Entering COP, many commentators like to use the line that renewables are just about meeting additional energy needs, or “energy addition”. But this misses the real story. The economics and geopolitics driving decision making shows that there is political momentum behind a full scale transformation of energy systems rather than just a greening of its margins.

Clean power is scaling faster than any fossil fuel in history, gas and coal face fierce competition on power system flexibility, electrification is seen as a benchmark for global competitiveness and hard-nosed security and investment decision makers are choosing renewables as a shield against volatility. Progress remains uneven and insufficient in climate and development terms, yet, these four structural trends – and one fading illusion – evidence the scale and depth of energy transformation.

1. Renewable energy expansion outpaces demand growth

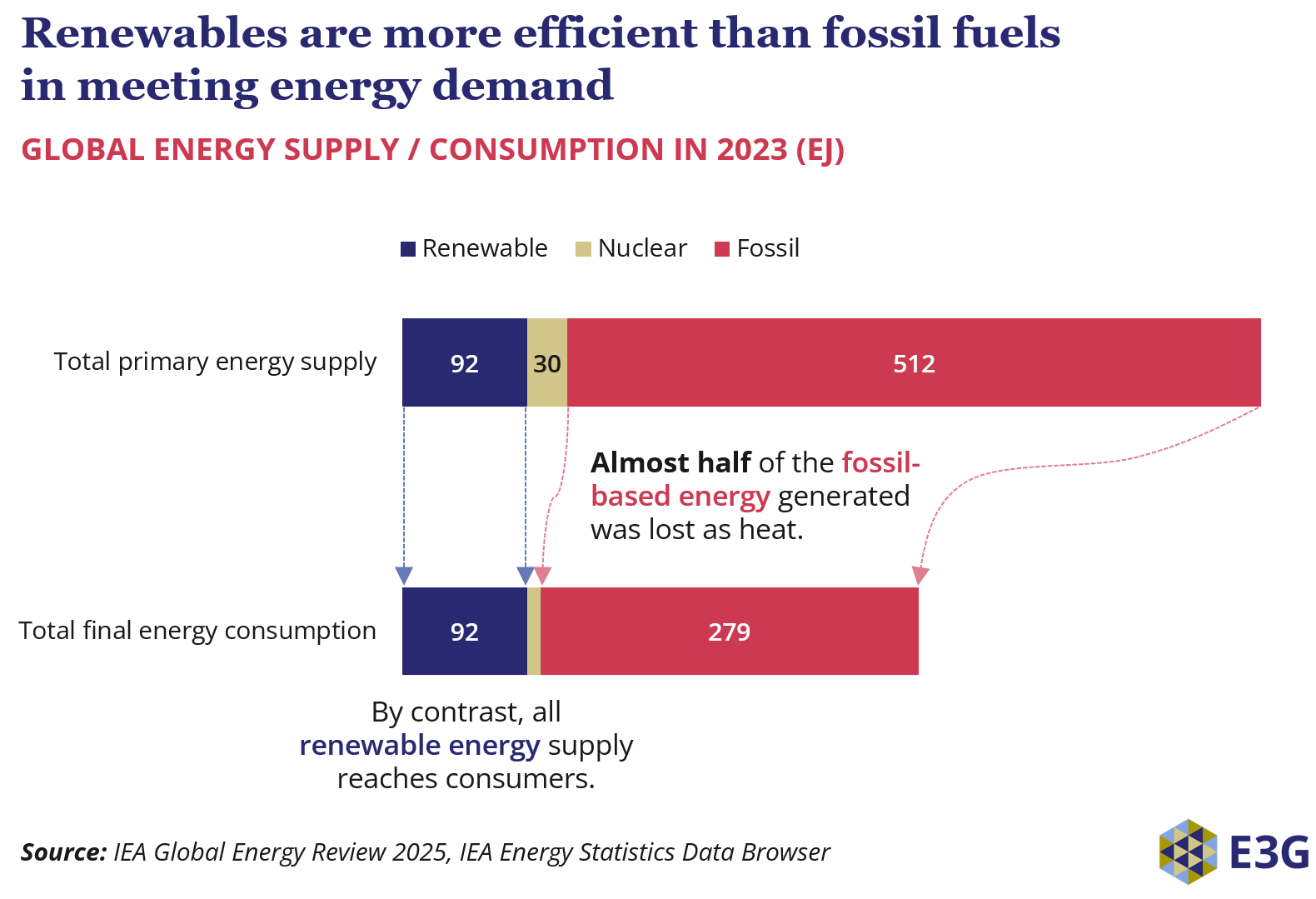

A technical accounting quirk has long obscured the scale of the energy transition: fossil fuels still dominate energy supply on paper, but actually 40-70% never reaches the consumer and is lost as heat. There are no such losses with renewable electricity.

Measured by useful energy output, renewables are now the dominant source of growth. In 2024 alone, renewable additions added a record 858 terawatt-hours (TWh) of generation – 49% higher than the previous record. Growth of solar and wind alone outpaced total energy demand growth eightfold and fossil energy growth sixteenfold.

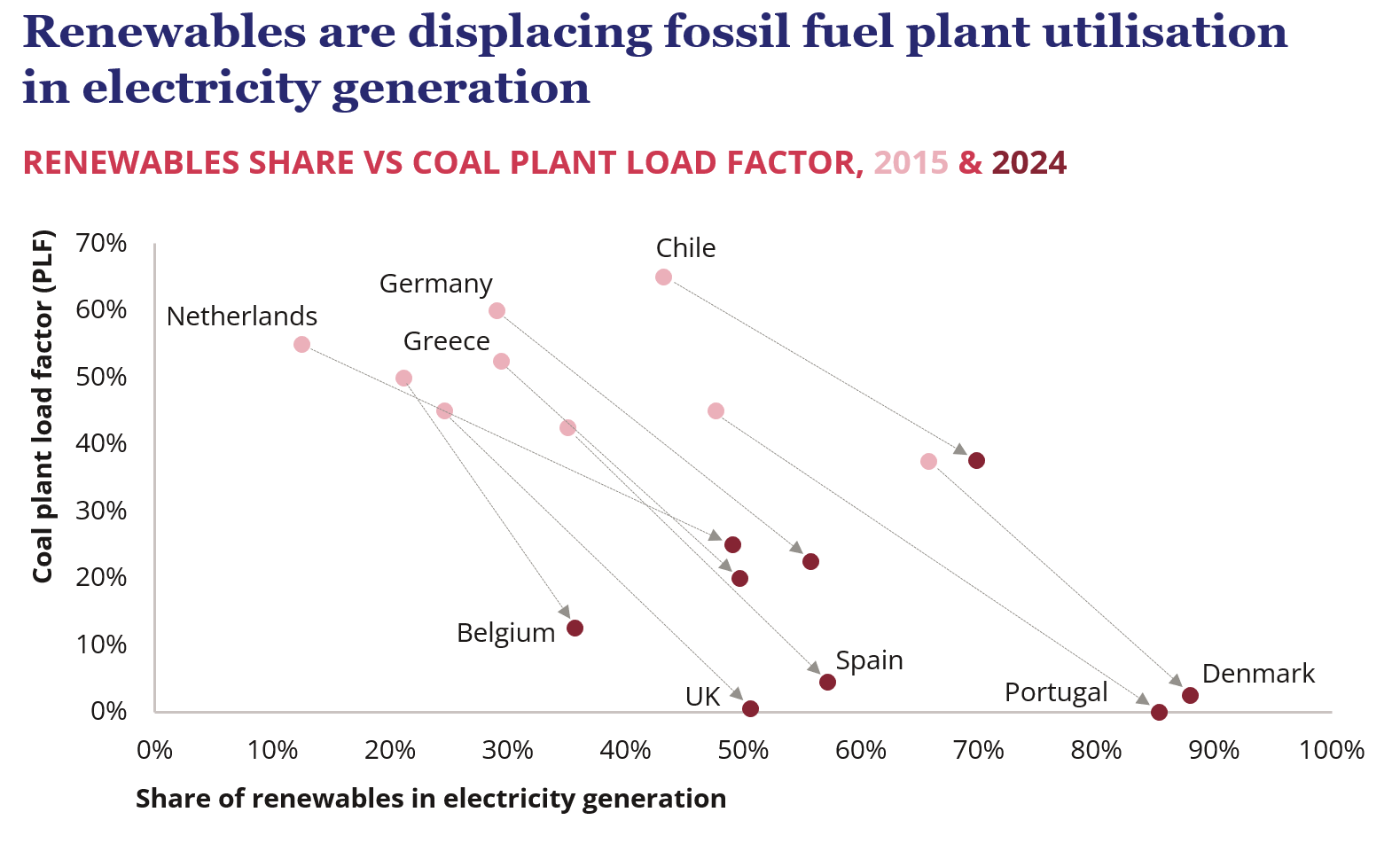

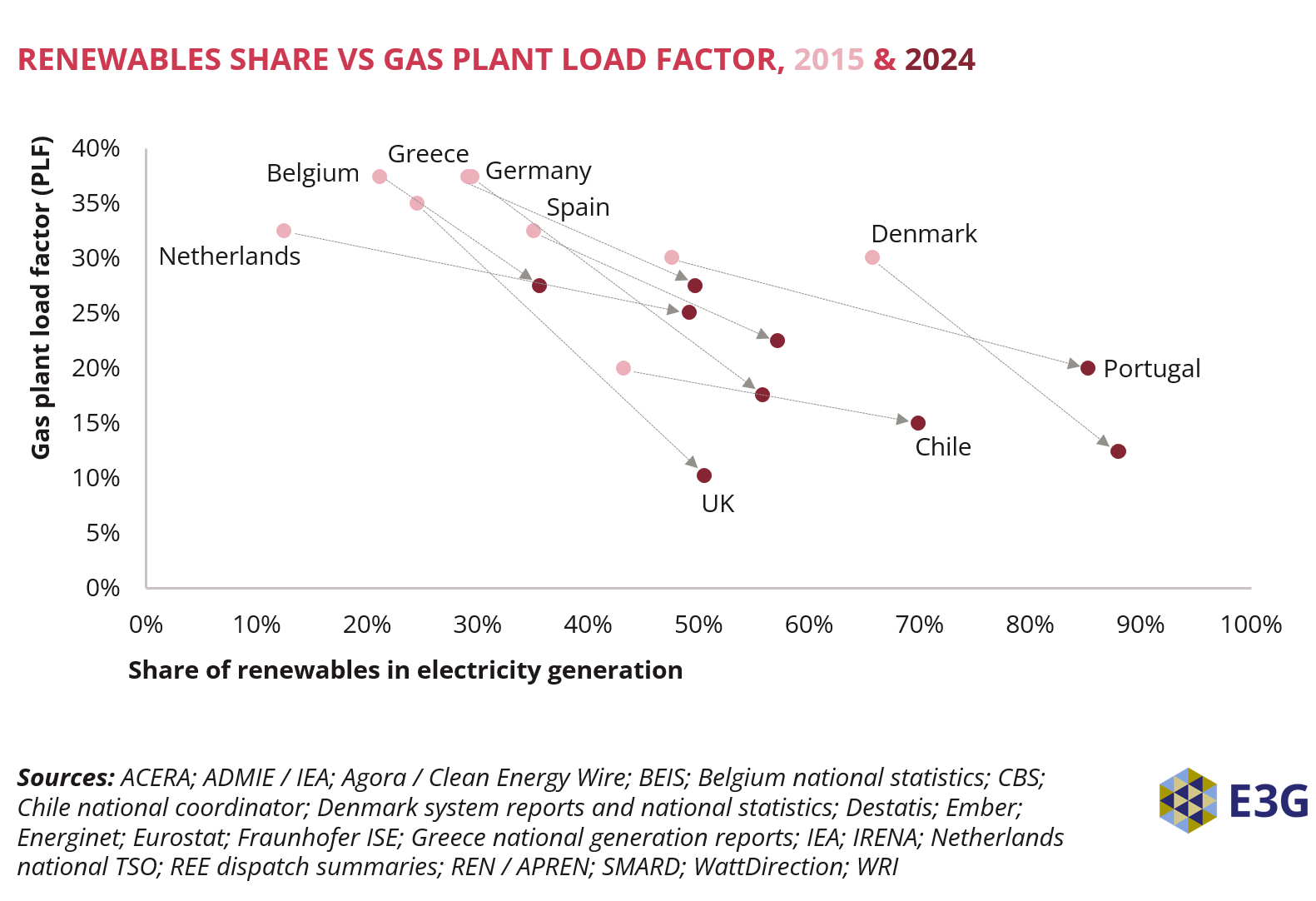

2. From baseload to flexibility: Renewables are displacing fossil fuel plants in electricity generation

The role once filled by large fossil plants to balance changing demand profiles is shrinking. Storage, demand response, distributed generation, and smarter transmission can now meet a large part of the balancing work. In grids with higher renewable penetration, fossil plants face falling utilisation and weaker economics -even where new plants are built, they are unlikely to run many hours a year.

3. Electrification is remapping global value chains

Electrification is not just a change in fuel. It is reshaping transport, industry, and logistics. Electric vehicle (EV) adoption continues to surge: more than 17 million EVs were sold in 2024, exceeding 20% of new car sales in many markets and dampening medium-term oil demand growth. Business leaders see a renewable energy based economy as more attractive, with almost two thirds willing to consider relocation for access.

4. Geopolitics and finance are accelerating the shift

The 2022 energy shock changed strategic calculations for many countries, making clean energy an economic and security resilience strategy. Together with the actions already taken in the past decade, these policies have saved $1.3tn in avoided fossil fuel imports.

This is no longer just an EU or China strategy. Pakistan has quadrupled its solar capacity since 2022 becoming the world’s second largest solar importer, slashing reliance on volatile LNG and diesel imports. Turkey has doubled solar capacity in 2.5 years, cutting the country’s oil and gas import bill by roughly $12bn in 2024. Ethiopia banned the import of petrol cars to limit foreign reserves going to petrol imports. Agreement is growing in the defence sector that renewables must be one of the core elements of homeland security.

Finance is following suit. In 2024, global clean energy investment exceeded $2 trillion, outpacing fossil energy investment two to one. Projected increases in electricity demand from AI fuel even more interest in clean energy, one of the last bastions of hope for the fossil fuel sector.

5. The fragile case for “gas as a transition fuel”

Finally, the case for gas as a safe “bridge” for developing economies is weakening. Weaker macroeconomic environment, delays in infrastructure buildout and rigid LNG import contracts dampen the appetite for new imports in the Asia-Pacific region which was expected to determine the global gas demand trajectory.

Vietnam’s power development plan, Plan VIII, aims for 48% renewables in total installed capacity, limiting new gas to balancing roles. Half of India’s power mix is now delivered by non-fossil energy, the majority of it renewables, while the government’s projection doesn’t foresee an increase in new gas power capacity and some existing plants have been decommissioned due to inefficiency and low utilisation rates. The Philippines is betting on solar energy as an alternative to LNG imports. Meanwhile, investors question the sustainability of future LNG supply amid uncertain demand.

The transition is happening, but policy action still necessary

These trends indicate a clear directional shift: the transition to clean energy is increasingly driven by economic and geopolitical imperatives. It is not an add-on, it is becoming the default choice for utilities, investors, and governments seeking strategic resilience.

Meanwhile, the end of addition is not the end of policy effort. It is the start of critical system re-engineering work: ensuring the transition is fast, equitable and durable. The markets are beginning to choose a different future. Policy needs to provide a framework to ensure that the finance and industry’s choice also comes with urgency and fairness.