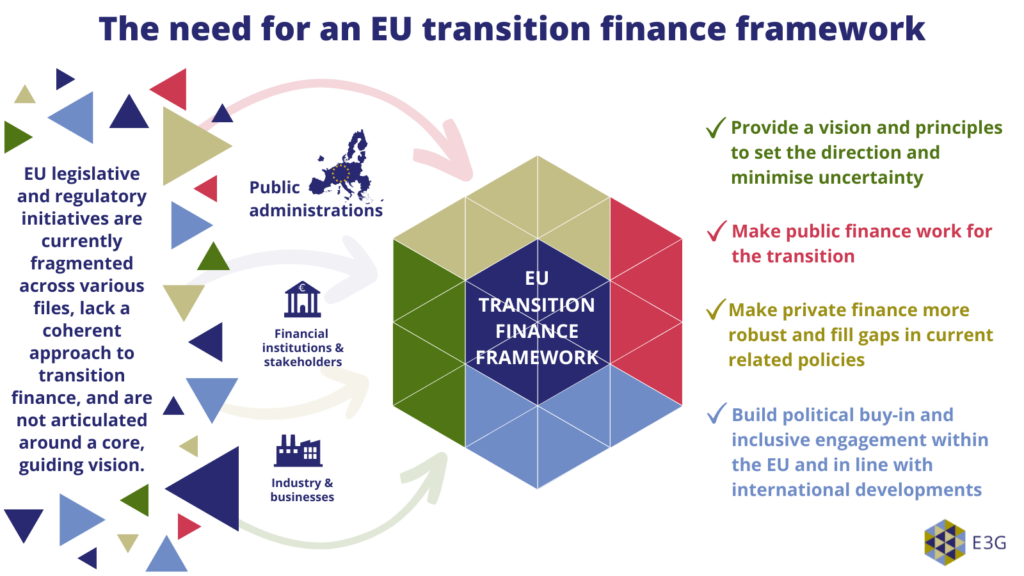

Public and private actors at all levels need to work together to build a robust transition finance framework for the EU. This framework must incentivise both finance and businesses to develop transition pathways that match the targets in the European Green Deal. Currently, initiatives at the EU level are fragmented, creating regulatory uncertainty and hampering progress. This report explores how we can achieve an effective transition finance framework in the EU.

The transition of the EU economy to climate neutrality is challenging and requires unprecedented investment. A just and equitable transition depends on finance flowing in directions that enable a low-carbon future. This includes “transition finance”, for activities that are not “green” but are in the process of becoming green.

Yet currently, legislative and regulatory initiatives are fragmented across various files, lacking a coherent approach. They are not mutually articulated around a core, guiding vision of the nature and place of transition finance in the EU’s financial regulation and the economy and fosters continued legislative fragmentation and overlaps that lead to additional regulatory and administrative burdens.

This E3G report identifies how the EU can move towards a coherent policy framework for transition finance by:

- Establishing a common vision and understanding of what transition and transition finance mean at various levels and among different stakeholders, including recommendations for how to do this.

- Articulating high-level principles for what transition finance is to guide policymaking and private sector efforts.

- Identifying a governance structure for the EU transition that can be integrated into existing governance architecture without overlaps. Such a framework should bring coherence and coordinated action on the ground.

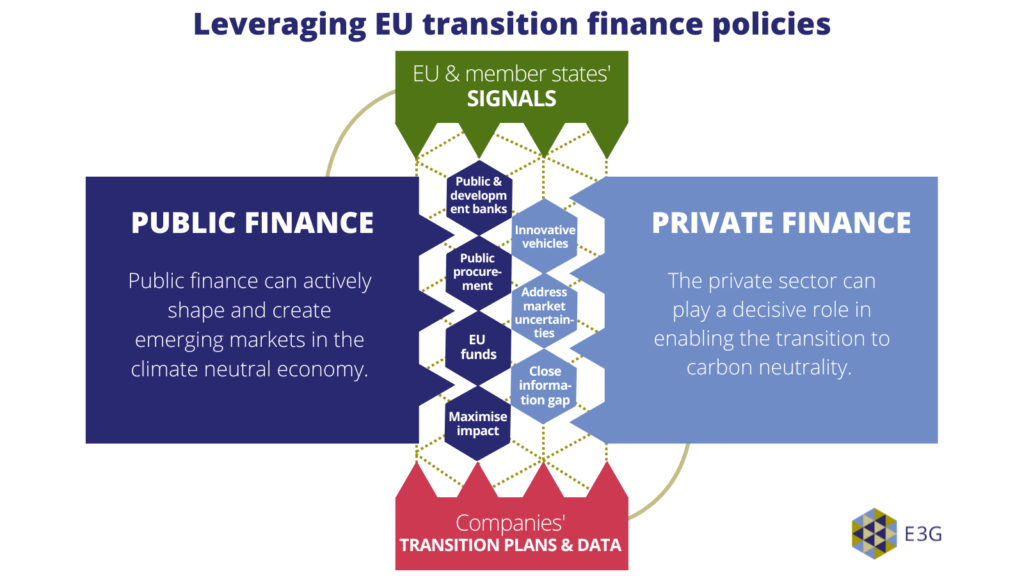

Leveraging EU transition finance policies

The research examines how public and private finance EU policies can optimally interact in a holistic transition finance framework. In particular, it looks at how public and private finance can leverage each other and makes concrete policy recommendations.

A smooth and equitable transition depends on public investment and market interventions that are dynamic, to maximise their effectiveness and drive the transition forward. In this context, approaches such as mission-oriented investments that can leverage public and private collaboration can be a way forward.

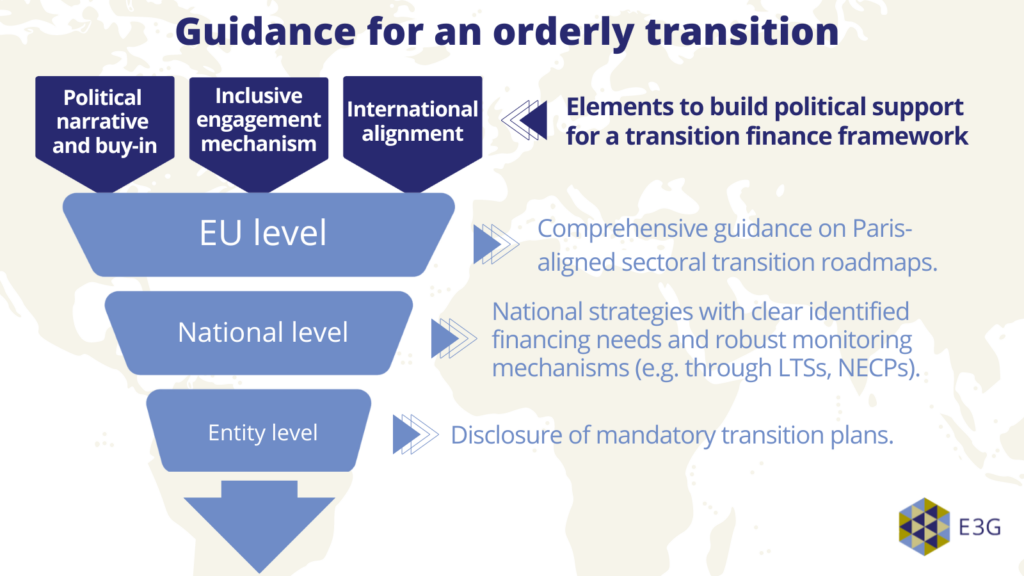

Guidance for an orderly transition

The report also analyses the political narrative of the broader regulatory ecosystem. It explores how the EU could find support and consensus internally in order to both create and implement a successful transition framework, and to also drive developments globally. Creating awareness of the risks and opportunities of the transition will help secure support.

The report also notes emerging global trends that will create uptake and support for a transition finance framework in the EU, and how the Union could navigate these developments.

Recommendations

- The European Commission should adopt a set of high-level principles which provide a core European vision for transition finance.

- EU institutions and member states should address both public and private sectors, to leverage their respective contributions to transition finance more coherently and to maximise synergies.

- The European Commission should develop a domestic and international narrative and stakeholder engagement plan around its vision and approach to transition finance. This will build the political support and international alignment necessary to implement a comprehensive transition finance framework with multiple benefits for European businesses and society.

Download the report on how to build a robust EU transition finance framework.