This page is part of the E3G Public Bank Climate Tracker Matrix, our tool to help you assess the Paris alignment of public banks, MDBs and DFIs.

| Paris alignment | Reasoning |

|---|---|

| Some progress | The AIIB has started to apply internal carbon pricing systematically to energy projects only since July 2020. |

The Asian Infrastructure Investment Bank (AIIB) has piloted a shadow carbon price to energy investments and is likely to announce further details in 2020, possibly as part of the publication of the AIIB Corporate Strategy. E3G understands the AIIB systematically applies carbon pricing to energy projects.

The table below provides a summary of how it is applied across bank operations.

| Which projects subject to greenhouse gas (GHG) assessment | Information not available |

| Which projects apply shadow carbon pricing | Used in energy sector projects. |

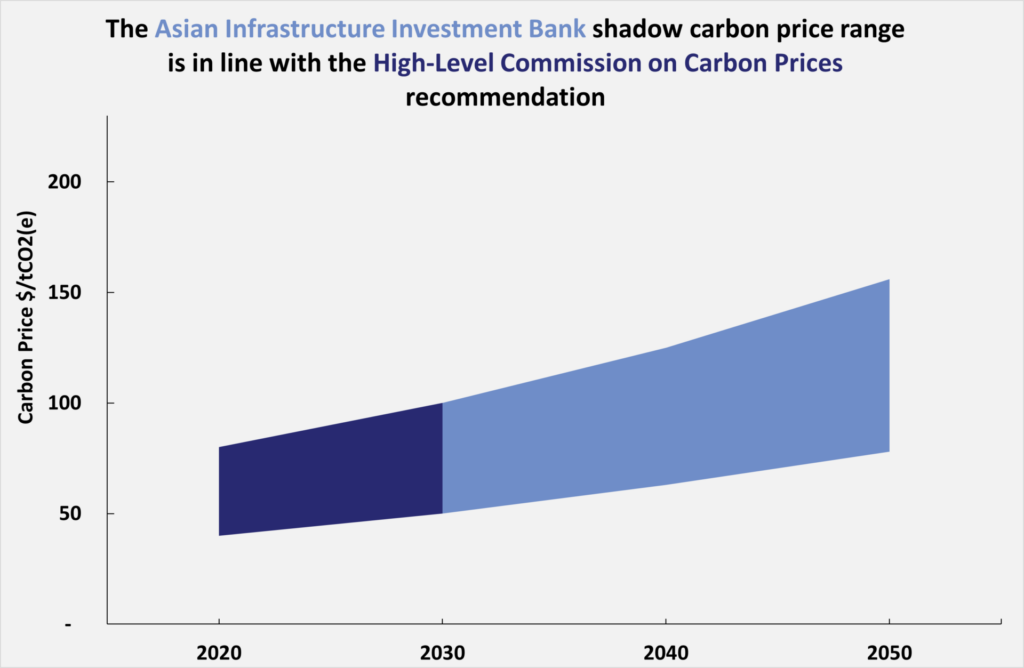

| Price level | Carbon prices align with the High-Level Commission on Carbon Prices (HLCCP). |

| How shadow carbon price is used | Not used as a hurdle, instead it will be considered alongside a range of other metrics. This is likely to include some sort of sensitivity check (see here and here). One project suggests it will be applied to the reduction of relative emissions to a business as usual project. |

| What is it compared to? | Information not available |

| Are scope 3 emissions included? | Scope 3 emissions are currently not included. |

The graph below shows how the level of carbon pricing at the bank compared with those of the High-Level Commission on Carbon Prices (HLCCP). The HLCCP prices only extend to 2030.

The use of the shadow carbon price in one project is worth highlighting. The project involved building a liquefied natural gas (LNG) terminal to reduce demand for coal. The AIIB appeared to calculate the reduction of GHG emissions from the switch from coal to gas and applied a shadow carbon price to this reduction in emissions. Within its sensitivity analysis, the AIIB showed that using the low value from the HLCPP range instead of the midpoint led to a lower economic internal rate of return (EIRR) because the economic value of GHG emission is considered a benefit within the AIIB analysis of this project. This therefore has the effect of making a fossil fuel project look more attractive with a higher carbon price.

Recommendation: Applying a shadow carbon price across all investments, not just those that reduce emissions.

Recommendation: Disclose the methodology of how the shadow carbon pricing is applied to decision making. This includes disclosing which discount rates are used for country categories, alongside the rationale and evidence for such rates, and how the carbon price is used with projects that show GHG emissions savings.

Recommendation: AIIB should apply a carbon price scenario to assess alignment with limiting warming to below 1.5°C, alongside the other MDBs.

Recommendation: Ensure that indirect emissions, even if not directly controlled by the project (Scope 3), are included. Their inclusion can substantially change the assessment of the environmental impact and thus are material to investment decisions.