Data trends: 🔴 COP26 Progress: 🟠 2022 Momentum: 🟠

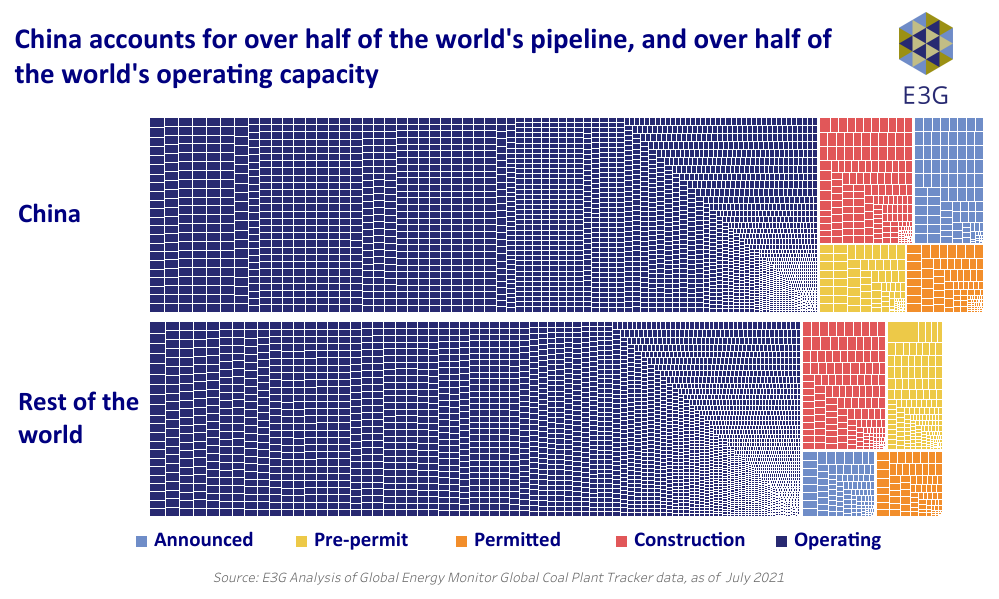

China is home to over half the world’s coal power plant capacity and over half the world’s proposed new coal power plants. In 2021, the Chinese government acknowledged that specific actions are required to address coal power generation and (over)capacity. Further action is required to keep the 1.5°C target alive and respond to the UN Secretary General’s call for a global phase-out of coal power by 2040.

Progress on coal through a series of steps

In 2020, China’s carbon peaking and neutrality pledge sent shockwaves through their energy sector. This created space for improved sectoral climate and energy policies. In March 2021, China’s 14th Five-Year Plan called for “controls” on the pace and scale of coal power construction but stopped short of calling for a halt in new coal plant construction. A month later, at the Leaders’ Summit on Climate, China indicated that coal will soon be on the way out of its energy system. President Xi pledged to “strictly control” coal consumption growth in the next five years and gradually “phase down” coal use in the next five-year plan cycle (2026-2030).

“Phase down” language found its way into the US-China joint declaration signed at COP26. Soon afterwards, it was at the heart of the last-minute diplomatic wrangling to forge consensus on the Glasgow Climate Pact. In signing the Pact, China for the first time acknowledged coal power generation as the specific target of a ‘phase down’, instead of its previous more general references to overall coal consumption in domestic policies.

Ending China’s international coal construction

Following commitments from South Korea and Japan to end public finance for new coal projects abroad, China was the last remaining provider of international coal finance. Its position was made untenable after key recipients either made significant cancellations of their coal pipelines (Indonesia & Vietnam) or announced an end to new coal (Pakistan).

In October 2021, President Xi Jinping announced that China will no longer build coal-fired power abroad and will step up support for low-carbon energy in developing countries. E3G analysis found that this could remove public financing of over 40GW of coal across 20 countries, almost equivalent to the entire operating fleet of Germany. As such, the end of Chinese coal finance has a significant impact on the global coal landscape, hastening the end of coal power around the world.

The fine print of China’s commitment to end international coal finance remains to be seen. It is unclear whether the pledge includes projects in which Chinese firms play a role in engineering and construction. There are also worrying signs that some projects in the pre-permit and permitting stages are still going ahead. Further details are needed to confirm the cancellation of proposed coal projects and clarify how clean alternatives will be supported instead.

Converting political signals into policy action

The positive political signals from China’s leadership are not a one-way ticket to successful policy delivery. Coal industry incumbents are seeking to delay the transition, promoting further construction of new coal power plants despite China’s existing overcapacity and low load factors. China’s power crunch in 2021 was a result of a mismatch between supply and demand, made worse by missing price signals – not a result of insufficient coal capacity. Still, some energy experts have defended the role of coal in China’s future energy system on energy security grounds, calling coal ‘a stabilizer of the energy transition’.

The government has subsequently introduced a series of regulatory and financial incentives for the coal mining and power sectors. These include a 200-billion-yuan ($31.3 billion) lending program for ‘clean and efficient’ coal, roughly what the Bank of China invested in coal power and mining between 2016 and 2020. Even though the fund will also finance projects such as coal-bed methane capture that could offer some climate benefits, it potentially throws another lifeline to the coal industry.

While ensuring supply and energy security will remain important, China is under increasing pressure to put an expiry date on coal in its power system. China accounts for 55% of the world’s pre-construction pipeline. But analysis shows that capping China’s coal capacity will still allow it to meet future energy demands. China may already be able to commit to no (net) new coal power, with new additions matched with retirements.

Energy sector plans as part of the 1+N and 14th Five-Year Plan policy frameworks offer an opportunity for China to introduce new policies to phase down (and out) coal. A plan to retire the least efficient and most polluting sub-critical coal plants by 2030 would lay the groundwork for a strengthened NDC in 2022. The pace of change advocated by these plans will determine how much longer coal will remain in China’s energy mix power system. The global spotlight on China’s coal consumption means that actions to phase down and then out will remain a top priority, with growing implications for trade and economy as well as climate.