France

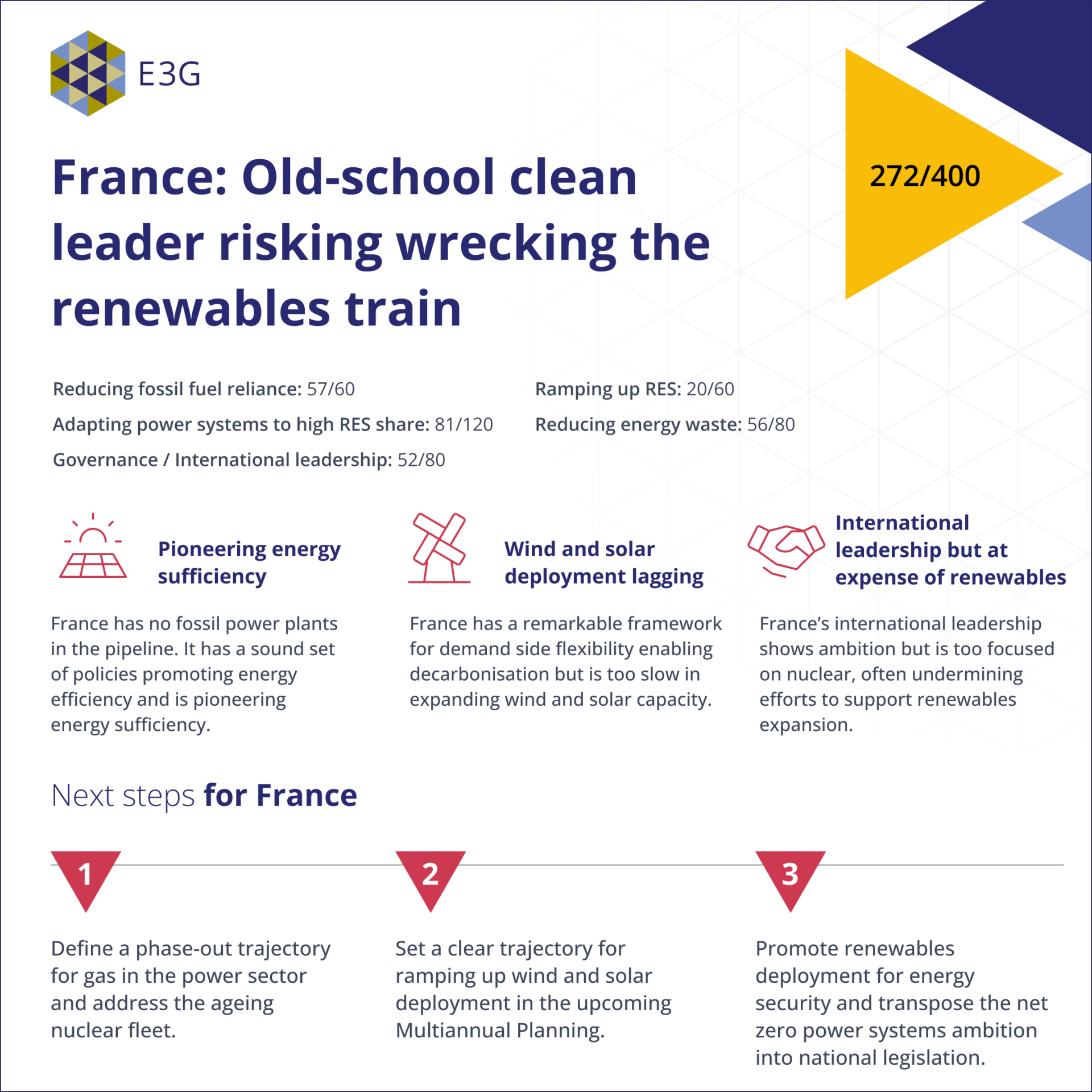

France has an extensive set of policies promoting systems flexibility and energy efficiency. It has low shares of fossil fuels in the power mix but its future progress is at risk due to strong focus on nuclear and too slow deployment of new renewable capacity. It shows commendable effort on demand side management, digitalisation, and the renovation of buildings.

France also is a member of key international initiatives supporting power systems decarbonisation. However, the focus on its ageing nuclear fleet and permitting delays are major obstacles to the deployment of renewables, leading to 2030 renewables targets which are not in line with the contribution under the revised EU Renewable Energy Directive and undermined EU efforts to adopt more ambitious RE targets.

Section 1: Infrastructure/Energy mix

Despite having one of the lowest fossil fuel shares and hence carbon intensity of the electricity mix, France is not delivering on the deployment of renewables. Updated targets are to be awaited in the 2024 multiannual planning. Besides the focus on nuclear, permitting delays are a major obstacle to the deployment of renewables.

Score: 59/60

France’s reliance on fossil fuels in the power mix has never been high due to a high nuclear and a stable hydro output which also leads to a considerably low carbon intensity of power (56 gCO2/kWh). The fossil fuel share in electricity generation currently stands at about 10%. France almost phased out its remaining coal capacity, but the phase-out date has been postponed to 2027. Meanwhile, France has grown gas use almost tenfold since 1990, meaning that the overall share of fossil fuels has barely changed. However, France has stated an ambitious gas consumption decrease by 2030.

1.1 New unabated coal and gas power plants in planning or construction

Score: 15/15

France has no new gas or coal infrastructure announced.

1.2 Share in electricity generation: fossil fuels

Score: 14/15

France has a considerably low share of fossil fuels in electricity generation with 8.4% in 2023.

1.3 Share in electricity generation: non-renewable low-carbon tech

Score: 15/15

The share of nuclear in electricity generation was 65.3% in 2023.

1.4 Carbon intensity of power index

Score: 15/15

The carbon intensity of power index was 83.9 in 2022. France’s CO2 intensity was 56 gCO2/kWh in 2023, placing it well below the global and G7 average.

Score: 20/60

France started to ramp up wind and solar capacity two decades ago, yet the growth has been slow compared to other G7 members. Today, the share of wind and solar is just above the share of fossil fuels (13% vs 10%) in electricity generation. Despite efforts to stimulate the deployment of renewables, the permitting process, particularly for offshore wind, remains lengthy and poses an obstacle to reach the 2030 target of 120 GW of RES capacity.

2.1 Share of variable RES in electricity generation

Score: 4/15

In 2023, France had a share of 14% of variable RES in electricity generation.

2.2 Share of other RES in electricity generation

Score: 4/15

In 2023, France had a share of 12.32% of other RES in electricity generation.

2.3 Variable RES pipeline capacity vs country’s announced target

Score: 5/15

The 2023 draft National Energy and Climate Plan (NECP) plans for 120 GW installed renewables capacity by 2030, representing 35% of the electricity mix. The updated target is expected to be incorporated in the upcoming 2024 multi-annual energy planning (PPE). The current PPE projects 34–35.6 GW by 2028.

In 2023, France had 23.4 GW of installed wind and solar capacity, with an additional 17.4 GW of installed hydropower capacity. In the pipeline is a further 1.9 GW of solar capacity (1.3 GW announced and 0.4 GW in pre-construction) and 18.5 GW of wind capacity (9.6 GW announced and 5.4 GW in pre-construction), which would add up to just over 60 GW. France risks falling short of its target of 120 GW installed renewables capacity by 2030 if the pace of installed capacity is not significantly accelerated.

2.4 Average permitting time for VRE

Score: 7/15

The permitting process in France remains lengthy: about 5.5 years for the permission of wind and 3.5 years for solar projects.

The Renewable Energy Acceleration Law set up in 2023 aims to streamline renewables and mitigate failures in meeting 2020 renewables targets.

Section 2: Policies/Targets

France already has an extensive set of policies supporting systems flexibility, energy efficiency, and overall net zero power delivery. Recently agreed EU power market rules provide another step in the right direction. Under these rules France has committed itself to setting national flexibility objectives and flexibility support schemes focusing on non-thermal options to increase grid flexibility investment, enabling grid integration of renewables and less dependence on gas for power systems balancing. However, it is overprotective of nuclear and thus falls short on its binding national commitments under the revised Renewable Energy Directive. Updated trajectories towards 2035 are to be expected in the 2024 PPE.

Score: 81/120

The French electricity system already has a high amount of built-in flexibility, established demand side management (DSM), short-term storage, and flexible tariffs. About 92% of consumption is covered with smart meters. France has ambitions to increase flexibility up to 2035, but further policies are needed for 2035 RES and electrification targets, specifically to address the declining nuclear capacity due to an ageing nuclear fleet. Long-term storage, sector coupling, and further DSM via hourly tariffs are needed. The new grid investment plan, which is expected in 2024 as part of the new PPE, will set the trajectory for grid development for the coming years.

3.1 Policies to limit curtailment to a minimum that ensures optimal RES capacity utilisation

Score: 0/15

Due to the nature of the French electricity system, the policies addressing curtailment are mostly focused on demand side flexibility rather than storage. This includes preferential tariffs for households, facilitated by France’s extensive smart meter rollout.

3.2 Active steps by the national grid operator to plan for short spells of 100% RE power

Score: 8/15

France does not have plans for short spells of 100% RE power. Instead, it plans for 96% of decarbonised electricity by 2030 in its 2023 draft National Energy and Climate Plan (NECP), consisting of 61% nuclear and 35% renewables. Given its ageing existing nuclear fleet, France’s high reliance on nuclear to achieve their net zero power target raises questions about its deliverability.

The NECP foresees 120 GW installed renewables capacity by 2030, requiring a doubling of the annual rate of development of solar PV capacity (to 54–60 GW of solar PV capacity), maintaining the current development pace for onshore wind capacity, and 18 GW of installed offshore wind capacity by 2035 (only about 3.6 GW by 2030 due to long development times).

3.3 Effective policies to ramp up electricity storage

Score: 13/15

France already has 5 GW of pumped hydro storage, and 3 GW contracted demand side management. It further plans to increase flexibility services, mostly batteries, demand side management (EV charging and peak electrolyser use) and the use of renewable molecules, such as hydrogen. The PPE defines a target of 6.5 GW of contracted demand side management by 2028.

RTE’s 2023 provisional planning report states that no new peak fossil power plants are needed to satisfy flexibility. Two coal fired power plants might stay in reserve, other existing ones will be converted to biomass or decarbonised energy carriers.

France’s legislation on electricity storage transpose the European Directive 2019/944 on common rules for the internal market for electricity into national law. As part of the French Energy Code (Art D. 141-12-6), France has a legal requirement to maintain a level of security of electricity to three-hour loss of load expectation. The 2021 Climate and Resilience act foresees an option for the minister in charge of energy to start a tender process if the storage capacities do not meet the objectives of the PPE (Energy Code L. 352-1-1) or if the transmission system operator RTE communicates a need for flexibility. RTE’s Ten-Year-Network-Development Plan foresees about 1 GW of grid-connected battery storage needed by 2030 in the reference scenario. It also mentions the future storage use of hydrogen molecules in salt caverns. The 2023 draft NECP states that France projects an installed flexibility capacity of 25 GW by 2030 and 35 GW by 2035.

3.4 Effective policies to increase end use flexibility

Score: 14/15

France already has demand side management policies in place, mostly by digitalisation and pooled demand side management via contractors. It also has ambitious plans to increase DSM to 6.5 GW by 2028.

The French system is based on demand side flexibility with economic incentives; peak pricing contracts, such as offered to households by EDF are enabled by digitalisation. The main document to set targets for flexibility rollout is the PPE which will be updated in 2024, and the forecast assessment by RTE. The latter develops three different forecast scenarios with different rates of consumption, electrification of uses, and development of low-carbon energies. The 2023 forecast assessment up to 2035 projects increased flexibility needs due to the electrification of demand (EVs, heat pump deployment, etc.) already by 2030 and plans for 6.5 GW of contracted DSM by 2028.

France requests electricity suppliers to encourage consumers to reduce consumption during peak periods by a higher electricity price as part of their supply contract. Alternatively, demand flexibility capacities can be aggregated by a curtailment operator which commits to balancing the demand with either offering or reducing the capacity. Besides further volumes of contracted demand side management, France should establish a real time/hourly tariff system for end users.

These national efforts are well aligned with recently agreed EU power market rules. France has committed itself to setting national flexibility objectives, to be defined by 2026, and flexibility support schemes focusing on non-thermal options to increase grid flexibility investment, which will enable grid integration of renewables and less dependence on gas for power systems balancing.

3.5 Effective policies to accelerate grid development

Score: 11/15

France plans substantial investments into the grid development, but the new investment plan as part of the 2024 PPE is to be seen. It currently has an interconnectivity below 5%, which contrasts with the 15% EU interconnectivity target by 2030.

The analysis of investment needs for grid deployment will be updated with the 2024 PPE. For the distribution grid, Enedis projects in their 2023 Grid Development Plan annual investment increases from just over €4bn in 2022 to €5bn in 2032.

RTE projects in their 2019 Ten-Year-Development plan a doubling of France’s interconnection capacity (from 15 GW to 30 GW by 2035) to achieve an import capacity of 16.5% by 2030, which is above the EU’s interconnection target of 15%. This requires a grid expansion of 30% by 2030. The plan focuses on new connections, for example for connecting offshore wind plants, an increase in capacity of existing grids, and a smartening of the grids. According to the European Commission’s 2023 country fiche, France reached an interconnectivity of 4.97% in 2023.

To facilitate the grid development, the 2023 French Renewable Energy Acceleration Law includes articles (Art 105f) to decrease the delay of grid connection. RTE has developed Regional Grid Plans to connect renewables (S3REnR) under the 2010 Grenelle 2 law. Those plans are developed in cooperation with the territories and each regional scheme includes an environmental evaluation which is to be published for the public ahead of the acceptance of the scheme by the prefect. They aim to:

- Boost the grid capacity to account for additional renewables.

- Anticipate the reinforcement of the grid.

- Mutualise the cost in areas in which the connection cost would be too high for a single project developer.

3.6 Effective policies to enable the required digitalisation of power systems

Score: 14/15

According to the 2023 report of the EU’s Agency for the Cooperation of Energy Regulators (ACER), 92% of end users were already equipped with the national smart metering system Linky in 2022. This enables critical peak pricing, but no real time/hourly pricing tariffs are available yet.

3.7 Effective mechanisms or frameworks to prevent preferential treatment for fossil fuel-based generation over RES on the market

Score: 9/15

France does not have any targeted preferential treatment policies, but it does have policies to support the rollout of renewables and to scale down consumption of fossil fuels.

The French Renewable Energy Acceleration Law 2023 (APER law) is designed to streamline administrative processes for renewable installations and facilitate the rapid deployment of solar photovoltaic (PV) systems. This legislation also emphasises the meticulous planning of offshore wind farms and identifies specific areas for accelerating renewable energy projects, involving early engagement of local authorities. Projects under this law are structured to benefit residents, local and regional authorities, and businesses, with provisions for overriding public interest for projects contributing to multiannual planning.

Moreover, France has committed to reducing its gas consumption by 46% in 2030 compared to 2019, in line with the European Climate Law objectives which require a reduction of 35% by 2030. It still falls short of the REPowerEU proposal, which would translate into a 52% reduction over the same time horizon.

To increase installed renewable capacity up to 100 GW by 2050, RTE’s France 2030 Investment Plan projects €1bn per year to the supply side of renewable energy projects including PV cells, heat pumps, and electrolyser giga-factories. Annual investments for low-carbon generation and flexibility are anticipated to be €25–35bn until 2035.

France’s National Low-Carbon Strategy for 2050 (SNBC) and successive five-year energy investment plans (PPE) set ambitious targets for reducing fossil fuel consumption and increasing renewable energy capacity. The 2022 Belfort speech already suggested the new targets for the 2024 update of the multiannual planning, projecting 20 GW offshore wind power capacity by 2030 (and 40 GW capacity by 2050), and 100 GW solar PV by 2050.

In its 2023 draft NECP, France aims for a renewable energy share of 33% by 2030 (with 35% renewables in electricity), falling short of the 42.5% requirement under the updated Renewable Energy Directive.

3.8 Electrification rate target and roadmap to support delivery

Score: 12/15

The 2023 draft NECP announced an electrification target of 50% of electricity consumption by 2050, which is expected to be included in the 2024 PPE.

Score: 52/80

France is party to some key international initiatives covering power systems decarbonisation, including the PPCA, JETPs, “cleaning up fossil fuel finance” agreements within G7, and the Glasgow Coal to Clean Power Initiative. France is keen to drive grids-focused initiatives (GGI).

However, France remains overprotective of nuclear leading to 2030 renewables targets which are not in line with its target contribution under the revised Renewable Energy Directive. Its 96% decarbonised power ambition by 2030 and Pentalateral Forum commitment to decarbonise electricity by 2035 (to be seen if included in next multiannual planning 2024) are commendable. France has the second highest electrification rate in the G7 and aims for 50% electricity share in energy consumption by 2050.

4.1 2035 carbon neutral power system commitment adopted in national legislation

Score: 5/10

The French renewables ambition is not in line with the target set by the updated Renewables Energy Directive. However, it has a target of 96% of decarbonised electricity by 2030 and to achieve net zero power by 2035. France also enshrined its carbon neutral energy system by 2050 in law.

France has developed comprehensive plans such as the multiannual energy plan (PPE) and the National Low-Carbon Strategy. The latter incorporates targets set forth by the 2019 Energy and Climate Law, with a clear trajectory towards carbon neutrality by 2050.

France’s draft NECP for 2023 outlines ambitious targets to reduce coal-based primary energy consumption by 70% in 2030 and 75% in 2035, using 2012 as the baseline. It further plans for 96% decarbonised electricity by 2030 (which consists of 61% nuclear and 35% renewables).

4.2 Global leadership on supporting power systems decarbonisation in developing countries

Score: 8/10

France has been involved in international leadership efforts supporting the energy transition.

France is part of the Just Energy Transition Partnerships (JETPs) with South Africa, Indonesia, Viet Nam, and Senegal. These partnerships focus on collaborative efforts to advance renewable energy deployment, improve energy efficiency, and promote sustainable development in the partnership countries.

The Statement on International Public Support for the Clean Energy Transition underscores France’s commitment to promoting clean energy technologies and supporting developing countries in their transition towards low-carbon economies.

As part of the G7 commitment, France supports the phase-out of international financing for unabated coal, signalling a collective commitment to align financial support with climate goals and accelerate the transition away from fossil fuels.

Moreover, France has been actively engaged in regional forums and initiatives aimed at decarbonising the electricity system. The 2023 Joint Statement from the Pentalateral Forum, which includes Germany, Luxembourg, Netherlands, France, Austria, and Belgium, highlights a collective commitment to fully decarbonise the electricity system at an accelerated pace, aiming for achievement by 2035, five years earlier than the EU-wide target.

As part of Mission Innovation 2.0, which was launched in 2021, France collaborates with global partners to accelerate research, development, and demonstration efforts aimed at scaling up clean energy technologies and achieving the goals outlined in the Paris Agreement.

4.3 International commitments on power systems decarbonisation through alliances or networks such as the PPCA, Glasgow Coal to Clean Power Initiative etc.

Score: 8/10

France takes part in several international commitments and alliances:

- PPCA member

- Seeking a pro-nuclear alliance

- International Solar Alliance

- Breakthrough Agenda Signatory

- Green Powered Future Mission Member

- Green Grids Initiative signatory (+ steering committee)

4.4 Net zero power system roadmap to drive delivery of 2035 commitment

Score: 8/10

France has extensive net zero power delivery roadmaps, though the 2035 net zero power systems ambition still needs to be translated into clear policies. This is to be expected in the upcoming PPE.

The 2023 Framework Strategy for Ecological Planning serves as a transversal roadmap, integrating climate policy, biodiversity, and climate adaptation strategies into a cohesive plan for sustainable development.

The National Low-Carbon Strategy 2020, currently under review, sets sectoral binding carbon budgets for three to five-year periods and projects a pathway towards carbon neutrality by 2050.

Legislation such as the French Renewable Energy Acceleration Law 2023 and the commitments under European legislation, such as the European Climate Law Regulation 2021/1119, the European Green Deal, and Fit for 55 package, commit to achieving climate neutrality by 2050 through binding targets for net zero greenhouse gas emissions.

The Five-Year Energy Investment Plans (PPE), amended by the Multiannual Energy Plan 2020, are the main planning tool for France’s energy transition. Planned to be updated in 2024, the plan currently sets targets extending until 2035, encompassing local objectives determined through a bottom-up approach to ensure coherence across administrative levels.

Specifically, the plan aims to achieve a solar PV capacity of 54–60 GW by 2030, a notable increase from the range of 35.1–44 GW projected for 2028. Additionally, the plan sets a target of 18 GW of installed wind capacity by 2035. It aims for more than 250 TWh of renewable heat production by 2030, and sets targets for energy recovery, aiming to recover 20 TWh of heat by 2030. Additionally, it addresses the operation of nuclear power reactors, permitting their continued operation beyond the 50-year deadline provided safety requirements are met.

The 2023 draft NECP projects the cessation of coal fired power plants by 2027 and oil fired power plants by 2030. The plan aims for a 96% decarbonised electricity mix by 2030, with gas fired power plants potentially accounting for the remaining 4% of electricity generation.

4.5 Critical role of renewables, interconnection, and demand side measures reflected in country’s energy security framework

Score: 4/10

France has frameworks for energy security and interconnection and for efficiency and flexibility, but lacks them for the overall promotion of renewables deployment for energy security.

The French Energy Code, coupled with EU Regulation 2019/941 on risk preparedness in the electricity sector, establishes a framework for crisis management, decentralised markets, increased renewable energy sources, and enhanced interconnection.

The Law on Energy Transition for Green Growth, with amendments to article L141-2 of the energy code, mandates the multiannual energy plan to prioritise security of supply, reduce import dependency, and promote renewable energy. It emphasises the balanced development of networks, storage, and flexibilities to ensure sustainable energy provision.

Under the S3REnR Scheme, regional grid development plans facilitate cost-sharing initiatives for the development and interconnection of renewable energy sources. This scheme promotes collaboration and efficiency in expanding renewable energy infrastructure across regions.

Furthermore, the RTE Ten-Year Network Development Plan outlines investments in new interconnections and aims to double capacity by 2035. Specifically, by 2030, France aims to double import capacity to exceed the EU’s 2030 target of 15%, enhancing energy security and fostering greater integration with European energy markets.

4.6 Unabated coal phase-out date and roadmap to support delivery

Score: 10/10

France has a coal in power phase-out planned for 2027.

4.7 Unabated gas phase-out date and roadmap to support delivery

Score: 0/10

France currently has no gas in power phase-out date and trajectory, but the new PPE is expected to include an exit from fossil fuels by 2050. The 2023 draft NECP plans for an ambitious reduction of gas consumption of –46% by 2030, compared to 2019.

4.8 2030 target for share of total RES in electricity generation

Score: 9/10

The 2023 draft NECP sets a 2030 target of 35% for France’s share of total RES in electricity generation.

Score: 62/80

France has an extensive buildings efficiency program, energy efficiency targets in line with updated EU legislation, ambitious heat decarbonisation targets, and plans promoting sufficiency. France has the second highest electrification rate in the G7 and aims for a 50% electricity share in energy consumption by 2050.

5.1 Efficient policies to retrofit / renovate buildings

Score: 18/20

France has extensive regulation and finance available for renovating the existing building stock.

As part of the European Clean Energy Package, the Energy Performance and Buildings Directive EU 2018/844 and the Energy Efficiency Directive have been revised, setting the basis for member states’ renovation trajectories.

In its 2023 draft NECP, France set ambitious targets for renewable heating and cooling, aiming for 45% by 2030 and 55% by 2035.

The 2021 Climate and Resilience Law further reinforces these efforts by outlawing badly insulated buildings and mandating Energy Performance Certificates (DPE) for property sales or rentals.

New buildings are subject to stringent regulations outlined in the 2019 Energy and Climate Law and the new Environmental Regulations (RE2020), building upon the Thermal Regulations 2012 (RT2012). The introduction of the new bioclimate standard (Bbio) requires a 30% improvement in building envelope performance compared to RT2012.

To facilitate retrofitting efforts, France has established the MaPrimeRénov energy efficiency renovation scheme, managed by the National Housing Agency, allocating €5 billion for property renovations in 2024.

Financial measures for renovating public buildings have been implemented under the Major Investment Plan (2018–22) and the COVID-19 Recovery Plan (France Relance).

The 2019 Energy and Climate Law aims to eradicate 4.8 million inefficient homes through mandatory renovations. Additionally, the 2023 Ecological Planning initiative targets the production of 1 million and the installation of 2.6 million heat pumps in France by 2027.

Legislation such as the Law on Energy Transition for Green Growth and the PPE incorporate energy consumption levels for buildings and provisions for renovations.

Furthermore, Ademe’s heat fund, established in 2009, promotes renewable heating and cooling, with an increased funding of €820 million in 2024.

5.2 National energy/power savings target?

Score: 18/20

France’s energy efficiency targets are in line with the Energy Efficiency Directive and focus on sufficiency

In the 2023 draft NECP, France aims to significantly reduce its primary energy consumption contribution to 157.3 million tons of oil equivalent (Mtoe) and final energy consumption to 104 Mtoe. These targets are in line with the Annex I formula results of the recast Energy Efficiency Directive (EED).

The Updated Energy Sufficiency Plan 2023 outlines measures to achieve a 12% reduction in energy consumption. This includes expanding the plan to cover the 120 largest businesses in France and supporting the deployment of programmable thermostats to optimise energy usage. Additional efforts are directed towards addressing light pollution.

France has also implemented the Directive on Energy Efficiency EU 2018/2002, which sets specific targets for energy savings and efficiency to reduce greenhouse gas emissions. The revised Energy Efficiency Directive (EU/2023/1791) increases the targets and national contributions.

5.3 Sufficient spending on energy efficiency programmes

Score: 10/20

The French spending on energy efficiency programmes focuses on the renovation of the existing building stock.

France’s MaPrimeRénov energy efficiency renovation scheme, managed by the National Housing Agency, allocates €5bn (in 2024) for renovating properties to improve energy efficiency.

5.4 High-quality appliance and equipment standards and labelling

Score: 16/20

Most of France’s equipment and appliance standards are set by EU standards, which are fairly ambitious.

- The EU Directive 92/75/EC established an energy consumption labelling scheme, with updated EU labelling requirements introduced in 2021.

- The Ecodesign Directive 2009/125/EC and Labelling Regulation (EU) 2017/1369 are implemented through product-specific regulations, directly applicable in France. A proposal for a new Ecodesign for Sustainable Products Regulation (ESPR) was originally published in March 2022. It builds on the Ecodesign Directive to incorporate more metrics on circular economy of products.

- France has further introduced appliance and equipment standards with the 2022 Decree No. 2022-748 2022, which relates to consumer information on the environmental qualities and characteristics of waste-generating products.

- The 2021 Climate and Resilience Law also sets out environmental and social labelling standards.

- For building standards, reforms have been made to the Energy Performance Certificate (DPE), introduced by the EU’s Energy Performance of Buildings Directive (EPBD), and Low Consumption Building Renovation Labelling under Article 179 of the Housing, Planning, and Digitalization Development Act (Loi ELAN) 2018, ensuring consistency and accuracy in energy efficiency assessments for buildings.

Progress could be made in appliance standards for space heating, as there are currently no European requirements for electric heating efficiency and the use of air conditioners for heating.