This page is part of the E3G Public Bank Climate Tracker Matrix, our tool to help you assess the Paris alignment of public banks, MDBs and DFIs.

| Paris alignment | Reasoning |

|---|---|

| Some progress | Transparency of financial intermediary lending needs improving. |

| Climate finance data | Publishes underlying project level data for the Joint Report on Multilateral Development Banks’ Climate Finance in PDF format but many projects in OECD database have no sectoral tag. |

| Financial intermediary lending | Financial intermediaries and size of loans are detailed but further information is limited. |

| TCFD Reporting | The EIB conducts TCFD reporting. Greater portfolio data disclosure is needed. |

The European Investment Bank (EIB) has provided the project level data underlying its submission to the MDB joint report in PDF format for 2016-2019. The release in the PDF format makes it difficult to do in depth analysis. However, within its submission to the OECD-DAC (Development Assistance Committee) climate-related development finance database, the EIB does not provide the sector in which the project sits for 75% of its projects in 2018. In 2013 and 2015, no projects had a sectoral tag. This makes it difficult to undertake analysis of the data.

The EIB also reports against the Sustainability Accounting Standards Board (SASB) framework and the Global Reporting Initiative (GRI) framework.

Recommendation: The EIB should improve the quality of the data it submits to OECD-DAC, and include a sector tag in all cases. The EIB should also publish the underlying data to its submission to the MDB joint report in an excel readable format

In its Climate Bank Roadmap, the EIB states that it will report against the EU taxonomy once it has been finalised. This should be encouraged at the EIB and other MDBs, if the taxonomy can be adapted for use in other regions of the world.

The EIB has an online portal which details every financial intermediary that has received a loan from the EIB. This is searchable by country and provides information on the type of loan and the FI website. However, no further details of the loan are provided on this portal. The EIB has a separate portal where all credit lines provided by the EIB can be searched. This gives details of the size of the loan and the country where the financial intermediary sits. However, information on the sub-projects financed and the impact of this financing is not available.

In the EIB environmental and social standards document, it states that the EIB “ensures it is comfortable that each financial intermediary is assessed to ensures it presents only sub-projects for allocation which comply with EU/national law and that is reserves the right to assess each sub-project“. Compliance with law is a relatively low bar, as there is a presumption no MDB will finance a project that is illegal.

Bankwatch analysis has shown that the EIB discloses information on its intermediated lending in its annual reports at an aggregate level and only offers some examples of sub-projects, and the EIB transparency policy suggests it puts the onus onto the intermediaries to disclose details of the financing.

A review of the 2015 transparency policy completed in 2019 suggested only that the EIB should communicate further with intermediaries on transparency and provide training where needed.

The EIB Climate Bank Roadmap foresees the development of an intermediary lending framework which will include climate risk assessments for physical and transitional risks. However, details of this framework are not yet public and it is expected to be updated in 2021. It is also unclear whether EIB intends to report on intermediary lending, as required for Paris Alignment.

The EIB does conduct TCFD Reporting. This section assesses what level of detail is disclosed within the 2020 TCFD report.

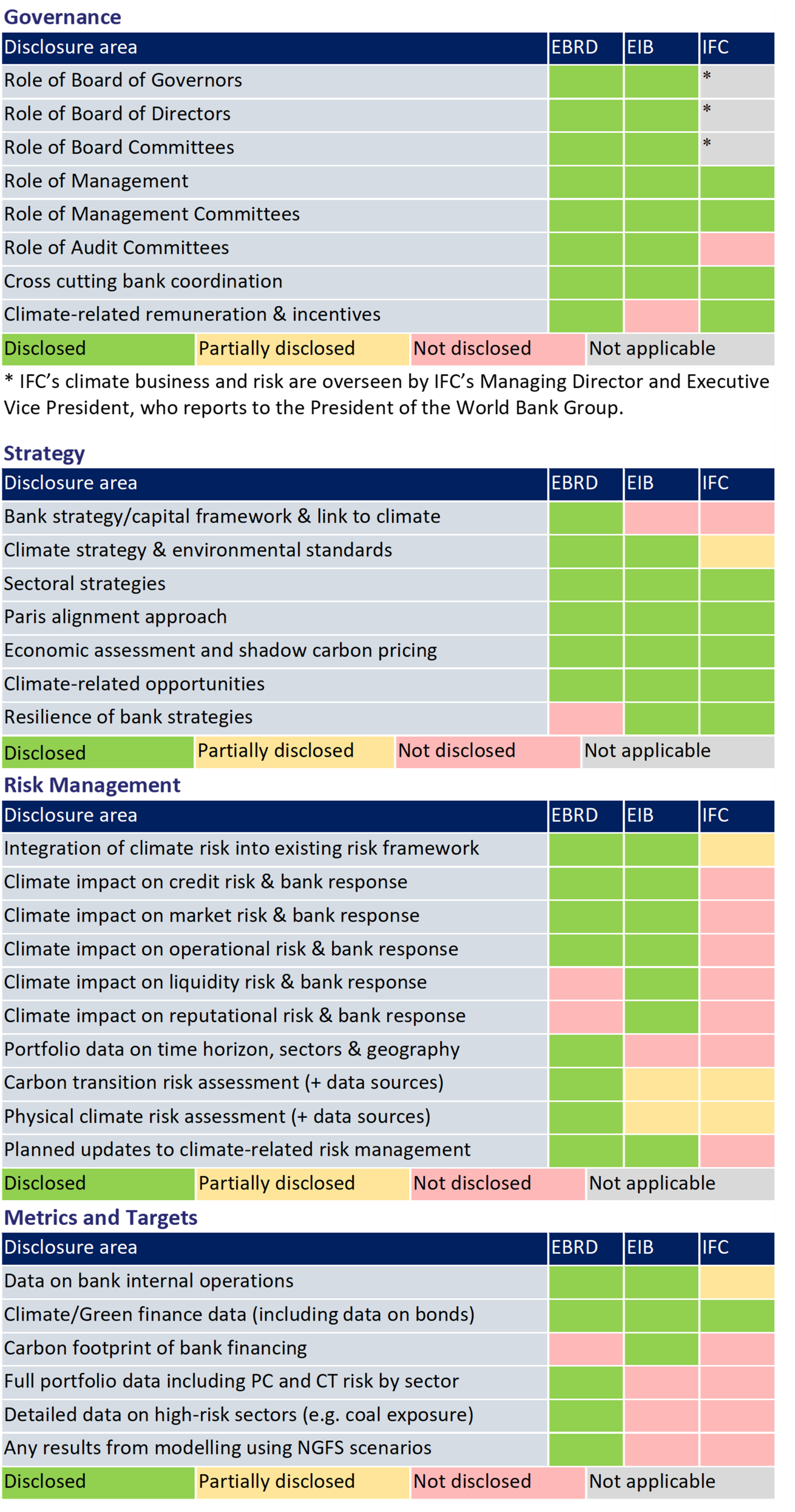

E3G has developed a list of areas under each TCFD category based upon the disclosure of the three MDBs who do TCFD reporting (EBRD, IFC and EIB). This allows a direct comparison between where each MDB is providing greater disclosure compared to their peers in certain areas.

The EIB should focus on its portfolio data disclosure in future TCFD reports.