This page is part of the E3G Public Bank Climate Tracker Matrix, our tool to help you assess the Paris alignment of public banks, MDBs and DFIs.

Asian Infrastructure Investment Bank

Non-fossil to fossil energy ratio and scaling up climate investment in all sectors

| Paris alignment | Reasoning |

|---|---|

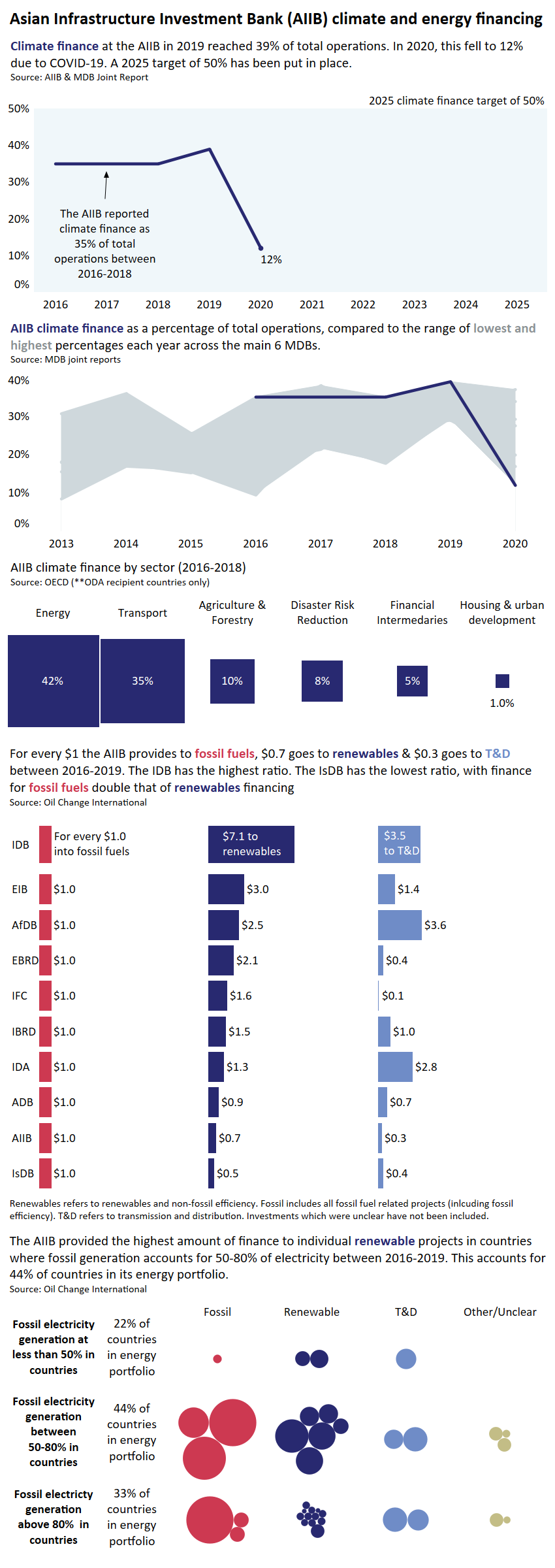

| Unaligned | The Asian Infrastructure Investment Bank (AIIB) has funded more fossil fuels than renewables between 2016-2019. For every $1 the AIIB provided to fossil fuels, $0.7 went to renewables and $0.3 went to energy networks (transmission and distribution). |

Explanation

The Asian Infrastructure Investment Bank (AIIB) has funded more fossil fuels than renewables between 2016-2019. For every $1 the AIIB provided to fossil fuels, $0.7 went to renewables and $0.3 went to energy networks (transmission and distribution).

Climate finance accounted for 39% of total financing approved in 2019, up from 35% over the previous three years combined. However, due to the COVID-19 response from the AIIB, climate finance dropped to 12% in 2020.

Recommendation: Scale up climate investment in the energy sector to ensure fossil fuel lending is at zero across a 3-year period.

Oil Change International (2018) Shift the Subsidies database

Joint Report on Multilateral Development Banks Climate Finance (2019,2018,2017,2016,2015,2014,2013)

This work is funded by Good Energies Foundation.

Last Update: July 2022