COP’s first week is dominated by leaders’ statements, followed by sectoral days. In week two, attention turns to negotiations, with endgame texts thrashed out to (hopefully) reach a consensus. This year many decisions, including on energy, are likely to emerge in the first Global Stocktake (GST).

Week one saw momentum for scaling clean energy and phasing out fossil fuels, and recognition that these must go hand-in-hand. Now, pressure is on the COP Presidency to channel this ambition into the GST as battle lines are drawn on phase out/phase down, abatement technologies, clean energy ambition, and energy finance.

At its best, COP can set signals and commitments for energy transition ambition, but these are often expressions of real-world progress.

COP commitments this week reflected real world proof points:

1. Climate science clear on energy transition

Many leaders and energy initiatives referenced the science, which states that fossil fuels must peak this year, sharply decline this decade, and reach near-zero usage by 2050. Abatement technologies will not significantly alter the downwards trajectory of fossil fuels, and play hardly any role in the near term. The IEA and IPCC both recommend that no new unabated coal power plants be built, and that coal power is phased out by 2030 in the world’s richest countries and by 2040 elsewhere.

2. The support system for phasing out fossil fuels is growing – led by coal

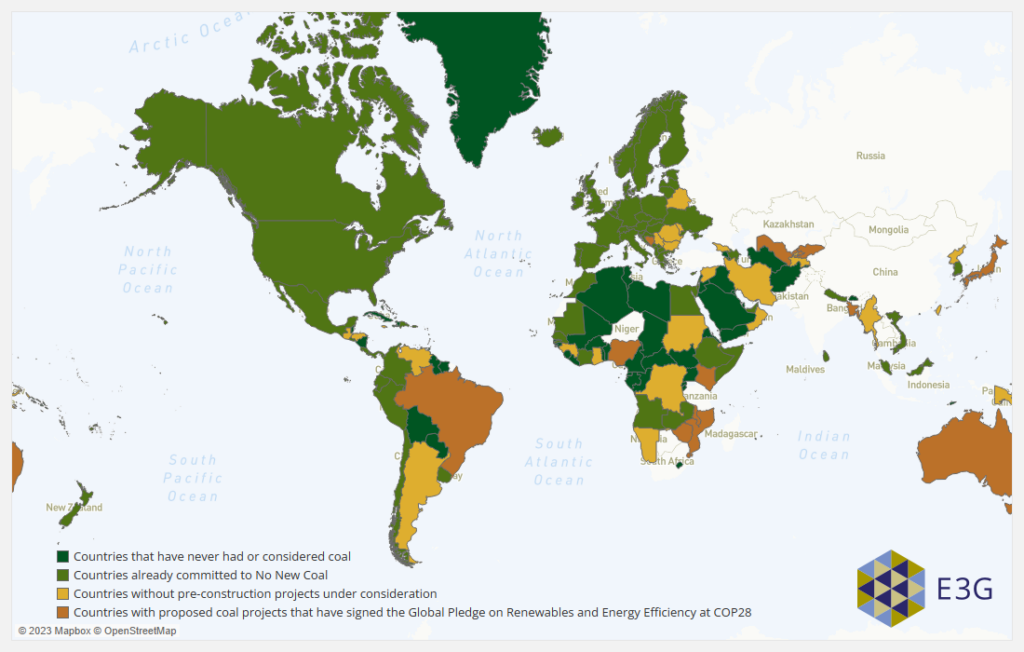

Many countries signalled they see no room for new coal plants in a 1.5°C-compatible world.

- A historic moment was the US, the world’s number three coal consumer, joining the Powering Past Coal Alliance (plus nine other new members), with John Kerry calling explicitly for “no new coal” in the GST.

- 75 governments are now committed to no new coal and a further 25 are no longer pursuing coal projects.

- French-led Coal Transition Accelerator and Commission will help unlock financing for the just transition of the existing coal fleet.

- There was some progress on Just Energy Transition Partnerships (JETPs): South Africa launched its Implementation Plan on governance and next steps; and Vietnam launched its Resource Mobilisation Plan which identifies priority investments to peak emissions and coal capacity by 2030 (though disappointingly confirms policy to keep coal with ammonia co-firing in the 2040s).

- This is against the backdrop of only 33 countries still considering new coal plants, and only China and India planning substantial coal power capacity increases.

On oil and gas, the support offered to countries wanting to phase out is patchy but growing:

- Kenya, Samoa and Spain joined the Beyond Oil and Gas Alliance, with grants awarded to Kenya and Colombia to plan their phase out.

- Eight export credit agencies pledged to support countries to transition from fossil fuel production.

Yet, industry-driven alliances went little beyond the status quo:

- The Global Decarbonisation Alliance failed to set Paris-aligned targets – no role for reducing production, and no pre-2030 milestones.

- The Methane Finance Sprint provides welcome financial support, but lacks near-term targets and commitments are dwarfed by last year’s fossil fuel revenues.

3. Renewable and energy efficiency ambition is supported by a strong group of leaders, businesses and civil society

- 127 countries (so far) have signed the Global Renewable Energy and Energy Efficiency Pledge to triple global RE capacity and double global EE improvements by 2030, also recognising the need to end new coal now and be free of unabated fossil fuels by 2050.

- Mission Efficiency, endorsed by Kenya and Ghana, launched new pledges and called on Parties to agree to doubling energy efficiency in the COP28 energy package.

- The Cool Coalition and UAE Presidency Global Cooling Pledge included 63 countries agreeing to invest more in passive solutions and curb emissions through higher efficiency and faster phase down of refrigerants.

- France and Morocco, with the Global Alliance for Buildings and Construction, launched the Buildings Breakthrough with 28 countries joining including China, Kenya, Canada, and the US, with a Ministerial planned in 2024.

What next?:

- Reflect ambition of Global Renewable Energy and Energy Efficiency Pledge in the GST.

- Develop implementation pathways for renewable energy (RE) and energy efficiency (EE) scale up.

4. Investments in clean energy are far outstripping those into fossil fuels, particularly coal, but more is required

For every $1 invested in fossil fuels, $1.7 is now invested in clean.

- Norway and Australia joined the Clean Energy Transition Partnership, with now 41 members committing to phase out international fossil fuel finance and prioritise clean.

- The Energy Transition Council Ministerial, co-led by the Philippines, called out the need for financial support for clean energy transition, and highlighted the RE/EE Pledge.

- More than $60 billion was pledged for mitigation, including $6.4 billion to the Green Climate Fund; $30 billion from the catalytic climate fund ALTERRA; $5 billion from Business and Philanthropy Forum members; and $2.5 billion from the EU budget.

What next?

- GST to recognise need to increase financial and technical support for energy transition, including grids financing

- Drive total finance system transformation to unlock more money for energy transition

5. Growing voices from leaders, business and civil society for fossil fuel phase out

Despite unhelpful off-script comments, the COP28 President reiterated that a fossil fuel phase down is “essential” and asked parties for workable language. The current GST draft includes options around unabated fossil fuel phase out, including specifics on coal, and tripling RE and EE, but also options for none of the above. Dividing lines are drawn with countries such as China and India reportedly blocking progress on the package, while tensions grow around need for and precision of abatement language in enabling “phase out” rather than “phase down”.

What next?

COP Parties need to recognise strong real-world momentum for the energy transition, resisting political postering and vested interests. A convincing energy package should include clear ambition on renewables and efficiency, and near term action on fossil fuel phase out by 2050. Some countries may reiterate their request for caveats like unabated; any such language must be accompanied by science-based guardrails and definitions aligned with the Paris Agreement that empower national and sectoral regulators to require emissions reductions. Further specifics on coal phase out and no new coal are important to reaffirm real world progress and extend efforts to all countries.

Beyond COP, the final phase is to ensure real world implementation and delivery. Broad support can be mobilised by emphasis on scaling finance, meeting energy access needs and recognising the responsibility of developed nations to move faster.