The RePowerEU plan will partly shift the EU’s reliance from Russian to US gas. However, as the EU accelerates away from gas, the US should avoid investing in new LNG infrastructure and investments that might never be recovered.

- The EU is implementing an ambitious package of measures to reduce its reliance on Russian gas, targeting both supply and demand. This will accelerate its move away from reliance on gas imports over the next decade.

- While this will lead to an increased reliance on liquefied natural gas (LNG) in the short term, the outlined strategy doesn’t imply any market growth in the long term as overall gas demand will reduce significantly.

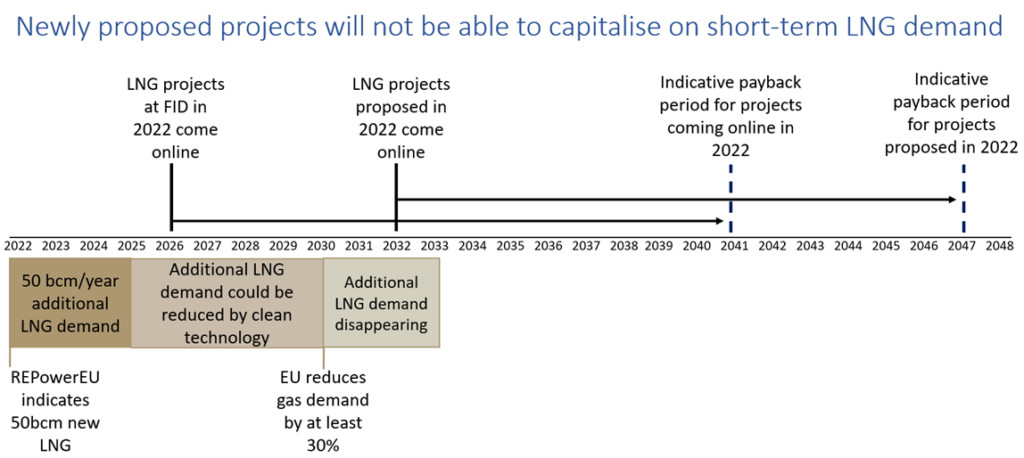

- The discrepancy between LNG project development timelines and EU gas demand projections means that newly proposed projects will not come online before EU gas demand declines.

- Long payback periods mean that any LNG export projects aimed primarily at the EU market may never recover the capital invested in building LNG infrastructure.

In response to Russia’s invasion of Ukraine, the EU announced in early March its REPowerEU programme, which aims to reduce reliance on Russian gas imports. Recent analysis shows that more ambitious targets in deploying clean technologies are possible and could end imports of Russian gas by 2025, meaning that any substitution effect from Russian gas would end within three years. Therefore the US can supply Europe with the 50 bcm of gas called for without expanding its export capacity beyond what is already under construction. This briefing examines implications for the US gas export sector as the EU accelerates away from gas.