Under current trends, global gas demand is set to peak before the decade’s end. Bringing forward this peak in line with climate imperatives can bolster economic growth, security, and resilience. To do this, demand must fall by 110 billion cubic metres (bcm) per year until 2030. Structurally reducing demand should become a focus of international collaboration.

The Golden Age of gas is ending

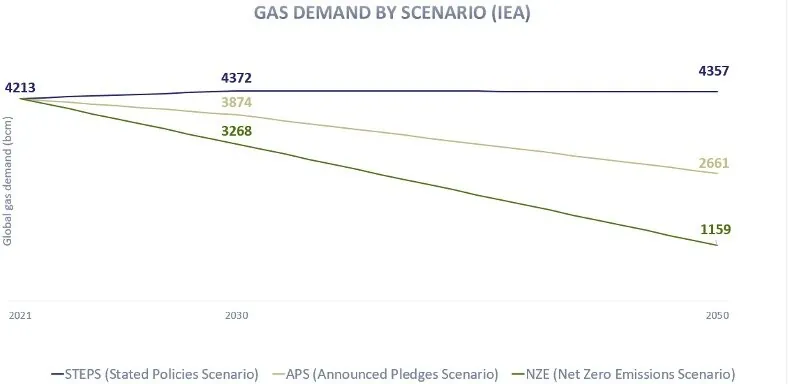

To align with the Paris Agreement, global gas demand would need to decline by 19% by 2030 and peak well before 2030. Under its business-as-usual scenario, the International Energy Agency (IEA) expects demand to plateau and peak around 2030.

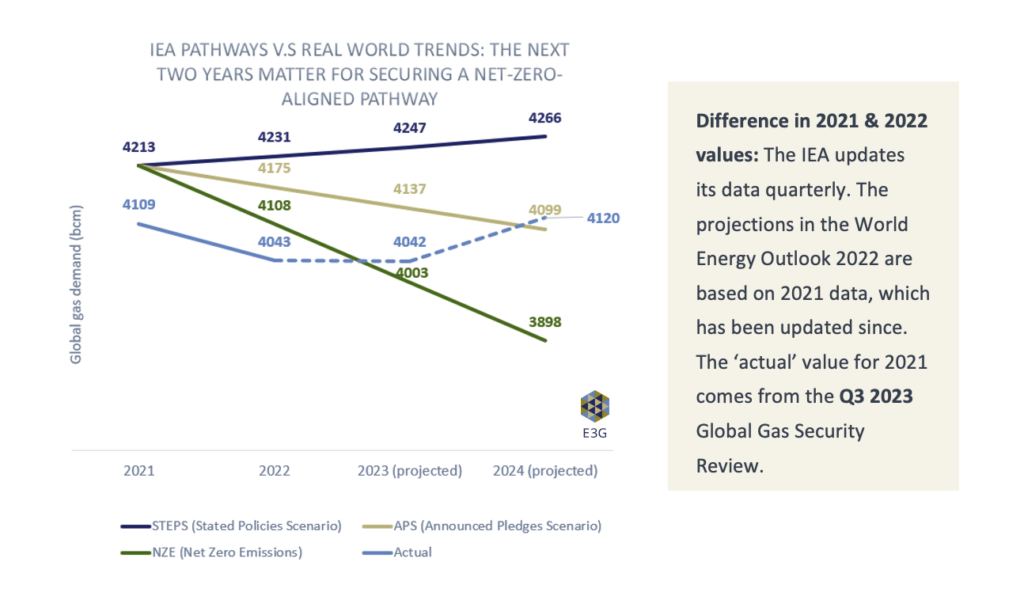

Recent data suggests peak gas could arrive earlier, with the next two years key to locking in this development. In 2022, global gas consumption was lower than expected under the IEA’s Net-Zero Emissions scenario. Despite the expected recovery in 2024, the IEA notes that ‘global gas demand growth for the period between 2020 and 2024 was reduced by 40% compared to projections prior to Russia’s invasion of Ukraine’.

Key markets are reducing gas demand

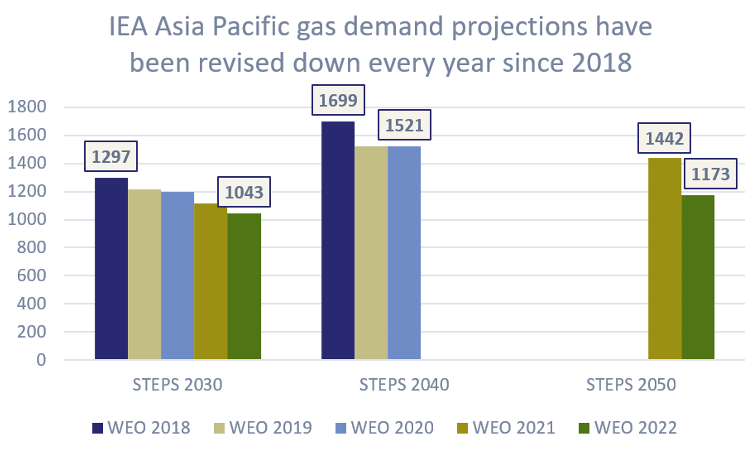

EU gas demand declined by 13% in 2022, driven by cuts in Russian supply. Almost one third of this change was structural, due to increased efficiency and accelerated renewables deployment. Further decline is expected this year. Meanwhile, the US introduced the Inflation Reduction Act, projected to erode gas demand by 12% between 2022 and 2030. Demand growth in Asia is still expected, but projections are revised down yearly.

Bringing forward peak gas demand enhances economic, energy and climate resilience

Volatile prices impact the entire economy

Gas prices drove Europe’s cost of living crisis last year, with trebling inflation, an 18% annual increase in food prices, and a range of social impacts. Some EU countries saw households’ energy bills double their income share, despite substantial government subsidies. The IEA estimates that EU consumers will save EUR 100 billion during 2021-2023 thanks to new solar PV and wind capacity replacing fossil fuel power generation.

For industry, higher gas prices mean increased production costs, smaller profit margins and outputs, and weakened export competitiveness. The impacts are economy-wide and affect fiscal discipline: in the UK, the debt impact fossil fuel price volatility to 2050 is expected to be 13% of GDP.

Dependence on gas imports augments energy security risks

Relying on other countries for energy carries the risk of sudden supply disruptions, as witnessed in Europe. With the growing role of LNG, gas markets are more interdependent at global level: disruptions in one place can reverberate elsewhere. Europe increased LNG imports to replace Russian pipeline gas, outbidding traditional LNG importers in Southeast Asia (e.g., Pakistan), and indirectly causing historic LNG and electricity price spikes in Japan and Korea. This caused profound economic disruption, energy rationing, and lengthy blackouts in some countries. While complete energy independence is impractical, reducing dependence on gas imports, and helping vulnerable importers to do the same, is a safe way to minimise risks for all.

Continued gas use escalates climate risks

Recent record temperatures highlight the growing scope and frequency of climate risks. Gas – a major source of methane emissions – is a large part of the problem. To remain on the net-zero path, demand must fall to 3268 bcm by 2030 (110 per year) from the current 4043 bcm.

International collaboration is key to peaking gas demand in line with the net-zero pathway

Global peak gas demand is in sight already. Countries have the tools to bring it forward in line with climate-safe pathways – while also improving economic and energy resilience. The focus of international collaboration should now be on ensuring that all countries have access to a future free from volatile and polluting fossil gas.

Europe and the US represent almost a third of global gas demand and are structurally reducing usage. They should double down on and share their plans with other G20 nations, responsible for another 40% of global gas demand. This would represent a triple win for the climate, the economy, and energy security.