This page is part of the E3G Public Bank Climate Tracker Matrix, our tool to help you assess the Paris alignment of public banks, MDBs and DFIs.

| Paris alignment | Reasoning |

|---|---|

| Some progress | The EBRD publishes its project level climate finance data and makes it available to the OECD-DAC climate-related development finance database. However, disclosures related to project and portfolio level impact indicators results and sovereign loan agreement contracts should be improved. While it discloses financial intermediary lending information, it is insufficiently granular as it does not systematically include disclosure of subprojects. The EBRD undertakes comprehensive TCFD reporting, reflecting best practice among MDB peers. |

| Climate Finance Data | The EBRD provides project level data in its submission to the OECD-DAC climate-related development finance database, the IATI, and publishes project level data on its website. The EBRD is rated 4th for its non-sovereign portfolio and 5th for its sovereign portfolio in the 2023 DFI Transparency Index, making its performance average among MDB peers. |

| Financial intermediary lending | Project data for all financed operations are provided via an online portal, including those financed through financial intermediaries. This includes general information about projects as well as a description of environmental and social risks and the subsequent risk categorisation of the project. However, the EBRD does not disclose on all subprojects financed. |

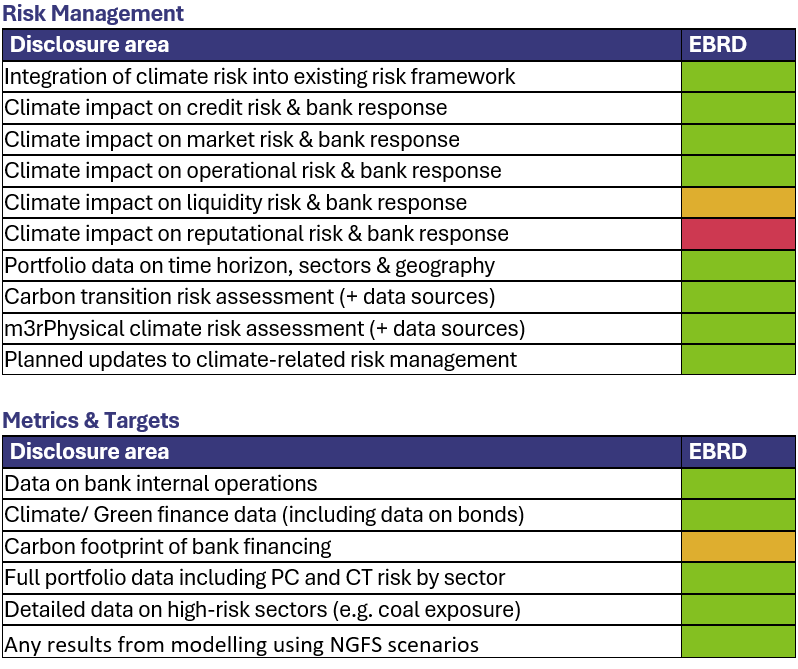

| TCFD Reporting | The Bank undertakes comprehensive TCFD reporting. Disclosure related to the resilience of Bank strategies and the impact of climate on reputational risk could be improved. |

Explanation

Transparency of climate finance data

The EBRD publishes project level data in Excel-readable and bulk-downloadable format on its website. This includes the client’s name, total project value and amount of EBRD investment, project location, brief description of the project and expected transition impact. The EBRD’s annual Sustainability Report provides additional project level climate finance data, including Green Economy Transition finance and climate finance allocations as well as sector. However, releasing the data in PDF format makes it more difficult to do in-depth analysis. The EBRD also reports against the Global Reporting Initiative (GRI) framework.

The EBRD is rated 4th (out of 21) for its non-sovereign portfolio and 5th (out of 9) for its sovereign portfolio in the 2023 DFI Transparency Index, its performance being average among MDB peers. As elaborated in the Index’s analysis, the EBRD’s sovereign score was affected negatively by the Bank’s failure to publish project level results indicators and disclose loan agreements/contracts. The non-sovereign portfolio score was hindered by poor performance in the Financial Intermediaries Sub-investments section.

The EBRD has published its International Aid Transparency Initiative (IATI) data since 2015, doing so monthly. According to the Implementation of the EBRD’s Access to Information Policy: 2023 report, the EBRD is making incremental improvements to its data submissions by publishing mature data and providing separate information on its sovereign ad non-sovereign portfolio. The EBRD will also soon aim to publish all Paris alignment and green finance assessments in its project summary documents on its website.[1] Furthermore, the EBRD is working with Publish What you Fund to build on recommendations provided in the DFI Transparency Index.

Transparency of financial intermediary lending

The EBRD’s Access to Information Policy requires that Project Summary Documents (PSD) be disclosed for all projects through an online portal. The name of the intermediary, location, size of the loan, and a general description of operations and objectives are made available for such projects. Subprojects are not disclosed on this portal.

For financial intermediary (FI) projects, the PSD includes a description of environmental and social risks and impact, and a subsequent categorisation as low, medium or high risk. The FI must furthermore include information on the environmental and social management system (ESMS) to be used and confirmation of its adequacy to address the identified risks. The PSD is to be reviewed by the Bank and updated as appropriate, including according to the yearly environmental & social reports submitted by the FI to the EBRD for monitoring and evaluation purposes as stated in the Bank’s Environmental and Social Policy (ESP). Furthermore, according to the EBRD’s ESP, FIs are required to publicly disclose their ESMS.

The EBRD does not disclose on all subprojects financed. While the EBRD requires all high-risk “Category A” subprojects financed through an FI to be reported to the Bank, there are no public disclosure requirements. The EBRD’s Green Economy Financing Facility (GEFF) conducts some subproject disclosure on its website. This includes project name, financed amount, sector and emissions reduction. This represents best practice and should be applied to all intermediary lending.

TCFD reporting

This section assesses the level of detail the EBRD has provided in its EBRD TCFD Report 2022. To note that the EBRD has committed to following International Sustainability Standards Board (ISSB) disclosure standards by the end of financial year 2025 which will replace TCFD reporting.

Recommendations:

- The EBRD should consider releasing the project level data underlying its GET 2.1 approach disclosure in a machine-readable, ideally Excel, format.

- For intermediated operations, the EBRD should require the disclosure of detailed information on subprojects financed, including their location, sectors, and a brief description of activity. This can be achieved through specific disclosure clauses in financial intermediary agreements. If commercial confidentiality genuinely prevents disclosure, this should be explicitly noted. In these cases, the EBRD should also publicly share details of a comprehensive counterparty assessment to justify the investment decision and work on enhancing the counterparty’s disclosure practices. When needed, the EBRD should offer technical assistance to support this process.

[1] Information obtained directly from the Bank.