This page is part of the E3G Public Bank Climate Tracker Matrix, our tool to help you assess the Paris alignment of public banks, MDBs and DFIs.

| Paris alignment | Reasoning |

|---|---|

| Some progress | Further clarification needed from IFC on how it currently applies carbon pricing . |

The International Finance Corporation does apply a shadow carbon price, the table below provides a summary of how it is applied across IFC operations.

| Which projects subject to greenhouse gas (GHG) assessment | Over 25ktCO2 annual gross emissions. |

| Which projects apply shadow carbon pricing | Power, cement, chemicals, oil and gas, mining, livestock. |

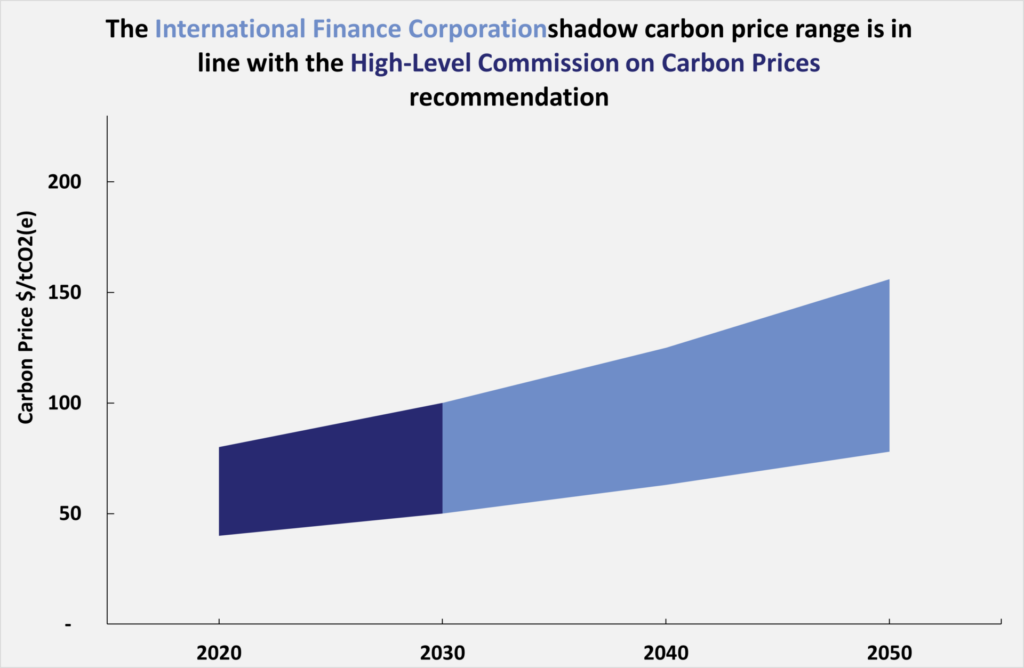

| Price level | Carbon prices align with the High-Level Commission on Carbon Prices (HLCCP). |

| How shadow carbon price is used | “Projects in lower-income countries will be subject to prices at the bottom end of the range and projects in middle income countries will use carbon prices at the upper end” (IFC on medium.com). Not clear whether the shadow carbon price is used as a hurdle or is used as part of a wider assessment. E3G understands that IFC includes the impact of the carbon price on the project’s economic performance in Board papers. |

| What is it compared to? | Information not available |

| Are scope 3 emissions included? | Information not available |

The IFC Strategy & Business Outlook Update FY20-FY22 states that investment operations in key emission producing sectors are to incorporate the shadow price of carbon. IFC has implemented carbon pricing in project finance in key emitting sectors as of May 2018.

The graph below shows how the level of carbon pricing at the bank compare with those of the High-Level Commission on Carbon Prices (HLCCP). The HLCCP prices only extend to 2030.

Recommendation: IFC should apply a carbon price scenario to assess alignment with limiting warming to below 1.5°C, alongside the other MDBs.

Last Update: November 2020