The global outlook for coal has radically shifted in just the past couple of years, dramatically increasing the prospects of the world being able to avoid dangerous climate change. But there is still too much coal in the pipeline, particularly in Asia. Digging into the numbers gives reasons for optimism – and an agenda for action.

Over the past decade, the position of coal in Europe and North America has taken a decisive turn. The proposed wave of investment in new power plants has been seen off, through a combination of market forces and organised opposition. Across the majority of the OECD the coal debate is now firmly centred on the challenge of phasing out existing coal.

But in parallel to this positive dynamic, the past decade has also seen a surge in coal power generation in Asia, particularly in China. The world’s new coal problem is now overwhelmingly an Asian problem: 92% (322GW) of coal plants currently under construction are located across the region, as are 81% (757GW) of the coal plants at the various pre-construction stages of project development.

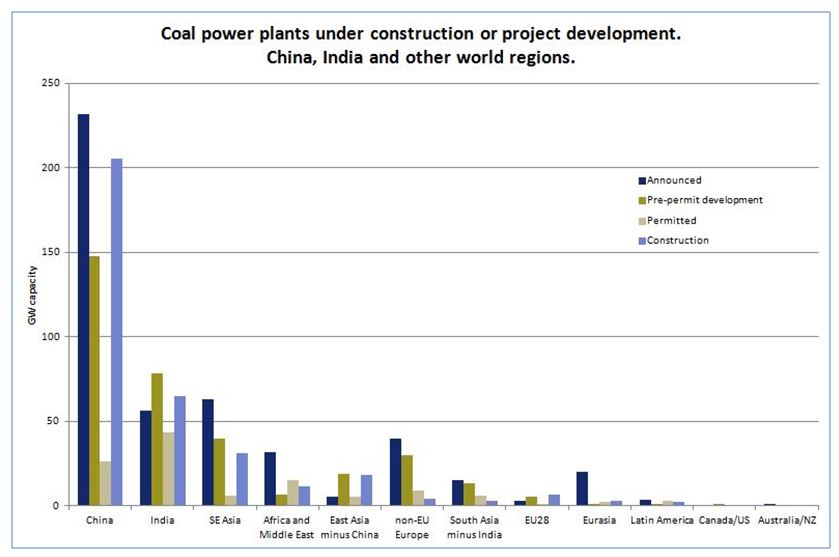

The sheer size of these headline figures can be paralysing, but the scale of the problem is far more approachable when we dig down into the data. Figure 1 below provides an overview of the distribution of coal plants under construction or in project development across China, India and the other world regions.

The right hand side of the chart shows how the coal power plant development pipeline has been reduced to just a handful of projects across North America, Australia & New Zealand, Latin America and the EU28. The last few coal plants under construction in Europe are already stranded assets and the cause of billions of lost Euros to utility companies. They serve as a warning to the rest of the world to get out of coal before it is too late.

But it’s the left hand side of the chart where the action currently remains. Let’s start with China, which now consumes half of the world’s coal. China remains the #1 location for new coal plants, as shown in Figure 1. China alone has 205GW of coal capacity under construction (59% of global total), and a further 406GW (44%) in the development pipeline. But this is no longer a sign of economic strength; instead it is a growing economic weakness that is receiving urgent attention. Chinese policy makers are now directly confronting this challenge, having ordered coal plant cancellations and regional construction bans in an effort to hold back the multiple negative impacts of coal power plants. This isn’t just a question of air pollution and CO2 emissions, but also encompasses increasing overcapacity of electricity generation and under-utilisation of existing coal plants, with resulting economic losses.

A similar story is emerging in the #2 coal location: India has 65GW (18%) of coal plant under construction, plus 178GW (19%) in the development pipeline. But the emergence of cheaper renewable technologies and poor economics for power plants and coal imports means that the scale of coal plant cancellations continues to grow. As in China, the Indian government has acted to close older inefficient coal plants.

The huge scale of their proposed coal plant capacity means that China and India’s choices on coal have global reverberations. Between them, they are host to 77% of coal plants under construction and 63% of pre-construction project proposals. Positively, analysts at Coal Swarm have recently calculated that in the first 6 months of 2016 the coal plant development pipeline in China shrank by 114GW, and by 40GW in India. So while the situation in both countries is still extremely challenging, policy makers are definitively moving to try to reduce the risk of lock in to new coal plants.

We get a much clearer picture of the dynamics on coal across the rest of Asia when we look beyond China and India at the regional distribution of coal projects. If we exclude the figures of the ‘Big 2’, the other Asian regions are home to 65% of the remaining total of global coal plants currently under construction (52GW) and 50% of plants at prior stages in the development pipeline (173GW).

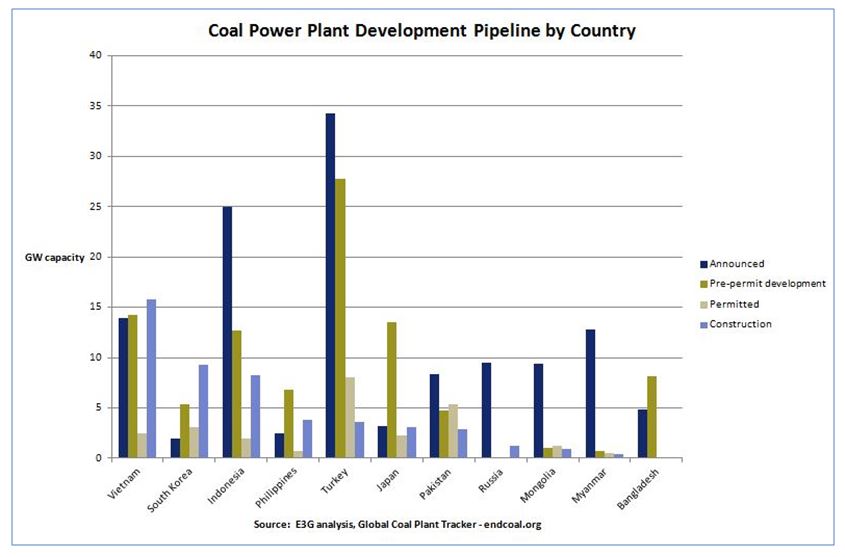

By digging down to the next level of granularity, we find that 10 of the countries in the top 15 coal developers are from Asia. Figure 2 below provides more insights into this list, which includes OECD members Japan and Korea, plus growing South East Asian economies such as Vietnam, Indonesia and Philippines. South Asian countries Pakistan and Bangladesh also make the list, albeit with much smaller levels of plants currently under construction. This increases their chances of getting out of coal before they lock in CO2 emissions and infrastructure choices.

This is the set of country plans that stimulated World Bank President Jim Kim to warn earlier this year that “If Vietnam goes forward with 40GW of coal, if the entire region implements the coal-based plans right now, I think we are finished”. Irrespective of the efficiency of any new plants, their cumulative lifetime emissions would break global carbon budgets.

But a key insight from delving into the data is that the scale of proposed new investments in coal at the national level is far more amenable to the pursuit of alternatives. The clear trend over the past year has been towards increased plant cancellations and shifts in policy by multiple countries that were previously pursuing coal at full throttle, as detailed recently by colleagues at ECIU. Just this past week, Vietnam moved to accelerate the financing and construction of wind power generation, while cancelling a coal power plant.

This analysis points us to two interlinked action points required to reduce the risk of lock in to new coal power generation in Asia.

Firstly, it’s no surprise that coal remains an Asian problem given the continued aggressive promotion of coal power generation by Japan, China and South Korea across the region. These leading regional players are all competing to export coal power plant technologies and secure opportunities for their domestic companies. By offering finance through development banks and export credit agencies they are undermining the ability of recipient countries to prioritise clear development pathways, instead locking in coal power plants that increase health costs and climate impacts. Diplomats and politicians from these three countries need to step up to their regional leadership positions and find ways of de-escalating coal investment instead of stoking the fires of short-term commercial advantage.

Secondly, it is essential to get finance flowing into clean alternatives instead of coal, as part of the effort to further reduce the deployment costs of renewables and provide repeatable business models. The World Bank and other MDBs are explicitly seeking to accelerate this, but have more work to do. Governments across the region can help by reasserting their demands for clean energy alternatives to coal. But public and private financiers alike must assist by reassessing coal plant investment proposals over a radically shortened time horizon compatible with accelerated emissions reductions trajectories.

Taken together, these two actions would help to pinch out the project development pipeline for new coal plants in the region, helping to catalyse a full scale shift from coal to clean energy.