Europe’s quest to reduce its reliance on Russian gas, prompted by Russia’s invasion of Ukraine, initially benefited the US liquified natural gas (LNG) sector. However, long-term market trends and regulatory changes indicate a substantial decline in European demand as early as 2030. The EU market will no longer drive US LNG demand growth, diminishing the need for additional export infrastructure.

The European Union – a shrinking gas market

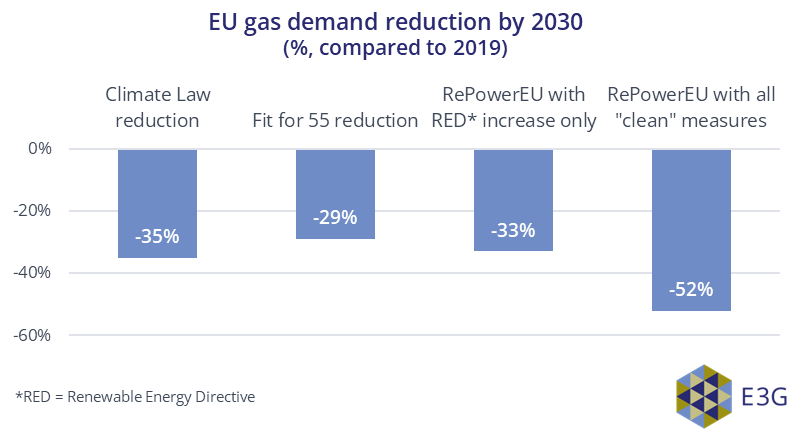

The EU’s strategic response to the war in Ukraine, REPowerEU, aims to eliminate dependence on Russian pipeline gas by 2027 and halve overall gas demand by 2030. Recent legislative packages underscore this commitment, with a projected 29% reduction by 2030 from implementing the Fit for 55 package, driven by advancements in renewable energy, energy efficiency, and electricity market reforms (Figure 1).

Figure 1: Projected EU gas demand reduction embodied in the European Climate Law, Fit for 55 programme and RePowerEU action plan.

Gas use in the EU is already on the decline, with a 13% reduction in gas demand recorded in 2022 and a similar trend in 2023. Existing US LNG infrastructure can adequately address European energy security concerns, surpassing the outlined need for 50 bcm of new LNG imports in REPowerEU.

Data from the IEA and compiled by Greenpeace confirms that the EU’s fossil gas demand is on a steady downward trajectory. Any increase in production would exceed current and future demand, and engaging in new long-term contracts carries considerable risks of oversupply.

Global gas demand growth is contracting

Globally, factors such as last year’s price surge and increasing alternatives to gas are dampening demand growth.

As the IEA forecasts that gas demand could peak this decade, LNG demand faces a dual challenge: short-term price volatility and long-term policy shifts away from gas.

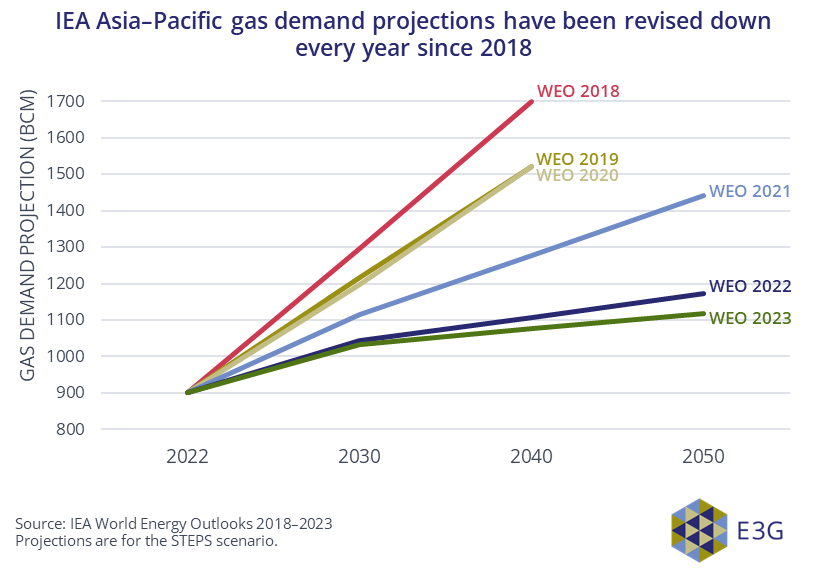

Forecasts for Asian gas demand growth, on which much of the long-term hope of US exporters depends, are lowered year by year (Figure 2). Final gas consumption level of the US’s biggest LNG buyers in Asia and the Pacific – Japan and the Republic of Korea – peaked over a decade ago (in 2007 and 2013, respectively).

Figure 2: Successive iterations of the IEA’s World Energy Outlook report have made ever lower projections for future gas demand in Asia–Pacific.

Who bears the risk?

The US LNG sector faces mounting challenges such as rising production costs and uncertain shipping routes.

LNG projects sanctioned this year won’t reach the market until the late 2020s, exposing them to the global demand peak expected at that moment.

As gas demand declines in key markets such as the EU and Asia, expanding gas export infrastructure and entering new long-term gas supply contracts will pose significant financial risks for the US LNG sector.

While European companies currently shoulder most of the burden, the growing involvement of US companies exposes the American economy to this risk.

The upcoming EU-US Energy Council presents a strategic opportunity to shift focus.

Collaboration on accelerating clean energy in developing countries and championing a diversified, equitable clean energy supply chain can be a win-win for energy security and climate leadership. Additionally, the Council can champion crucial such as implementing the methane regulation, and supporting the G7 commitment to decarbonise power systems by 2035.