This page is part of the E3G Public Bank Climate Tracker Matrix, our tool to help you assess the Paris alignment of public banks, MDBs and DFIs.

This page is part of the E3G Public Bank Climate Tracker Matrix, our tool to help you assess the Paris alignment of public banks, MDBs and DFIs.

| Paris alignment | Reasoning |

| Paris aligned | The Bank is active in the realm of green bonds and has provided some information on other areas of green finance promotion. The promotion of green finance is one of the four workstreams of the EIB Climate Bank Roadmap. |

One of the four workstreams of the EIB Climate Band Roadmap is ‘Accelerating the transition through green finance’ under which the Bank commits to increasing and mainstreaming green finance. The EIB states that it will do so as an observer/partner in the International Platform on Sustainable Finance, the Network on Greening the Financial System and the Coalition of Finance Ministers for Climate Action. In addition, the EIB states that it will “also actively seek to transfer its knowledge to other potential green issuers, to help them develop and market products that meet the EU Taxonomy and so contribute to broadening and deepening the market for green finance.” The Bank further outlines that it will do this work through its European Investment Advisory Hub, but fails to specify which tools it will provide to do that.

The EIB has an active green bond programme. In 2007, the green bond market kicked off with issuances from the European Investment Bank (EIB) and the World Bank. Since then the EIB has been an important body in terms of issuances, having raised EUR 26.7bn across 13 currencies as of December 2019. By May 2019, this number had risen to more than $18bn in green bonds across 11 currencies, which has funded over 150 projects. EIB was also responsible for the green bond market’s first comprehensive impact report in March 2015.

EIB is a founding member of the Global Green Bond Partnership (GGBP).

EIB has also been undertaking work in partnership with China on green bonds, including on the development of a common language and terminology on green finance. This work could be transformational with its potential to enhance investor confidence in green finance, increase transparency, and raise standards through the sharing of best practices.

One example of a credit-enhancement mechanism used by the EIB is the Global Energy Efficiency and Renewable Energy Fund (GEEREF) which includes a first-loss provision by donors to cushion risk absorption for senior lenders and private investors.

EIB recently launched a platform to support green growth in the MENA region, leveraging private funds through the Luxembourg-EIB Climate Finance Program.

While we ranked EIB as transformational on green bonds, there is comparatively less information about whether EIB is working with central banks, finance ministries, sub-national or national financial institutions on green finance or green fiscal reform. The Bank is in constant contact with member state representatives who sit on the Board of Governors. In this role ministers, usually from the state’s Ministry of Finance, take decisions on various financial matters including new funding programmes and specific projects, but it is unclear if this facilitates work between the EIB and central banks specifically.

| Climate Action Framework Loan II to Caribbean Development Bank (CDB) In 2017, EIB provided a loan to the Caribbean Development Bank of $120m, with the aim of financing projects to support CaDB to mainstream climate action and to provide the necessary low-cost funding to Caribbean countries to address adaptation and mitigation. Additionally, EIB provided extra funds to CaDB ($24m) to help countries after the hurricane events of 2017. The investments eligible for the second tranche of the funding are those projects that integrate climate risk and vulnerability assessment in their design. This is with the view of helping countries to build back better[4]. Outcome: From the first Climate Action Line of Credit, approximately $65.6 m in 2011, nine projects in seven different countries were financed. In October 2019 the Procedural Procurement Framework, a continuation of funding to better monitor and implement projects across the region, was signed by both parties.[5][13]. This is expected to support CaDB in mainstreaming climate action when supporting its borrowing member countries, as most of them are highly vulnerable and need to improve their climate resilience. Furthermore, the EIB technical programme has supported the development of a pipeline of climate action projects which may be eligible for funding. Transformational aspect: This is the second operation building on the results from the first Climate Action Credit Line from 2011. In 2012 the CaDB Climate Resilience Strategy was approved and EIB has been working closely with the CaDB to support it to mainstream climate action across its borrowing member countries. The credit line was complemented with technical assistance which was key to ensuring that projects were considering context-specific climate risks in feasibility studies. This was a way of ensuring that the principle of ‘building back better’ was integrated. |

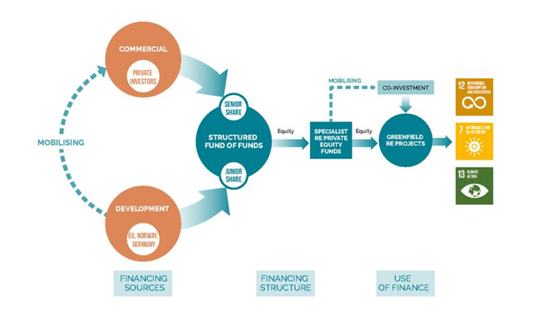

| Case Study: Global Energy Efficiency and Renewable Energy (GEEREF) Market failure addressed: reduce investment risks for private capital The “funds of funds” of the GEEREF is advised by the EIB. GEEREF is focused on supporting investment into renewable and energy efficiency projects in developing countries by providing equity to specialist private equity funds, who in turn are able to mobilise additional commercial capital. GEEREF was established in 2006 as a public-private partnership and has €222m under management, of which €122m was provided by governments with €110m raised from private investors. This blended capital approach, allowing the sub-funds to raise further private capital, is a way of maximising the leverage of the initial public funds provided. The fund provides equity to specialist private equity funds for projects requiring up to €10 million of equity. The GEEREF is aiming to leverage private capital for a mix of small and medium-sized projects such as renewables and energy efficiency projects. The fund of funds is composed of three tiers: a top tier that pools patient capital of public and private investors in a fund-of-funds; an intermediate tier of regional sub-funds which attract co-investors; and a bottom tier of investment projects financed by equity finance and debt. The funds of funds enhance the catalytic effect by attracting public investments into the first tier and enabling the commercial investors to diversify their portfolio. Over €10bn could be mobilized through the funds in which the GEEREF participates. |