As we focus on the need to reform financial systems to fund the climate transition, we must not forget that countries burdened by both economic and climate vulnerability need transition finance that will not push them further into debt distress as they seek to build more resilience and adapt to the impacts of the changing climate.

The report by E3G and Mistra Geopolitics, explores this relationship between climate, debt and resilience and the influence of geopolitics, looking at what must be done to break the cycle of risk.

Ronan Palmer on why debt matters:

Resilience is essential to the success of economies and societies and is the smart economic option. But the debt and climate crises intertwined are creating a vicious cycle between a lack of economic resilience and a lack of climate resilience. In the face of this fragility, there is not nearly enough financial support for these countries. How can we unblock the money that, again and again, climate and development reports say is needed?

Ronan Palmer on what’s the problem and what needs to be done:

The recent report by E3G and Mistra Geopolitics, explores this relationship between climate, debt and resilience along with the influence of geopolitics. Human security and environmental change are top of leaders’ agendas, however these further serve to highlight the essential role of global finance in building both economic and climate security – or destabilising it – if we don’t reform it far and fast enough.

André Månberger on the shared responsibilities for finance solutions to debt:

We want countries to be able to plan ahead the actions and investments needed to support the growth of their economies in the future. And we want donor countries and the private sector to step in and relieve the existing burden of debt but also provide much longer-term assistance to countries on the back of these roadmaps. Together this will mean that investors, both private and public (such as development banks) have a strong sense that investing in these countries is a growth area for much greater future sustainable development, while supporting a hopeful future for these countries.

Clear roadmaps and transition plans will help frame the roles and actions of debtor countries, their donors and creditors in emerging from the present crises. The debt products, the institutions and the whole social contract between these parties must move to a more just, mutually engaged and supportive one, if the world as a whole is to move to a more resilient future.

André Månberger on how roadmaps and transition plans help to tackle debt.

The next two COPs we have are a great opportunity to use climate finance for mitigation, adaptation and loss and damage, and to break this cycle of debt-climate-resilience fragility. They can greatly suupport countries, currently labouring under debt burdens and climate pressures, to get onto a sound footing for the future.

Ronan Palmer on why COP29 is a key milestone for debt reform:

Building resilient economies is going to be essential for countries to be able to absorb shocks, in this dynamic environment where uncertainty and increasing frequent shocks are becoming the norm.

Resilience is about how to break the cycle of risks – and the vicious feedback loop between climate risk and debt. But it’s equally important to think about the future of debt as an enabler

Dileimy Orozco on how debt can be an enabler to building more resilience.

These countries need a robust safety net and a new contract with International Financial Institutions, including Multilateral Development Banks (MDBs), the IMF and the private sector to ensure they thrive and have access to finance, particularly in the hardest times.

The risk aversion that is intrinsic in the financial system also exacerbates the issue of the lack of investment in resilience and there needs to be a change in mindset from both the public and private sector to put more value on adaptation and on the benefits of investing in resilience.

Dileimy Orozco on putting a value on resilience:

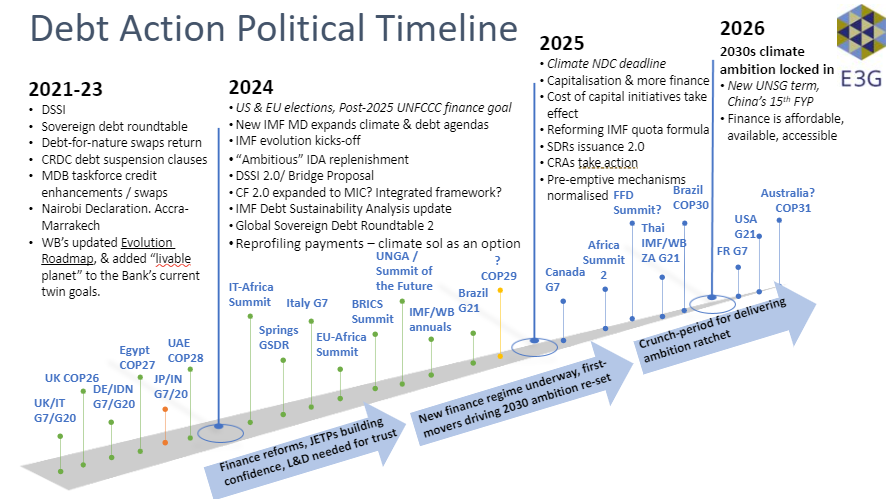

The politics of debt action is also rising up the G20’s agenda with the Brazilian G20 Presidency placing a significant focus on restoring fiscal space, deemed essential for addressing both debt burdens and climate-related challenges effectively. This blog by E3G’s Dileimy Orozco and Christine Seet highlights the key takeaways from the 2024 IMF and World Bank Spring Meetings for a critical dialogue on the intertwined issues of debt, climate action and development. including the Debt Action Political Timeline.

The report by E3G and Mistra Geopolitics, explores this relationship between climate, debt and resilience and the influence of geopolitics, looking at what must be done to break the cycle of risk.