This page is part of the E3G Public Bank Climate Tracker Matrix, our tool to help you assess the Paris alignment of public banks, MDBs and DFIs.

| Paris alignment | Reasoning |

|---|---|

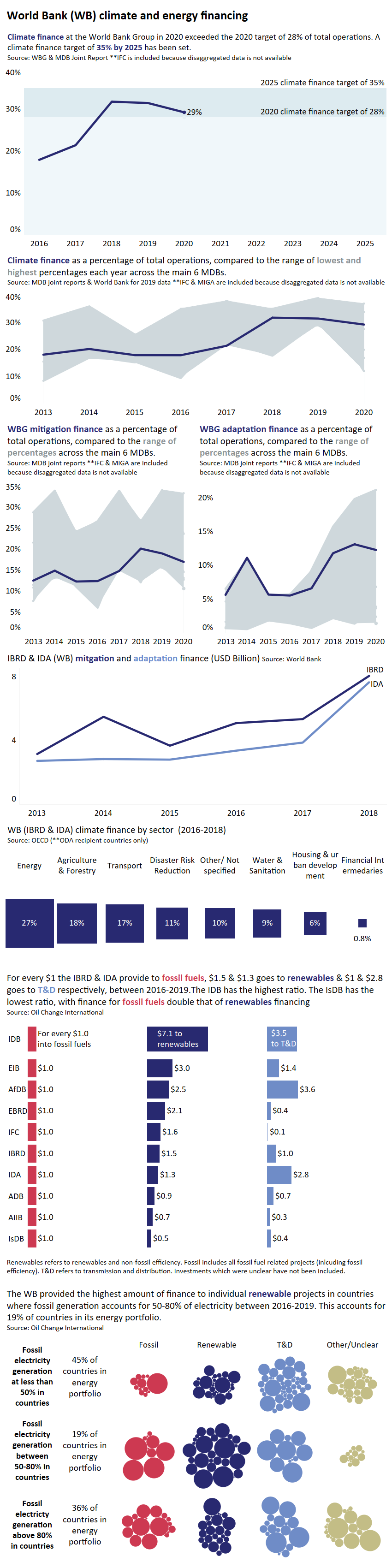

| Unaligned | For every $1 the IBRD & IDA provide to fossil fuels, $1.5 & $1.3 goes to renewables & $1 & $2.8 goes to T&D respectively, between 2016-2019. |

Explanation

For every $1 the IBRD & IDA provide to fossil fuels, $1.5 & $1.3 goes to renewables & $1 & $2.8 goes to T&D respectively, between 2016-2019. This is a slight improvement on the figures for 2016-2018.

Positively, IBRD and IDA did not invest in new fossil fuel finance in fiscal year 2021 and stopped investing in upstream oil and gas in 2019. However, these actions are not included explicitly in any official policy. This leaves an opportunity open for IBRD and IDA to continue fossil fuel finance such as gas power or other support still allowed under their policies. IBRD and IDA are still financing fossil fuels through indirect finance. Additionally, the other lending arms of the World Bank, IFC and MIGA, are still participating in ‘new’ direct fossil finance.

The World Bank has met its internal climate finance target of 28% by 2020, and has now adopted a 35% target for 2025.

The World Bank has seen a large increase in adaptation financing as a percentage of its total portfolio. In 2020, adaptation financing almost equalled the level of mitigation financing at the World Bank.

Recommendation: Scale up climate investment in the energy sector to ensure fossil fuel lending is at zero across a 3-year period.

Oil Change International (2018) Shift the Subsidies database

Joint Report on Multilateral Development Banks Climate Finance (2019,2018,2017,2016,2015,2014,2013)

World Bank (2020) World Bank Group Announces Ambitious 35% Finance Target to Support Countries’ Climate Action

World Bank (2019) World Bank Climate Finance

This work is funded by Good Energies Foundation.