Through the introduction of the Energy Profits levy, the Chancellor is looking to secure a short-term revenue boost from the North Sea. However, at the same time he is providing a subsidy to oil and gas producers which will do long-term harm to the energy transition.

By introducing additional tax relief limited to oil and gas investment, Treasury incentivises a slower transition and pushes companies to allocate profits towards new oil and gas developments instead of renewables. If this revenue had instead been spent on supporting energy efficiency measures it would have the potential to lift households out of energy poverty for good.

New measures mean that the Government has committed to a subsidy of up to £5.7bn in tax relief for investment in oil and gas in the next three years. This lost revenue could have instead supercharged an energy efficiency drive, insulating two million British homes over the same period, with an average bill saving of £342 per household every year.

Energy efficiency was absent from the Chancellor’s emergency support package announcement, meaning UK households’ long-term reliance on gas will remain. This indicates that the Government has not grasped what is needed in order to deliver a genuinely resilient and affordable energy system. Instead, it is willing to design and implement policies that support the interests of oil and gas companies instead of British households.

What was announced?

Energy Profits Levy

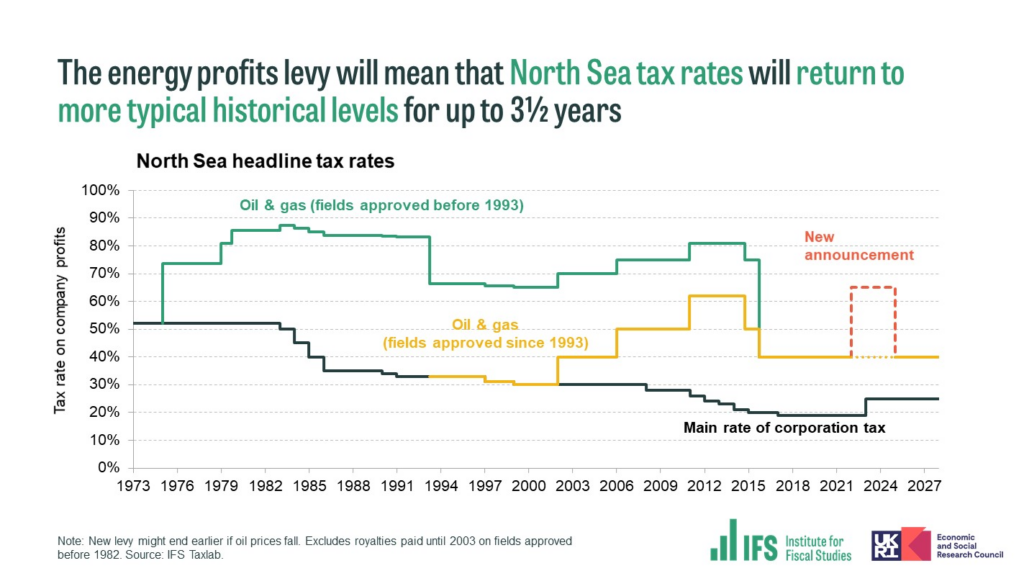

On Thursday 26th May, the Government introduced an additional 25% levy on oil and gas company profits. This increases the effective combined tax rate from 40% to 65%, bringing taxation of oil and gas production back to levels held before the oil price crash of 2014. Taxation on oil and gas extraction remains below the global average of 70%, and significantly below North Sea neighbours Norway’s taxation rate of 78%.

Figure 1: History of headline North Sea tax rates on oil and gas production, Institute for Fiscal Studies

Tax relief on new oil and gas investment

At the same time, the Government announced increased tax relief for investment in oil and gas production. Companies can be exempt from the Energy Profits Levy through a new Investment Allowance, and a First Year Capital Allowance. Altogether, this doubles tax relief on investments made in new oil and gas fields from 46.25p on every pound to 91.25p in every pound. A significant share of the increase can be claimed back instantly.

The UK government has previously maintained that the “UK does not give any subsidies to fossil fuels“. However, these measures meet both international definitions of a subsidy and those in the UK’s Subsidy Control Act 2022 which came into effect on 28 April 2022. Since 2016, the UK Government has committed to phase out “inefficient” fossil fuel subsidies by the end of 2025.

What does it mean for new fields?

It is more likely that new fields will go ahead. 80% investment allowance is paid back instantly (not once a field starts producing) which drastically lowers the upfront cost to producers of pushing ahead with new projects. Construction time of new fields (typically around 3 years) will also mean that the 25% levy on profits from extraction will no longer be in place once they start producing.

What does it mean for the energy transition?

It incentivises companies to allocate more capital towards oil and gas rather than renewables. Companies will only receive this tax relief if they invest in oil and gas rather than in other technologies. This penalises a company if it was planning to invest more in renewables, and benefits companies with no intention to shift their portfolios away from oil and gas.

What should Government do?

Launch a home energy efficiency retrofit programme to lower energy bills for good. The UK has some of the leakiest homes in Western Europe. By boosting existing schemes and providing additional support to vulnerable households, Government can lower energy bills for good. It will also mean UK homes are more resilient to future shocks.

Remove the new tax relief in the Energy Profits Levy that incentivises a slower pace of transition. Government risks incentivising projects which may become uneconomic and misses an opportunity to accelerate the UK’s renewable rollout.

Ensure UK tax for oil and gas extraction is aligned with its G7 commitment to phase out fossil fuel subsidies. The UK is damaging its climate credibility otherwise.