This page is part of the E3G Public Bank Climate Tracker Matrix, our tool to help you assess the Paris alignment of public banks, MDBs and DFIs

| Paris alignment | Reasoning |

|---|---|

| Transformational | Transformational – Leadership in energy transition, green bonds, joint MDB standards, the EU Sustainability Taxonomy and Paris alignment. The Climate Bank Roadmap, if implemented as proposed, will consitute a transformational precedent for other PDBs to consider. |

Explanation

The EIB has shown particular leadership in climate related areas and we have therefore classed it as ‘Transformational’.

The Climate Bank Roadmap, if implemented as proposed, will consitute a transformational precedent for other PDBs to consider. Additional information on this is available in E3G’s report published in July 2020 “The EIB: Becoming the EU Climate Bank”.

The EIB has also demonstrated leadership in the coordination of the MDB working group on climate mitigation definitions and the Joint MDB Paris Alignment Working Group, as well as in reporting and disclosing absolute emissions for projects. EIB has been calling for reporting on absolute emissions by other MDBs and is thus an institutional leader in this regard.

The EIB was also involved in initiating the process that is now putting together the EU Sustainable Finance Taxonomy, which will create a classification system for sustainable economic activities. This is intended to be applied both within and outside the EU. The EIB has issued new Climate Awareness Bonds that it intends to be taxonomy-compliant in line with the emerging framework which is still being finalised.

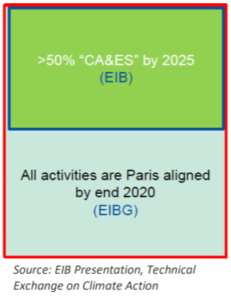

In 2018 it also committed to align all financing activity with the Paris Agreement by end of 2020. In late 2019 the Bank announced it would end all financing for fossil fuel energy projects (with a few limited exceptions) by end 2021 and that 50% of its lending by 2025 would be dedicated to climate finance or environmental sustainability.

The EIB also signed the “Statement on International Public Support for the Clean Energy Transition” at COP26. Amongst other things, this statement commits the signatories to “end new direct public support for the international unabated fossil fuel energy sector by the end of 2022, except in limited and clearly defined circumstances that are consistent with a 1.5°C warming limit and the goals of the Paris Agreement”. The EIB was the only MDB to sign this statement, demonstrating leadership.

The EIB is the world’s largest issuer of green bonds, launching the green bond market alongside the World Bank in 2007 with its issuance of their Climate Awareness Bond (CAB). The CABs in 2019 alone are valued at EUR 3.3bn across 84 projects in 31 countries. The Bank’s Sustainability Awareness Bond program (SABs) add a further EUR 872m across 34 projects in 25 countries. Using their two Awareness Bond platforms, the Bank has helped shape thinking and taxonomy in the EU Sustainable Taxonomy.

Percentage of EIB funds dedicated to Climate Action and Environmental Sustainability

The EIB has also done leading work with the Chinese Green Finance Committee that seeks to facilitate the establishment of a common language in green finance and could lead to the raising of standards.

The EIB has been a pioneer in its use of shadow carbon pricing in cost-benefit analysis across all investments, although clarification from the EIB would be useful as to how it establishes baselines in its carbon footprint and how it than applies its carbon price to project that show a relative emissions saving compared to those baselines.