This page is part of the E3G Public Bank Climate Tracker Matrix, our tool to help you assess the Paris alignment of public banks, MDBs and DFIs.

| Paris alignment | Reasoning |

|---|---|

| Some progress | The ADB has made some progress on climate finance transparency, publishing detailed project level data annually and implementing transparency improvements as part of its Environmental and Social Framework. Consequently, it was ranked 1st (sovereign) and 3rd (non-sovereign) in the 2023 DFI Transparency Index. However, there remains room for improvement regarding disclosure of sub-investments through financial intermediaries. Moreover, concerns have been raised regarding potential overreporting of adaptation finance. |

| Alignment and reasoning | |

| Climate Finance Data | The ADB publishes underlying project level data for the Joint Report on Multilateral Development Banks’ Climate Finance, and is ranked 1st (sovereign) and 3rd (non-sovereign) in the 2023 DFI Transparency Index. |

| Financial Intermediary Lending | The ADB discloses monitoring reports for transactions financed through its financial intermediaries (FIs) and has committed to disclosing summaries of FIs’ environmental and social monitoring systems. However, the Bank does not appear to require any disclosure from FIs relating to sub-investments. |

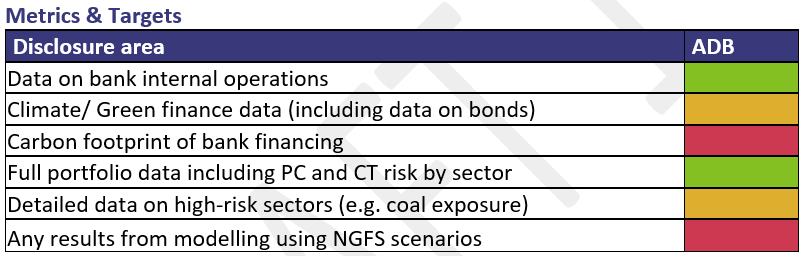

| TCFD Reporting | The ADB conducts TCFD reporting. However, this reporting could be enhanced through greater inclusion of portfolio data and coverage of sectoral strategies. |

Transparency of climate finance data

Since 2016, the ADB publishes its project level climate finance data annually in a machine-readable and Excel format. The Bank also reports this data as part of the Joint Multilateral Development Bank (MDB) Report on Climate Finance and follows the MDB Joint Methodology for tracking climate finance for both mitigation and adaptation. This represents best practice among the MDBs, with the ADB being the only Bank other than the Inter-American Development Bank (IDB) to have published their project level climate finance data in this way.

The ADB also discloses climate-related development finance to the relevant OECD-DAC database. Compared to other MDBs, the ADB provides the most detail in its description of projects. Its extensive project documentation includes reports of project activities, climate change assessments, monitoring and evaluation results, and gender action plans for most of its projects. This reflects best practice among MDBs in terms of the project level transparency of climate finance.

Reflective of these strong disclosure practices, the ADB ranked 1st (sovereign) and 3rd (non-sovereign) in the 2023 DFI Transparency Index. In particular, the index recognised the ADB for providing extensive information on their organisational policies and investments in accessible formats, publishing summaries of its environmental and social (E&S) risks in accordance with the IATI standard and being the only non-sovereign DFI to consistently publish whether disclosure to communities was required for its projects.

Despite these promising indications, recent research by Oxfam included a suggestion that the ADB’s approach to adaptation finance accounting could potentially lead to overreporting of its finance levels, estimating this at 44%. The ADB’s adaptation finance accounting and reporting is aligned with the Joint MDB Methodology for Tracking Climate Adaptation Finance, most recently revised as of late 2022. However, Oxfam’s research suggests that this does not prevent inconsistencies in reporting, due to the lack of standardisation across the Bank’s own adaptation finance reporting, and the reliance on subjective assumptions in estimating project costs. The report goes on to assert that, to improve its methodological rigor, the ADB should set clearer criteria and categorisations for adaptation activities and the determination of baseline scenarios for measuring additional costs associated with adaptation measures.

Notably, the agenda items of the ADB’s Climate Change Action Plan 2023–2030 include enhancing approaches to tracking and reporting private capital mobilisation and catalysation, as well disclosure and reporting in line with international standards and regulations. This is indicative of the ADB’s continued efforts to iterate and improve on its disclosure practices.

Transparency of financial intermediary lending

The ADB’s Environmental and Social Framework (ESF), which was approved in late 2024 and will be effective from 1 January 2026, requires the Bank to “classify all activities and transactions involving financial intermediaries (FIs) or delivery mechanisms involving financial intermediation” into E&S risk levels. It also requires the ADB to verify that FIs have an environmental and social management system (ESMS) in place that will uphold the Bank’s own safeguards. Currently, the ADB only discloses the summary of an FI’s ESMS, but the new ESF will extend this to include the FI’s E&S risk profile, as well as relevant E&S documentation reported and submitted by FI’s borrowers and investees.

In addition, the Bank has published its technical guidance note developed to support Bank staff and consultants in conducting financial due diligence on FI projects. With the updated ESF, the Bank has committed to disclose financial monitoring reports for transactions financed through FIs.

Despite the above transparency efforts resulting from the updated ESF, the Bank does not appear to yet (or plan to) require any disclosure from FIs relating to sub-investments. The ADB currently only discloses use of funds at the counterparty level for lending through FIs. Such an approach may risk ADB funds being used in activities that are unaligned with the Bank’s Paris Agreement commitments. Oversight of subprojects financed by FIs is a critical component of safeguarding the implementation of the ADB’s climate commitments at the investment level.

TCFD reporting

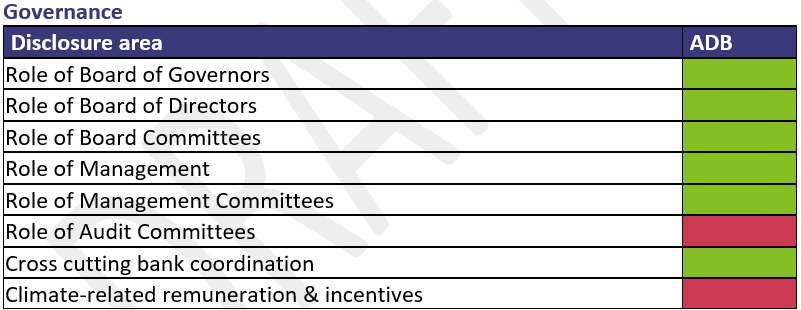

The ADB published its first climate-related financial disclosures report in September 2022. This section assesses the level of detail disclosed within the 2022 TCFD report.

Recommendations:

- The ADB should develop and implement a comprehensive policy for disclosing sub-investments made through financial intermediaries, going beyond the current practice of reporting only total loan amounts and responsible intermediaries. This enhanced disclosure policy should include detailed information on the nature, sector, and climate impact of subprojects, as well as their alignment with Paris Agreement goals. By increasing the transparency of intermediary lending, the ADB would enable better assessment of climate risks and impacts across its entire portfolio and set a leading example for other MDBs.

- The ADB should enhance its disclosure practices in future TCFD reports by focusing on portfolio data transparency and sectoral strategy disclosure. This could include providing more comprehensive data on its investment portfolio’s climate impact. By improving disclosure in these areas, the ADB would demonstrate greater accountability in its climate commitments and provide stakeholders with a clearer understanding of its progress towards Paris alignment.

- The ADB’s leading project level climate finance disclosure practices have allowed for greater public interrogation of its accounting (such as by Oxfam’s recent report on the Bank’s adaptation finance). To further reinforce confidence in the rigour of the Bank’s reporting, the ADB should engage with recommendations and queries regarding the clarity of its accounting procedures, to ensure accurate and representative reporting. Through doing so, the Bank could further solidify its position as a best practice example in terms of climate finance disclosure, and engagement with resultant third-party scrutiny of its accounting. In turn, this could enable the Bank to positively influence wider MDB work to enhance the accuracy of accounting for adaptation finance.