The Capital Markets Union (CMU) was set up to provide new sources of funding for business, help increase options for savers and make the economy more resilient. To deliver this overarching ambition, the CMU has five sub-objectives. One of these is to ensure “an appropriate regulatory environment for long term, sustainable investment and financing of Europe’s infrastructure”.

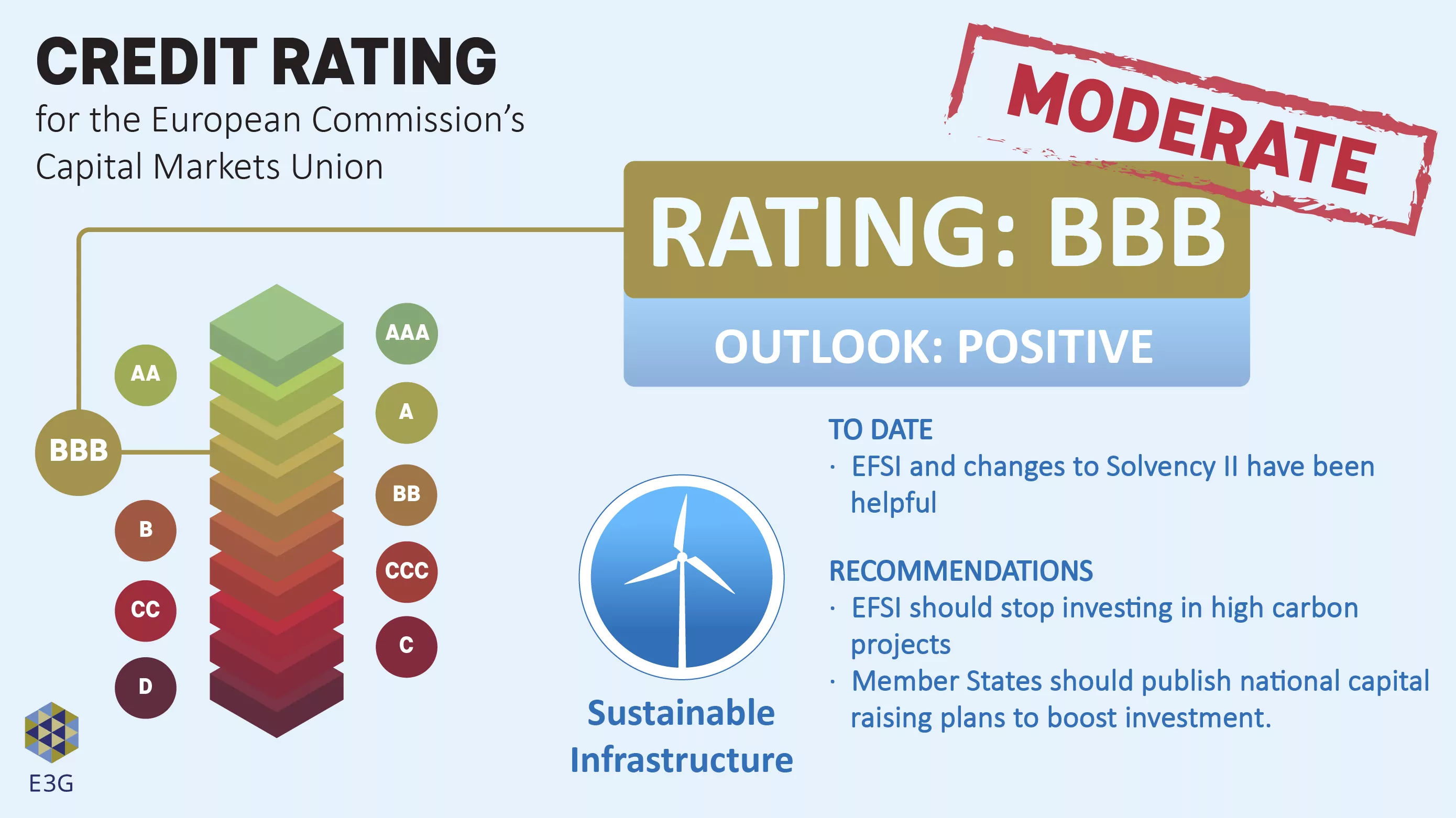

This briefing paper assesses the progress made in delivering sustainable investment, by scoring progress made against what E3G regards as the core principles necessary to achieve this. They are: delivering sustainable infrastructure; supporting sustainable development; and improving understanding of climate and other ESG-related risks. The CMU is given a ‘credit rating’ based on the actions taken so far and those it planned under the next phase of initiative.

(All infographics are free to use.)

Overall, one year on from the publication of the CMU Action Plan, the CMU is given a ‘BB’ rating for sustainability. To date the focus on delivery of the sustainability objectives has been inadequate. Additional policies are required to boost investment in sustainable infrastructure, help deliver the UN’s Sustainable Development goals and understand climate and ESG risks. Currently there is a €100bn a year energy infrastructure investment gap. This risks Europe’s ability to meet its obligations under the Paris Agreement to deliver its 2030 climate and energy targets and to make “finance flows consistent with a pathway towards low greenhouse gas emissions and climate-resilient development”.

This review should be a useful sense-check as the European Commission moves forward with its refresh of the CMU. While the rating is currently BB, we regard the outlook as positive. On 14th September 2016 the European Commission announced that it will establish an expert group with responsibility for developing a comprehensive European strategy on sustainable finance. The expert group represents a significant new commitment by the European Commission both to pursue the ‘greening’ of the EU financial system and to build a supportive regulatory environment in which to deliver sustainable development. We suggest setting out to address the policy gaps outlined in this briefing paper should be a core focus for this group.

The paper makes a number of recommendations that the Commission should consider once the sustainable finance expert group has been established.

These include:

Sustainable infrastructure

- The European Commission should support the rapid development of robust, fully-developed and widely-accepted industry standards for green bonds.

- The European Commission should work to facilitate a situation that ensures issuing a green bond is, at the least, no more costly than issuing a regular bond. To do that, it should use its convening power to stimulate debate with Member State Governments on the role of fiscal policy in promoting the green bond market.

- The European commission should focus on Improving the pipeline of infrastructure projects – for example by requiring the inclusion of national capital raising plans within Member States’ 2030 National Energy and Climate Plans .

- The European Fund for Strategic Investment should cease investing in high-carbon projects.

Responsible investing

- the European Commission should send a clear message that fiduciary duties are not a barrier to integrating ESG information into their investment decisions.

- greater accountability of assets owners and managers to their beneficiaries should be encouraged – for example by requiring institutional investors to consult formally with beneficiaries to understand their preferences regarding sustainable investment.

- the European Commission should publish a plan on how to align financial policy with the EU’s climate goals and the Paris Agreement.

Climate risk disclosures

- The European Commission should develop a plan on how it will respond to the Financial Stability Board’s (FSB) Taskforce for Climate-related Financial Disclosures, which was established to provide voluntary standards for companies’ disclosure of climate-related information.

- The European Commission should also provide assurances that it will ensure current regulations that require the disclosure of material risks, including those related to climate change, are fully implemented in Member States.

These recommendations are the result of a collaboration between E3G and working group of think tanks and NGOs. The recommendations presented here will be set out in more detail in a joint paper entitled ‘A Sustainable Finance Plan for the European Union’ due to be published later this month.

Read the full briefing State of the Capital Markets Union: Has it delivered on sustainability? here [PDF 1Mb]