This page is part of the E3G Public Bank Climate Tracker Matrix, our tool to help you assess the Paris alignment of public banks, MDBs and DFIs.

| Paris alignment | Reasoning |

|---|---|

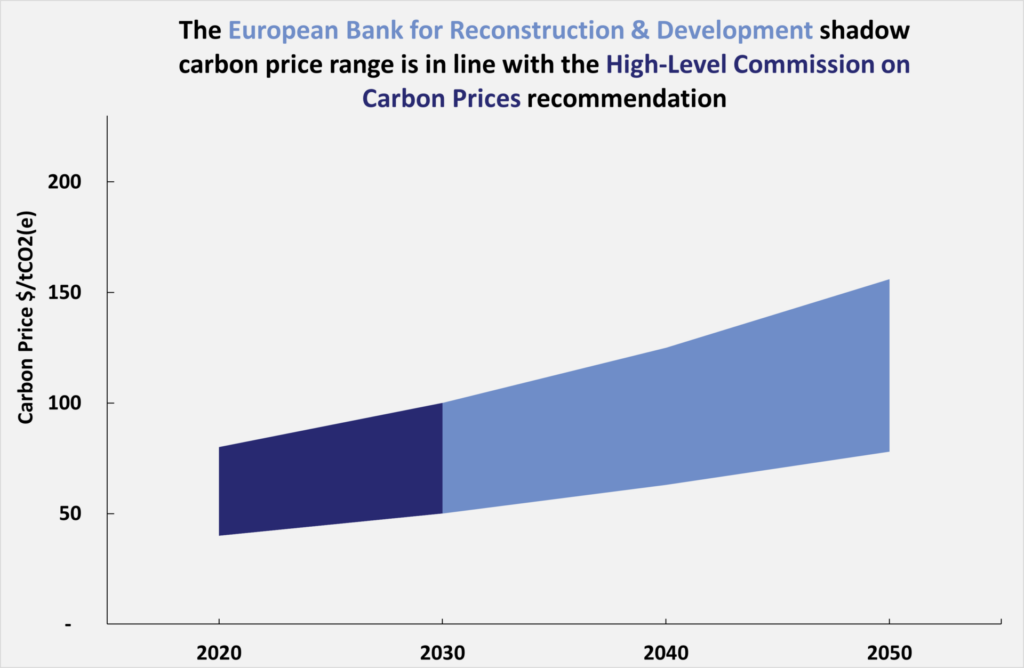

| Paris aligned | Prices align with the High-Level Commission on Carbon Prices (HLCCP) and are applied to all projects above the emission threshold. |

The European Bank for Reconstruction and Development (EBRD) does apply a shadow carbon price. The table below provides a summary of how it is applied across bank operations.

| Which projects subject to greenhouse gas (GHG) assessment | Projects which increase net emissions by 25kCO2e OR Gross emissions over 100ktCO2e. |

| Which projects apply shadow carbon pricing | All projects. |

| Price level | Will use the high and low values from the range of prices recommended by High Level Commission on Carbon Prices |

| How shadow carbon price is used | Shadow Carbon Price ‘will be an important input to decision making’. Uses levelised cost of energy (LCOE) in assessing projects, suggesting the carbon price is likely incorporated into a project baseline. The Bank’s methodology for the assessment of projects with high greenhouse gas emissions applies a shadow carbon price to the gross emissions linked to the project and also compares its social value against a range of low carbon alternatives. |

| What is it compared to? | Identify all other realistically available options to meet the same energy needs as the proposed project. Slightly unclear what this means for projects outside the energy sector. |

| Are scope 3 emissions included? | Scope 3 greenhouse gas emissions may be taken into consideration where relevant (e.g. energy pipelines). |

The graph below shows how the level of carbon pricing at the bank compares with those of the High-Level Commission on Carbon Prices (HLCCP). The HLCCP prices only extend to 2030.

Recommendation: The EBRD should apply a carbon price scenario to assess alignment with limiting warming to below 1.5°C, alongside the other MDBs.

Last Update: November 2020