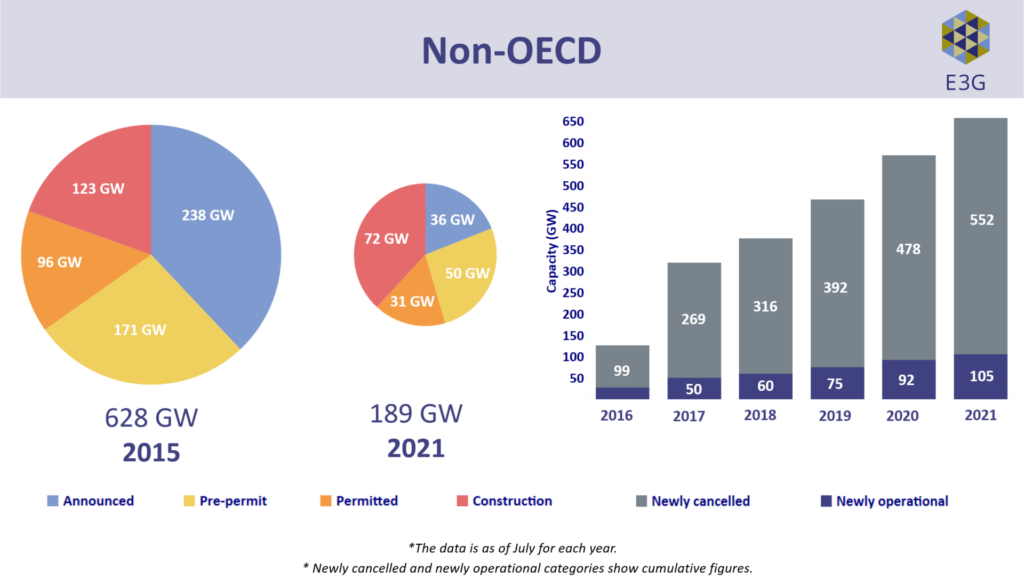

- The pipeline of proposed coal power plants in non-OECD countries (excluding China) has contracted by 77% since 2015.

- 552GW of coal power projects were cancelled over this period, compared to 105GW which went into operation; a ratio of 5.3:1.

- 27 non-OECD countries that had previously considered new coal power generation no longer have any projects in the pipeline.

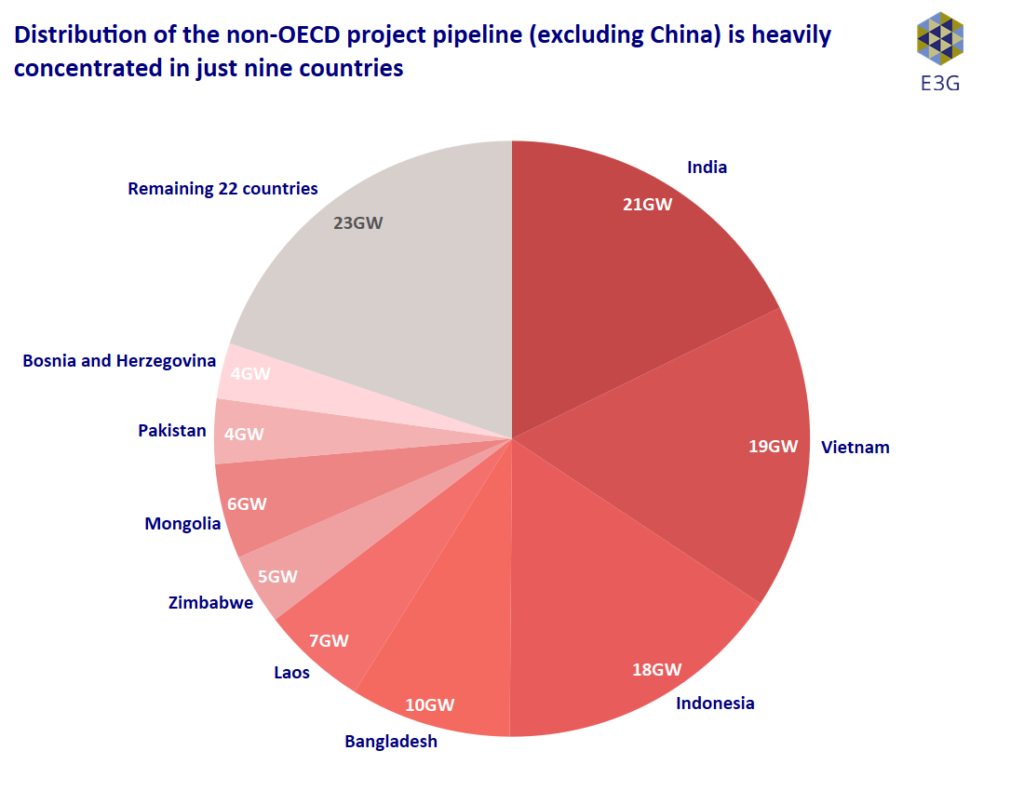

- The 189GW of projects remaining as of July 2021 is heavily concentrated, with 80% locatedin just nine countries.

- South-East Asia (42%), South Asia (32%) and Sub-Saharan Africa (13%) collectively account for 87% of the non-OECD pipeline.

Figure 1:Reductionin size of the non-OECD coal project pipeline (left) and year-on-year tracking of projects that were cancelled or newly operational (right). Click to expand.

Outside the OECD & EU and China, the dominant dynamic sees the once-large coal pipeline rapidly shrinking as countries pivot from coal to other energy sources. Overall, this group has seen 552GW of cancellations, compared to only 105GW of newly operational capacity – a ratio of 5.3:1. This amounts to a 77% decline in the size of the project pipeline since 2015. 117GW remains in the pre-construction pipeline, in addition to 72GW currently under construction. Since 2015, 27 non-OECD countries have ended the development of new coal power generation through project cancellations and/or policy commitments, totalling at least 58GW of capacity.

Figure 3: Distribution of the non-OECD project pipeline (excluding China) is heavily concentrated in just nine countries. Click to expand.

The remaining pipeline in the non-OECD is heavily concentrated. Figure 3 shows the distribution of the non-OECD pre-construction pipeline, highlighting that 80% of the non-OECD pre-construction pipeline is now located in just nine countries (India, Viet Nam, Indonesia, Bangladesh, Laos, Mongolia, Zimbabwe, Pakistan, Bosnia & Herzegovina). Four of these governments, collectively accounting for nearly 45% of the non-OECD pipeline (Bangladesh, Pakistan, Indonesia,and Viet Nam), have recently indicated restrictions on new coal construction, which are in the process of being further clarified and translated into policy. We discuss these developments and the implications for the remainder of the global coal pipeline further in the overview below.

The remaining 20% is spread across small projects in 22 countries. The international community has a particularly important role to play in supporting these countries in moving away from coal, through provision of public (and private) clean energy finance; support to develop flexible grid infrastructure; and technical and capacity assistance to bolster regulatory and policy frameworks that encourage a transition from coal-to-clean. COP26 will be a key moment to show this support is available for countries that are willing to take this next step.

Collectively, South-East Asia, South Asia, and Sub-Saharan Africa account for 87% of the total pipeline capacity in non-OECD countries outside China. These regions include 23 countries out of the 31 non-OECD countries that still have a pre-construction pipeline. The following sections provide a detailed assessment of coal pipeline dynamics within these three regions. We look at the rest of the non-OECD below.