This page is part of the E3G Public Bank Climate Tracker Matrix, our tool to help you assess the Paris alignment of public banks, MDBs and DFIs.

| Paris alignment | Reasoning |

|---|---|

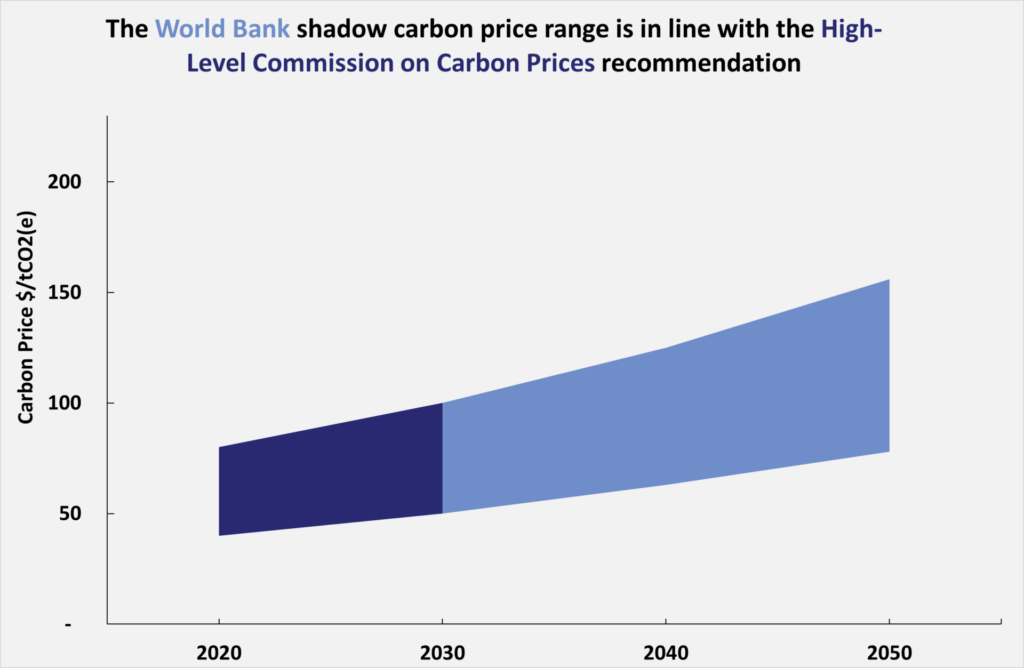

| Paris aligned | Carbon prices align with the HLCCP & Scope 3 emissions included where required |

The World Bank (WB) does apply a shadow carbon price, the table below provides a summary of how it is applied across bank operations.

| Which projects subject to greenhouse gas (GHG) assessment | Over 25ktCO2 net emissions. |

| Which projects apply shadow carbon pricing | Energy, agriculture, transport, water, urban. |

| Price level | Carbon prices align with the High-Level Commission on Carbon Prices (HLCCP). |

| How shadow carbon price is used | The shadow carbon price will be used for all investment projects subject to GHG accounting. Price used in either cost benefit analysis or cost effectiveness analysis. However, ‘scenarios considered in the economic analysis can be done both with and without the shadow price of carbon’. |

| What is it compared to? | The Energy Sector Directions Paper 2013 specifies that – in the energy sector – global externalities be assessed comparing alternatives delivering the same level of service within the same time frame as the proposed project. |

| Are scope 3 emissions included? | If costs and benefits include indirect costs and benefits, such as induced investments, emissions generated out of the project need to be considered. |

The graph below shows how the level of carbon pricing at the bank compared with those of the High-Level Commission on Carbon Prices (HLCCP). The HLCCP prices only extend to 2030.

Recommendation: The World Bank Group should apply a carbon price scenario to assess alignment with limiting warming to below 1.5°C, alongside the other MDBs.

Last Update: November 2020