The US has seen significant developments in key cleantech sectors following the introduction of the Inflation Reduction Act (IRA). Notably, demand for solar PV and battery storage has increased significantly, the latter sector receiving the bulk of cleantech manufacturing in recent years. While the expiration of tax credits may stem the rise in imports of electric vehicles (EVs), the solar and battery sectors can remain strong even with reduced support.

The IRA became law in August 2022. Among its provisions were various measures to support cleantech industries, with the dual aims of reducing greenhouse gas emissions and increasing manufacturing and related jobs in the US. Most funding was expected to go to electricity generation, storage and efficiency, as well as mobility – in particular EVs.

In this report, we assess the impacts of the IRA on investment flows, imports and exports in key cleantech sectors in the US, based on data available up to Q1 or Q2 2025. We also consider the global impacts of the IRA.

With the signing into force of the One Big Beautiful Bill Act this year, key provisions of the IRA will phase out or become more restrictive. Looking ahead post-IRA, the expected growth in US electricity demand means new generating capacity that can be brought online quickly will be essential. Only solar PV combined with battery storage provides a ready remedy. While exporters and investors will need to adjust to the new policy environment, the US cleantech market can still offer opportunities.

Imports of key clean technologies increased following the introduction of the IRA

- EV imports grew fastest, growing from around $5bn in 2021 to almost $23bn in 2024.

- Solar imports rose from below $7bn in 2021 to over $18bn in 2023.

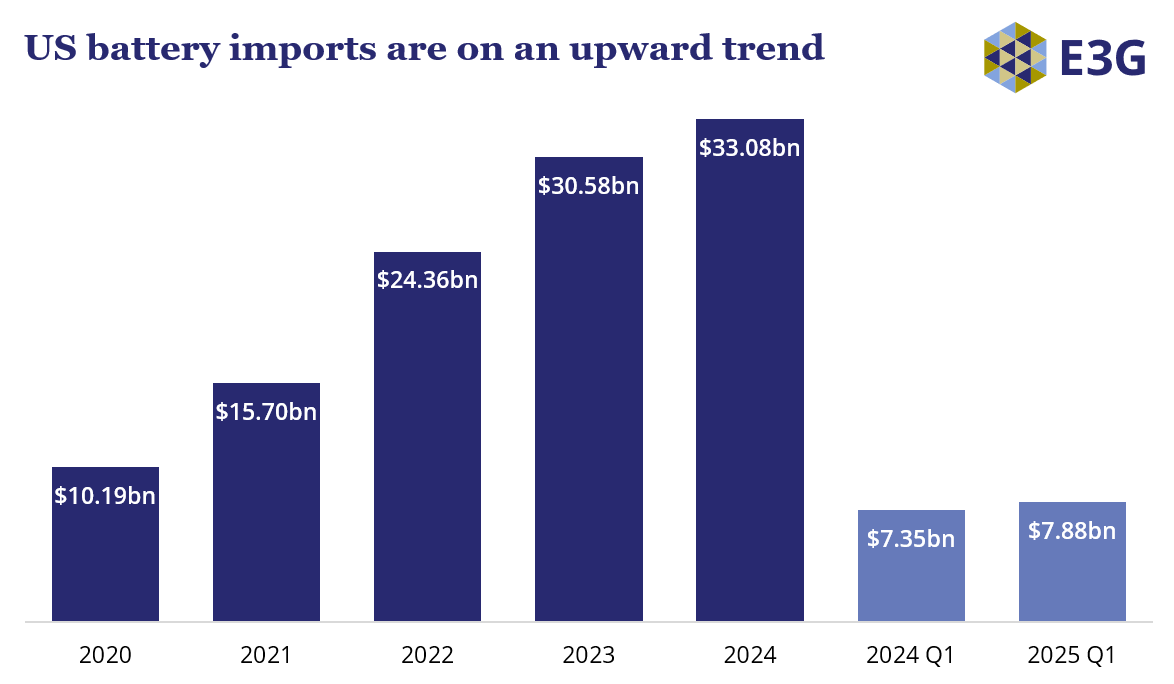

- Battery imports increased from just under $15bn in 2021 to over $33bn in 2024, on a trend that preceded the introduction of the IRA.

- However, wind imports – already on a downward trend – decreased from over $4.5bn in 2020 to around $3.2bn in 2024.

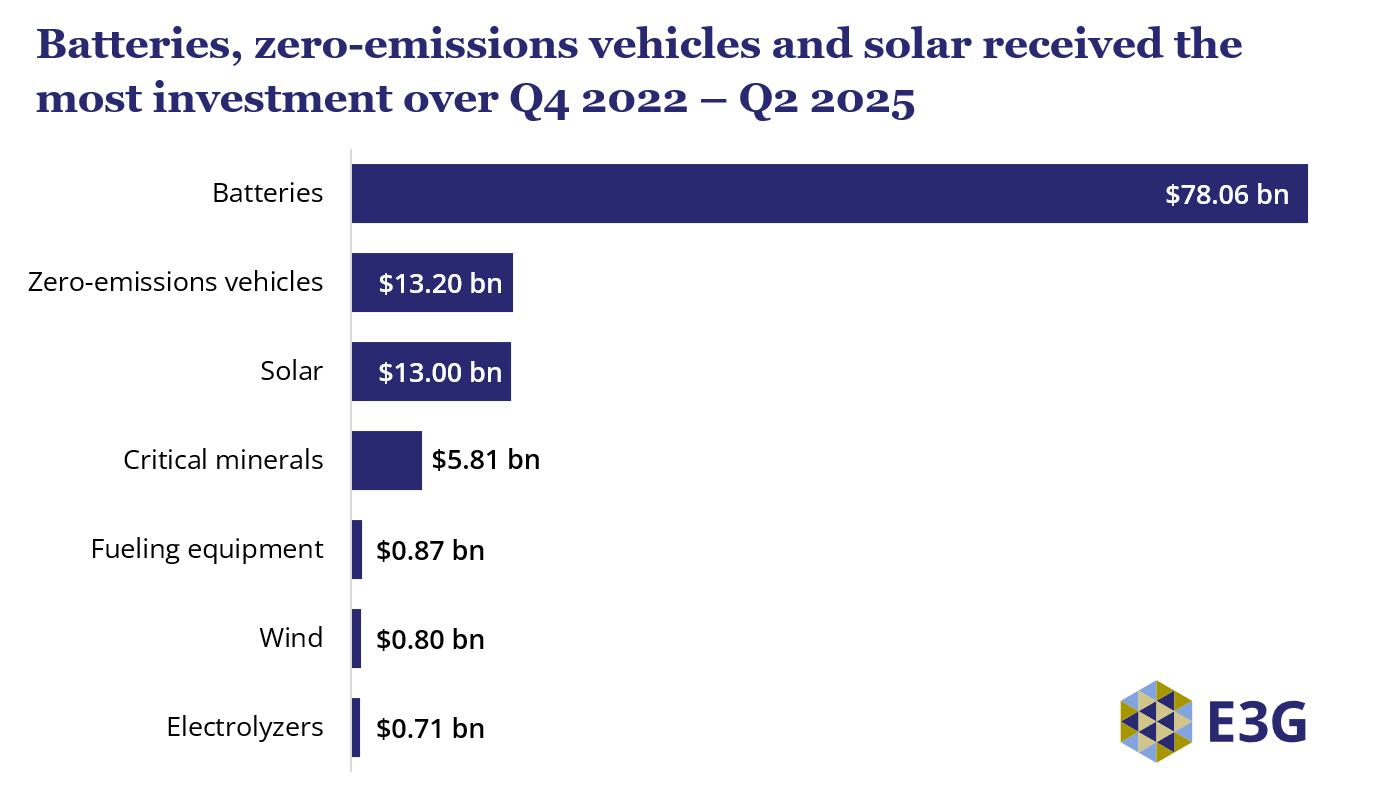

Batteries dominate cleantech investments

The IRA did not result in a major re-allocation of capital on a global scale. However, increased foreign investment in cleantech sectors was notable, rising from $4.5bn in Q4 2022 to $13.5bn in the second quarter of 2024. Domestic investment in the same sectors doubled from $2.5bn to over $5.5bn over the same time period.

Batteries received over 68% of this investment, making this the leading cleantech investment sector by far. Zero-emissions vehicles and solar lead the rest of the pack. Asian countries were the biggest investors in US cleantech, with over 80% of foreign cleantech investment coming from South Korea, Japan and China.

Global impacts of the IRA have been limited

- While both manufacturing capacity of and demand for cleantech have increased in the US, US cleantech manufacturing is not likely to have a major role in the energy transition at global level.

- No clear co-benefits for global development, for example through availability of lower cost cleantech, have so far materialized.

- Initial tensions related to the IRA among close allies have been mostly defused. China’s dominant position in batteries and critical minerals has not been affected.

With thanks to Hansika Nath, who made invaluable contributions to the data research and analysis for this report during her time with E3G as a climate diplomacy and geopolitics intern.