This page is part of the E3G Public Bank Climate Tracker Matrix, our tool to help you assess the Paris alignment of public banks, MDBs and DFIs.

| Paris alignment | Reasoning |

|---|---|

| Some progress | The ADB applies a social cost of carbon assessment to all projects in the energy and transport sectors, as well as projects with a primary objective of GHG emissions mitigation. The Bank bases its price level on mean social costs of carbon reported in the Intergovernmental Panel on Climate Change’s (IPCC) Fifth Assessment Report (to be increased 2% annually in real terms), resulting in a price level consistent with (but at the lower end of) the price range recommended by the High-Level Commission on Carbon Prices (HLCCP). Where its use is mandated, the social cost of carbon is to be applied to inform a given project’s economic internal rate of return (EIRR), calculated with reference to a “without project” scenario, and used as a binding requirement for investment decisions. Options to augment the Bank’s use of this tool include deploying it more consistently in analysis of least cost options and project alternatives, considering how the tool could be tailored to context while maintaining alignment with the Paris goals, and expanding the scope of its use on the basis of establishing dedicated emissions accounting guidelines for additional sectors. |

The table below provides a summary of how a social cost of carbon is applied across the Bank’s operations.

| Which projects subject to greenhouse gas (GHG) assessment | All projects in the energy and transport sector as well as projects with a primary objective of GHG emissions mitigation should quantify and value emissions. Notably, as of the ADB’s updated Environmental and Social Framework (approved in late 2024); any projects that exceed the inclusion threshold (for both absolute and/or relative emissions) of 20 ktCO2e/year require borrowers/clients to monitor GHG emissions (as part of the Bank’s safeguards, rather than necessarily for the purpose of social carbon costing). |

| Which projects apply a social cost of carbon | All projects in the energy and transport sectors as well as projects with a primary objective of GHG emissions mitigation are required to apply a shadow carbon price. |

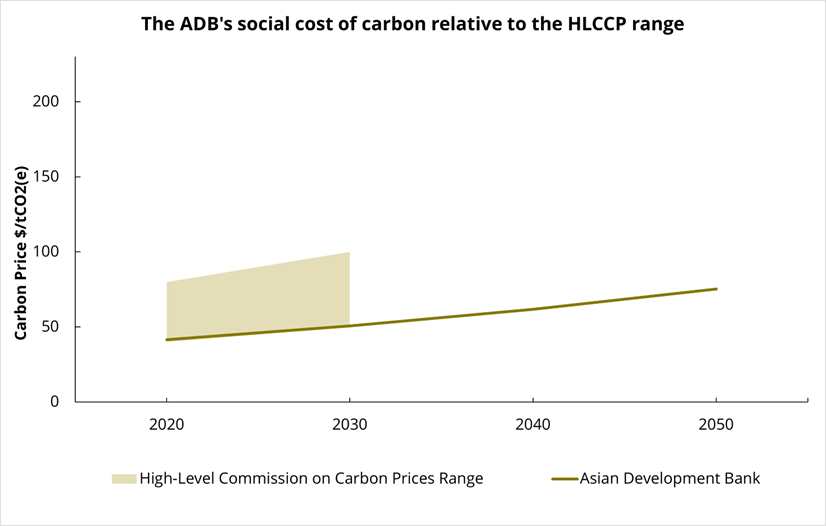

| Price level | The ADB bases its price level on the mean social costs of carbon reported in the IPCC’s Fifth Assessment Report from 2016, to be increased 2% annually in real terms. In practice, this reflects a pirce level consistent with the lower end of the price range recommended by HLCCP (which is what is most frequently used in the economic analysis of other MDBs), as of 2020. |

| How social cost of carbon is used | Where its use is mandated, the social cost of carbon is to be applied to inform a given project’s economic internal rate of return (EIRR), which is in turn used as a requirement for investment decisions. |

| What is it compared to? | Project EIRRs are calculated with reference to a “without project” baseline scenario. In line with best practice, the same reference scenario is used for the calculation of all benefit streams of a given project to ensure that different costs and benefits are consistently evaluated and comparably accounted for. Prior to EIRR calculation, least-cost analysis comparing project alternatives is also conducted, which should incorporate social costs of carbon.[1] |

| Are Scope 3 emissions included? | Social carbon costing does not include scope 3 emissions as standard practice. The ADB employs a ‘systems approach’ to economic analysis, wherein all costs of associated investments required for the delivery of outputs are considered. This automatically includes scope 1 and 2 emissions, and can include some scope 3 emissions on a case-by-case basis. |

Explanation

The ADB uses a social cost of carbon (as opposed to a shadow carbon price) which applies a consistent price level across contexts based on marginal damage costs (the value of losses from climate change from each additional ton-increase in GHG emissions). This contrasts with the more common approach across MDBs to use a price level (or range, in the case of the HLCCP) derived from marginal abatement costs (the cost to abate a ton of GHG emissions).

The ADB argues that marginal damage costs are both theoretically and practically superior. In particular, the Bank considers these to provide a more accurate reflection of the reality for the distributed responsibility for climate change (and action). Shadow carbon prices can be highly sensitive to national mitigation policies (given the reliance on marginal abatement costs) while social costs of carbon have no underlying assumption of burden sharing among countries and are driven primarily by global (as opposed to national) climate policy.[2]

In terms of implementation, the ADB’s strong approach of using a consistent “without project” baseline reference scenario enables the Bank to consistently evaluate project costs and benefits, with mitigation possible through displacement of emissive alternative energy sources (as opposed to comparison against a “business-as-usual” scenario, which could result in favouring an option that involves only a relative reduction in emissions growth). There is scope for the Bank to further strengthen its approach by considering more than the two scenarios of “project”, and “without project”. Considering and comparing alternative ways of providing the same service can support establishing what the least emissive and most economical option is. This can also help to identify whether there are barriers to the deployment of clean alternatives which can in turn inform programmatic country planning and dialogues.

Notably, the ADB’s economic internal rate of return (EIRR) analysis (including the application of the social cost of carbon) is conducted by a separate dedicated unit. This represents a clear best practice approach in terms of avoiding potential perverse incentives with regard to project teams undertaking analysis that could impact the viability of approval.

The graph below shows how the social cost of carbon used by the ADB (as set out in the GHG Emissions Accounting Guidance Note and derived from the survey of social cost of carbon estimates reported in the IPCC’s AR5 Report, which has not been updated since) compares with the price range of the HLCCP over time (noting the HLCCP prices only extend to 2030).

Recommendations:

- ADB should consider expanding the scope of its application of social carbon costing. Specifically, the Bank should confirm whether it will be extended to include all projects exceeding the updated 20 ktCO2e/year GHG accounting threshold (or outline a justification for retaining the previous threshold). Under such an extension, dedicated guidance for emissions accounting for sectors beyond energy and transport should be developed.

- ADB should consider applying its social carbon costing methodology more consistently within least cost analysis and to compare multiple project alternatives (i.e. not just against a “without project” scenario) to ensure the most emissions-efficient option is selected. It should also look to move towards incorporating scope 3 emissions within its carbon pricing assessments.

- ADB should consider updating the social cost of carbon used, particularly in view of the IPCC’s Sixth Assessment Report not reporting an updated survey of costs, and the Bank’s commitment in the Climate Change Action Plan 2023-2030 to revisit the unit value on the basis of newer estimated of damages caused by climate change. As part of this the Bank should consider options for for greater flexibility to tailor the approach to pricing according to the project context (while still aligning with or exceeding the minimum recommended pricing of the HLCCP).

[1] Information received directly from the ADB.

[2] Ibid.