost of a car by only around 1 %, while using low-carbon cement in buildings would add roughly 2 %. These steady, predictable costs pale in comparison to fossil-fuel-driven inflation — energy prices alone added six percentage points to EU inflation in 2022.

- Europe risks falling behind. While the EU still leads in announced clean-industry projects, many remain stalled. Emerging economies with abundant renewables are rapidly catching up: by mid-2025, China accounted for a quarter of committed clean-industry investments, and renewable-rich emerging economies a third of announced projects.

The EU’s plans to activate public procurement and voluntary labelling for clean commodities are important first steps. But to scale lead markets across all sectors, the upcoming Industrial Accelerator Act must go further — tackling barriers along each value chain through product standards and mandates, embodied-carbon limits in construction, and targeted demand-side subsidies to manage green premiums where costs impact consumers.