Following the signing of the Regional Comprehensive Economic Partnership, E3G analysis finds that Asia, the largest exporter and importer of air conditioning, will shape the future trajectory of energy efficient cooling equipment. Cooling currently accounts for 7% of total GHG emissions and is set to increase. If we are to limit climate change to 1.5 degrees, the adoption of higher efficiency cooling appliances is essential.

In 1990, the implementation of trade restrictions following ratification of the Montreal Protocol helped ensure the successful phase-out of ozone depleting substances. The Kigali Amendment to the Montreal Protocol passed in 2019, aims to replicate this success for potent greenhouse gases known as hydrofluorocarbons (HFCs) – used in air conditioning (A/C) and refrigeration. The amendment includes a ban on trade in these HFCs from 1st January 2033.

The International Energy Agency however, forecasts a trebling of cooling demand by 2050, propelled by rising purchasing power in hot countries and an increasing cooling need in a warming world. To accelerate the necessary phasedown of HFCs and reduce the energy demand of these appliances, countries must begin improving the energy efficiency of cooling equipment. Efficient and climate friendly cooling is key to staying within the Paris Agreement temperature limits.

Minimum energy performance standards (MEPS) in importing countries and technological improvements in exporting countries will play an important role in the overall adoption of energy efficient cooling equipment. Innovations in super-efficient appliances and ultra-low global warming potential refrigerants will drive export competitiveness.

Assessing the trade landscape for air conditioning is important for understanding how wider trends and tensions in global trade could impact this sector. While the long-term implications of COVID-19 present a big unknown. One certainty is the immediate increase in demand for cold chain equipment to store vaccines.

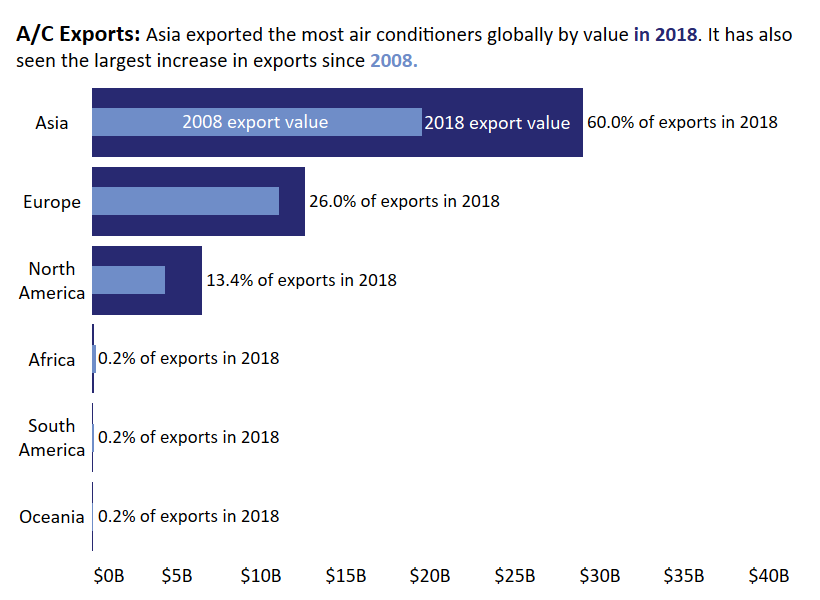

Global A/C exports (by value) in 2018 were concentrated in Asia, a region that has also seen the biggest increase in exports since 2008. China alone accounts for 35% of global A/C exports and Thailand accounts for 12%. This chimes with previous analysis showing that A/C compressor exports mostly originated in China and Thailand.

This analysis includes products captured by the Harmonized Commodity Description code 8415, which covers trade in air conditioners and air conditioner parts.

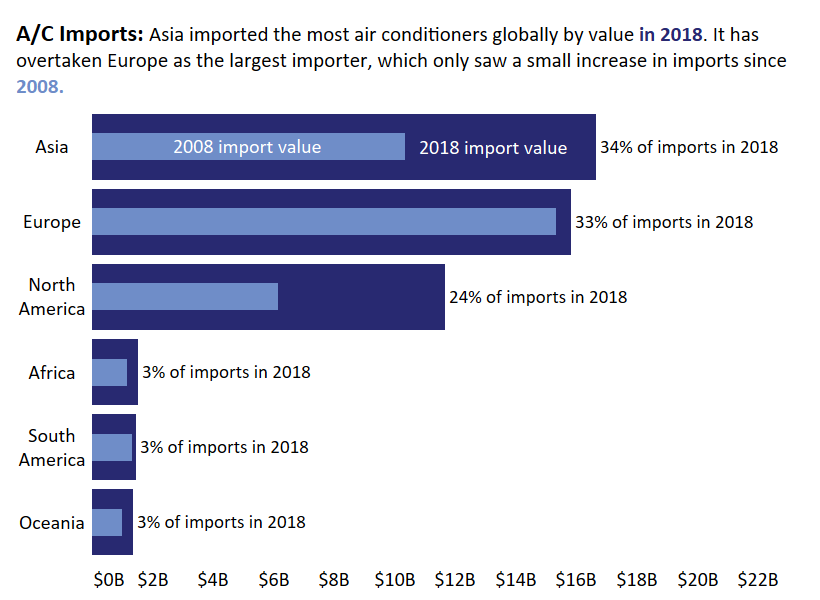

While A/C exports are largest in Asia, A/C imports are concentrated in Europe, Asia, and North America with the latter two seeing a large increase in imports since 2008. Europe has seen little change in imports or exports.

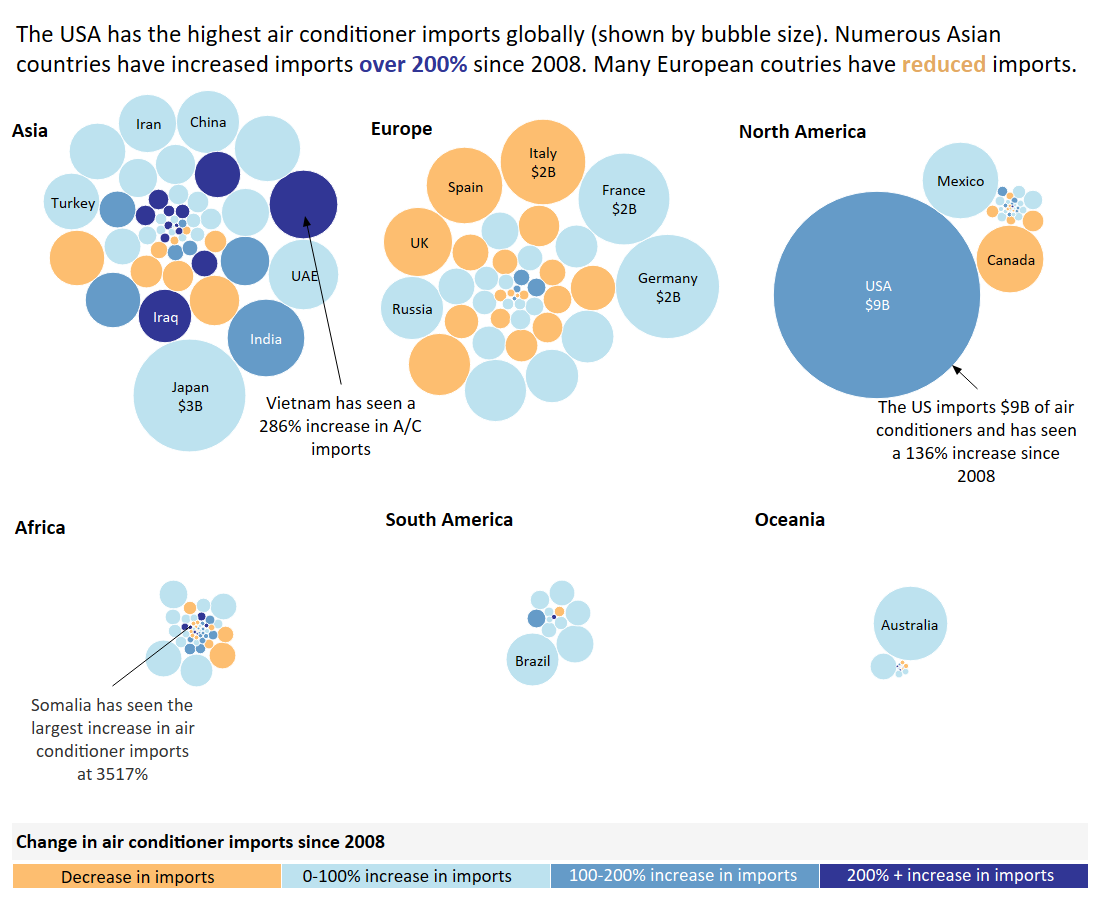

However, high level figures disguise the complexity of global A/C imports. The US is the largest individual importer, bigger than the combined imports of South America, Oceania and Africa. The graph below also shows the US experiencing a large increase in imports since 2008. Some large importing Asian countries have seen over a 200% increase while a high proportion of European countries have decreased their A/C imports.

To create an even more granular picture of trade in air conditioning, other areas must be considered. This is important for understanding the individual opportunities available to a country moving towards more efficient A/C. Bilateral flows between countries is important, as is whether the trade is primarily in A/C components or whole units. Ownership of companies in exporting countries is another element to consider. Many multinational companies have manufacturing bases in Mexico and Thailand, two of the largest exporting countries. Furthermore, import size does not directly correlate to market size, China is an obvious example, where demand is met by domestic manufacturers.

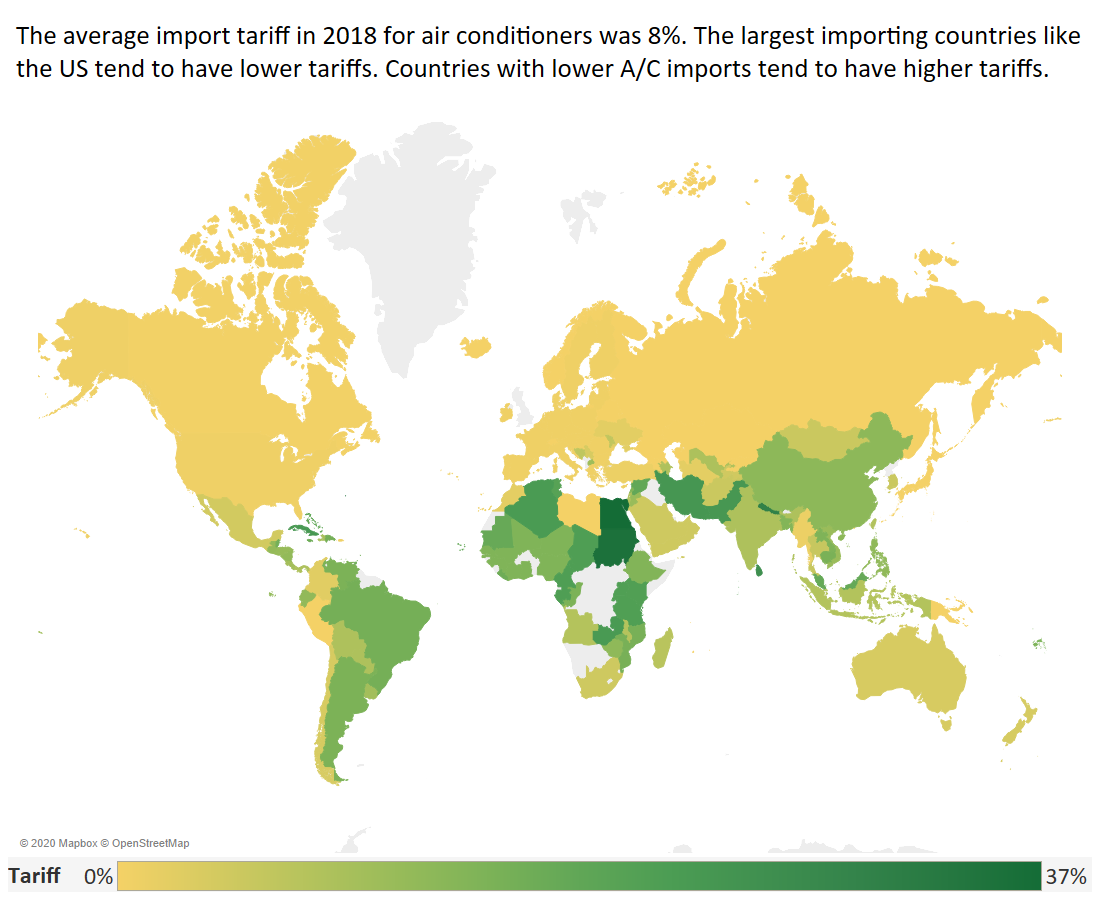

Tariffs also impact trade. High tariffs could inhibit the uptake of more efficient A/C because their upfront cost are usually higher, despite reduced operational costs meaning life cycle costs are lower. A/C tariffs vary across regions, Europe has the lowest tariffs. Countries with high tariffs include India, Brazil, Vietnam, and Iran. Refrigerants used in A/C have also not been immune to accusations of trade dumping, being sold below market value to gain market share or to offload surplus production.

Across most major cooling markets, the average efficiency of A/C’s sold today is less than half of what is typically available – and one third of best available technology. This shows exporting countries can produce high efficiency A/C. Importing countries have an important role to play in increasing demand for these products. Stringent mandatory MEPS are a clear way to achieve this.

A core objective of Free Trade Agreements (FTAs) is harmonisation of regulations and standards that facilitate a greater exchange of goods and services. Ensuring convergence towards high energy efficiency standards in FTAs can be complementary to MEPS.

Joining up trade negotiations with forums that establish energy efficiency standards is challenging and requires international collaboration. Initiatives like the BRI Green Cooling Initiative, CLASP and Efficiency For All can help bridge this gap, by supporting the formulation of markets for energy efficient appliances. Trade patterns can help inform where the focus of these initiatives should be.

This analysis suggests a focus on Asia is vital, due to the market size and growth rate. However, many countries in South America, Africa and Oceania are beginning to experience hotter climate change induced temperatures. Efficient, climate-friendly cooling will be essential for adapting to this change and ensuring market access to such equipment is crucial.