This summer we were reminded again of the cost of intensifying extreme weather events across Europe. While Europe has historically managed the economic impact of such events, the increase in frequency and severity, driven by global warming, will escalate their impact.

Insurance plays a pivotal role in mitigating macroeconomic losses after extreme climate-related incidents. However, currently, the European Union (EU) only insures about a quarter of climate-related catastrophe losses. This insurance gap may widen further due to climate change, potentially burdening governments with fiscal spending to cover uninsured losses, increasing government debt, and posing financial stability risks for countries with significant banking sector exposure to catastrophe risks, not to mention the socio-economic instability risks. At the same time, the distribution of vulnerabilities and the financial burden across European countries is not even. This article looks at the Central and Eastern Europe (CEE) region, where countries’ losses average a much higher percentage of their GDP, with a focus on Bulgaria and Romania.

Understanding the threats to regional financial stability under climate risk

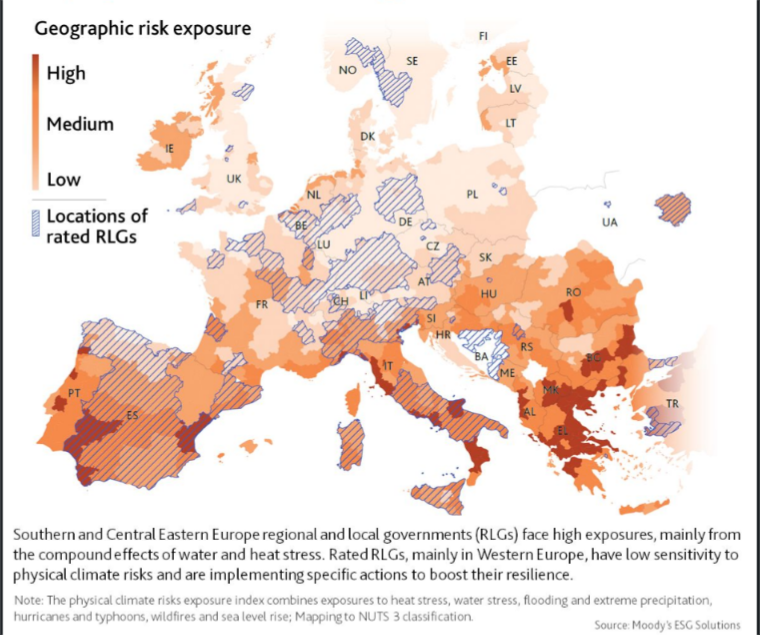

Analyses indicate that CEE countries, along with Southern EU member states, face heightened exposure to the risk of heat and water stress compared to other EU countries. For instance, while Romania already faces more frequent heatwaves than other parts of the EU (see graph below), these are projected to increase further by 50-80% in frequency and 30-80% in duration in the near future. These impacts imply massive costs and financial burdens on the national budget and individual households. The continual increase of risks further threatens the financial stability of the region. Additionally, they also contend with transition risks associated with emission-intensive heavy industries, which traditionally form a major part of the regional real economy. This dual risk exposure poses a significant challenge to the financial stability of CEE economies, potentially leading to far-reaching socio-economic consequences.

Notably, the regional banking sector lags in the adoption of climate risk management practices. The results of the 2022 European Central Bank (ECB) climate stress test partially highlighted this. Even though it was not officially part of the eurozone, in 2020, Bulgaria (alongside Croatia) joined the Single Supervision Mechanism and underwent an assessment alongside EU banks to evaluate their readiness for addressing and mitigating both physical and transition climate risks.

Way forward

To manage the climate, financial and political risks posed to the Bulgarian, Romanian and other CEE financial systems and to secure the resilience and competitiveness of these economies, regulators – particularly central banks – must play a critical role. They should monitor and assess the system’s exposure to these risks and implement precautionary measures to safeguard financial stability, such as climate-linked capital requirements. Focusing on financial resilience to climate risks is all the more important for CEE countries as their banking systems are mostly dependent on the presence of banking groups with headquarters elsewhere in Europe, some of them subject to ECB stress tests. From previous experience, such as the Global Financial Crisis of 2007-2009 or the COVID-19 pandemic, banking groups tend to exit the CEE region if their local business becomes too risky. Romania and Bulgaria, as well as other CEE banking systems, should aim to become climate-safe havens for banking groups, as their presence is crucial for the growth of local business and access to finance.

In addition, national prudential authorities should coordinate with the commercial banks and the European banking authorities to develop robust stress testing and management of both physical and transition climate risks to avoid further destabilization of their fragile socio-economic and political contexts. There are developments in the region that are promising on this front and that countries can mutually learn from. For example, while Bulgaria’s central bank, despite the country’s aspirations to join the eurozone, has not publicly demonstrated substantial involvement in climate risk initiatives, neighbouring Romania has taken proactive steps to monitor and address climate risks and require commercial banks to consider ESG within their risk management. More broadly, commercial banks in both countries, including in coordination with banking associations, have started gathering ESG data from their clients to assess portfolios, investing in green initiatives, and collaborating on decarbonisation efforts, which is reflected in their policies and financing terms and can inform climate risk management strategies.

We must move forward with mainstreaming climate risk in the CEE’s financial systems.

In autumn 2023 E3G will be releasing a new briefing on sustainable finance in Central and Eastern Europe. Subscribe to E3G’s newsletter to stay tuned.